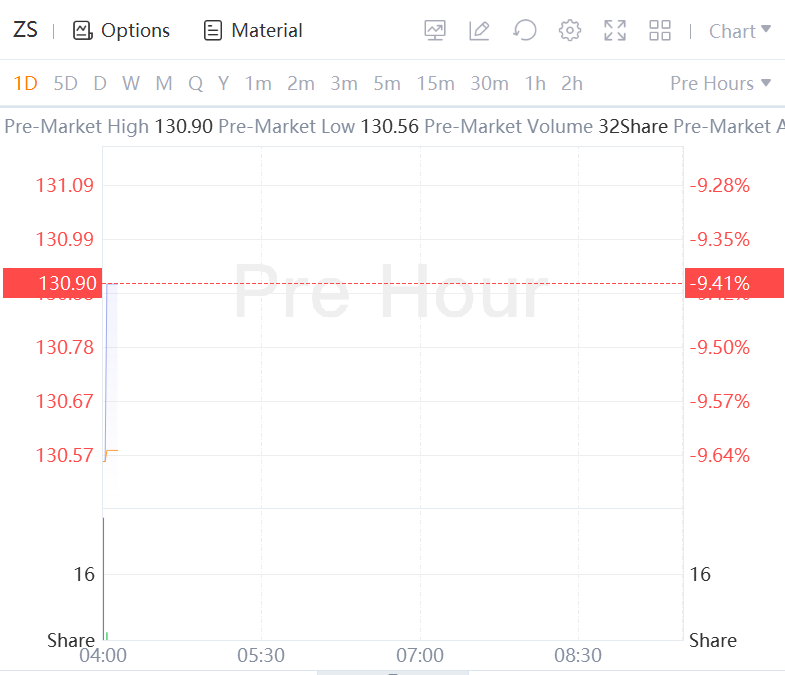

Zscaler Inc. stock fell over 9% premarket even as the cybersecurity company beat on earnings and offered an outlook that was just above the Wall Street consensus.

Revenue rose to $355.5 million from $230.5 million in the year-ago quarter, the company said. Calculated billings, or revenue plus deferred revenue acquired over the quarter, rose to 37% to $340.1 million from the year-ago period.

Analysts surveyed by FactSet had forecast earnings of 26 cents a share on revenue of $340.7 million and billings of $333.1 million.

Last quarter, Zscaler exceeded Wall Street expectations across the board, and the stock logged its best one-day performance since the company went public in 2018.

Zscaler said it expects adjusted earnings of 29 cents to 30 cents a share on revenue of $364 million to $366 million for the fiscal second quarter. Analysts estimate 26 cents a share on revenue of $325.1 million and billings of $355.3 million for the quarter.

The company also forecast adjusted earnings of $1.23 to $1.25 a share on revenue of about $1.53 billion for the year and billings of $1.93 billion to $1.94 billion.

Analysts had forecast earnings of $1.18 a share on revenue of $1.5 billion and billings of $1.93 billion for the year.

As of Thursday’s close, the stock is down 55% year to date, compared with a 15% loss by the S&P 500 index a 27% decline on the tech-heavy Nasdaq Composite Index and a 23% decline on the ETFMG Prime Cyber Security ETF.

Comments