U.S. stocks gyrated to a mixed close on Friday as investors headed into the Christmas holiday weekend, having digested cooler-than-expected inflation data which firmed bets for Federal Reserve interest rate cuts in the new year.

Market Snapshot

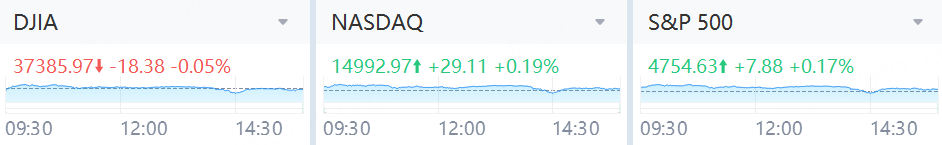

The Dow Jones Industrial Average fell 18.38 points, or 0.05%, to 37,385.97, the S&P 500 gained 7.88 points, or 0.17%, at 4,754.63 and the Nasdaq Composite added 29.11 points, or 0.19%, at 14,992.97.

Market Movers

Nike reported fiscal second-quarter earnings that beat analysts’ expectations but announced a $2 billion cost-cutting plan over the next three years as it expects sales to soften in the second half of fiscal 2024. Nike said it was looking at “streamlining” the company and would record pretax restructuring charges of about $400 million to $450 million, mostly in the third quarter, ”primarily associated with employee severance costs.” Shares of the sneaker and apparel company dropped 12%.

Shares of fellow athletic-gear retailers Dick’s Sporting Goods and Foot Locker fell 2.8% and 3.9%, respectively.

Karuna Therapeutics, the neuroscience-drug developer, rose 48% to $317.85 after reaching an agreement to be acquired by Bristol Myers Squibb for $330 a share in cash, or about $14 billion. Bristol Myers was up 2%.

U.S.-listed shares of NetEase dropped 16% after China proposed new curbs on online gaming. Tencent finished 12% lower.

Ansys jumped 18% following a report from Bloomberg that said the simulation software company was working with advisers to weigh its options, including a sale, after getting takeover interest.

Rocket Lab rose 23% after the commercial space company said it received a contract from a U.S. government customer worth $515 million to “design, manufacture, deliver, and operate 18 space vehicles.”

Shared of Coinbase Global rose 4.4% to $175.48 after JMP Securities raised its price target on the crypto broker to $200 from $107 and maintained its Outperform rating.

Berkshire Hathaway purchased 5.2 million shares of Occidental Petroleum in recent days, bringing its total ownership in the energy company to 243.7 million shares, or a 27.7% stake, according to a filing with the Securities and Exchange Commission. Occidental shares rose 0.6%.

Lumentum Holdings gained 2.9% after shares of the optical and photonic products provider were upgraded to Buy from Hold at Craig-Hallum.

Tesla dropped 0.8% to $252.54 after analysts at RBC Capital reduced their delivery estimates for the electric-vehicle maker in the fourth quarter to 456,000 from 476,000, citing registration data and app downloads. The analysts maintained their Outperform rating and $300 price target on Tesla shares. Analysts at Wedbush, meanwhile, raised their price target on Tesla to $350 from $310 based on the “increasingly bullish view of further EV share gains and margin stabilization in 2024.” Wedbush reiterated its Outperform rating on the stock and said it believes Tesla will reach $1 trillion market cap next year.

Market News

U.S. Core PCE Inflation Increased 3.2% Y/Y in November, Less Than Expected

A gauge the Federal Reserve uses for inflation rose slightly in November and edged closer to the central bank’s goal.

The core personal consumption expenditures price index, which excludes volatile food and energy prices, increased 0.1% for the month, and was up 3.2% from a year ago, the Commerce Department reported Friday.

Economists surveyed by Dow Jones had been expecting respective increases of 0.1% and 3.3% respectively.

Alibaba Names New Commerce Division Heads in Internal Shuffle

Alibaba Group Holding Ltd. has appointed a cohort of younger executives to lead its e-commerce unit, as the once-dominant giant seeks to reinvigorate growth in the face of fierce competition.

Chief Executive Officer Eddie Wu, who this week took the helm of the main online platforms Taobao and Tmall, announced on Friday the selection of six managers to report directly to him from various segments of the core business, according to an internal memo seen by Bloomberg News. A Taobao and Tmall spokesperson confirmed the appointments.

Comments