Lululemon Athletica on Tuesday forecast full-year profit and revenue above estimates as demand for athletic wear remains consistent even as people return to offices, and said it plans selective price increases on some of its products.

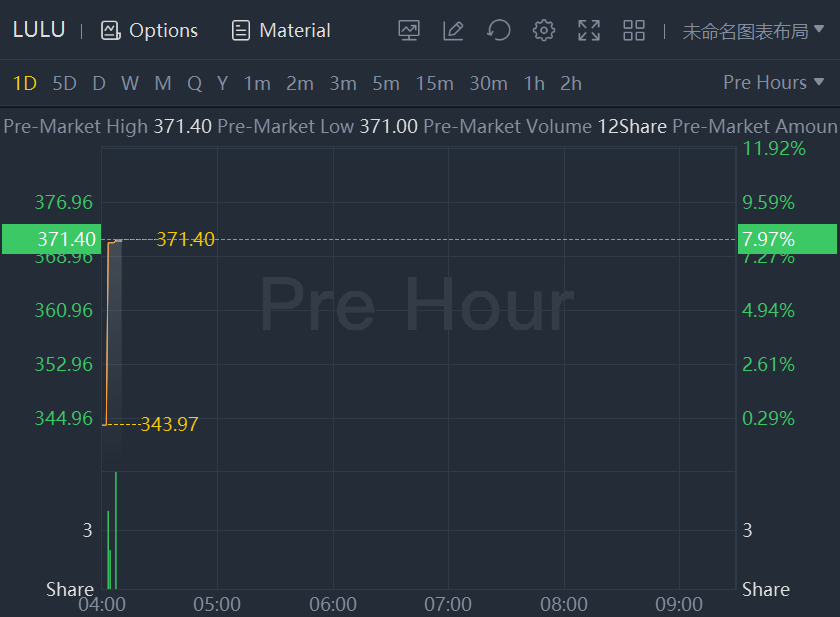

Shares of the yogawear maker rose about 8% in premarket trading Wednesday as the company also posted better-than-expected fourth-quarter adjusted earnings despite reduced store hours due to an increase in Omicron infections.

Since the pandemic started, many consumers have shifted their preference to comfortable and casual clothing helping brands such as Lululemon whose athleisure and sportswear have now become a major part of everyday fashion.

"We are taking modest selective price increases over the course of the year... It's a very small portion of our styles that are impacted... this will help offset some of the pressure we're seeing on average unit cost," Chief Executive Officer Calvin McDonald said in an earnings call.

Morningstar Research analyst David Swartz said as Lululemon has premium pricing all the time, "having high cost, high price products is nothing new for Lululemon... they can push through that price increase without any problem."

Lululemon forecast full-year 2022 revenue between $7.49 billion and $7.62 billion, while analysts are expecting $7.30 billion, according to IBES data from Refinitiv.

It also forecast full-year profit between $9.15 and $9.35 per share, compared to estimates of $9.06 per share.

"Raising prices helps the company especially as they are still being impacted by lingering supply chain issues. And given the fact that they don't need to be as promotional, they probably have some room to raise prices," said Matthew Jacob, senior analyst at M Science.

Excluding items, Lululemon earned $3.37 per share in the fourth quarter ended Jan. 30, beating estimates of $3.28 per share.

Comments