Market Overview

The S&P 500 and the Nasdaq closed higher on Monday(Aug.14) as Nvidia led gains in other megacap growth stocks.

The S&P 500 climbed 0.58%. The Nasdaq gained 1.05%, while Dow Jones Industrial Average rose 0.07%.

Regarding the options market, a total volume of 36,027,315 contracts was traded, down 9.99% from the previous trading day.

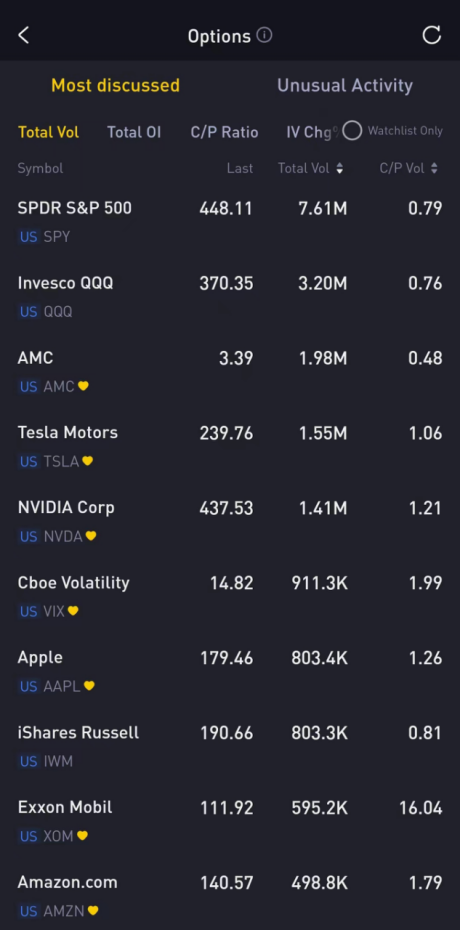

Top 10 Option Volumes

Top 10: SPDR S&P 500 ETF Trust, Invesco QQQ Trust, AMC Entertainment, Tesla Motors, NVIDIA Corp, Cboe Volatility Index, Apple, iShares Russell 2000 ETF, Exxon Mobil, Amazon.com

Options related to equity index ETFs are popular with investors, with 7.61 million SPDR S&P 500 ETF Trust and 3.20 million Invesco QQQ Trust options contracts trading on Monday.

AMC Entertainment crashed 35.55% on Monday as its 10-to-1 reverse stock split will take place on Aug. 24 and its preferred shares "APE" will be converted to common stock on Aug. 25.

There were 1.98M AMC Entertainment option contracts traded on Monday, surging over 150% from the previous trading day. Put options account for 67% of overall option trades. Particularly high volume was seen for the $4 strike put option expiring August 18, with 145,087 contracts trading. $AMC 20230818 4.0 PUT$

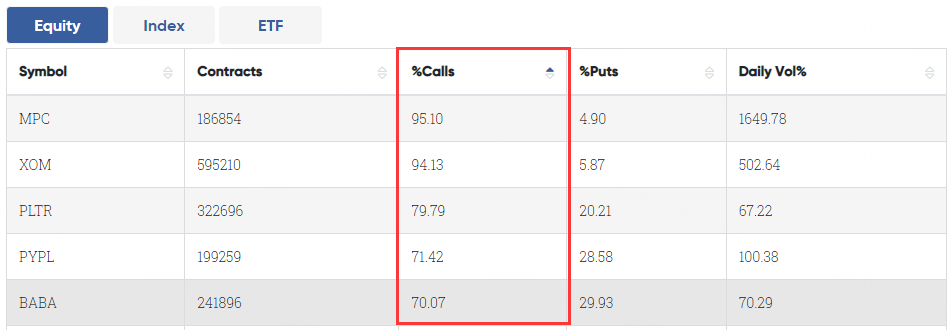

Most Active Trading Equities Options

Special %Calls >70%: Marathon; Exxon Mobil; Palantir Technologies Inc.; PayPal; Alibaba

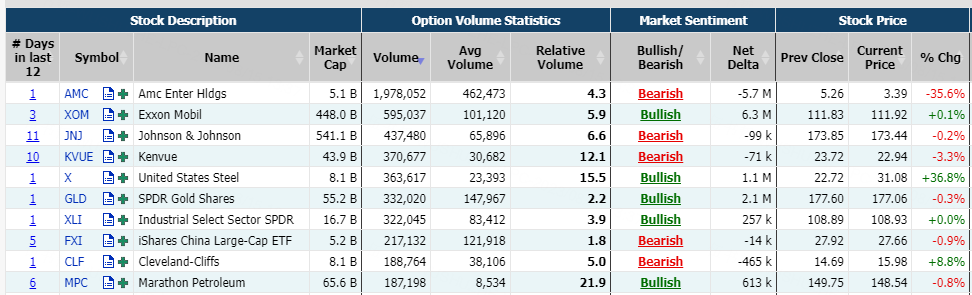

Unusual Options Activity

NVIDIA Corp jumped 7.09% on Monday as Saudi Arabia and the United Arab Emirates have reportedly bought "thousands" of Nvidia graphics processing units to build artificial intelligence software.

There were 1.41M NVIDIA Corp option contracts traded on Monday. Call options account for 55% of overall option trades. Particularly high volume was seen for the $430 strike call option expiring August 18, with 50,478 contracts trading.$NVDA 20230818 430.0 CALL$

Exxon Mobil rose 0.08% on Monday as it declared a third-quarter dividend of $0.91 per share, payable on Sept. 11, 2023, to shareholders of record of Common Stock at the close of business on Aug. 16, 2023.

There were 595.2K Exxon Mobil option contracts traded on Monday. Call options account for 94.13% of overall option trades. Particularly high volume was seen for the $108 strike call option expiring August 18, with 91,247 contracts trading. $XOM 20230818 108.0 CALL$

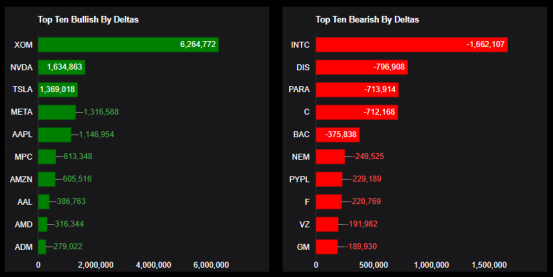

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Based on option delta volume, traders sold a net equivalent of -1,662,107 shares of Intel stock. The largest bearish delta came from buying puts.

The largest delta volume came from the 15-Mar-24 30 Put, with traders getting short 1,092,904 deltas on the single option contract.

Top 10 bullish stocks: Exxon Mobil, NVIDIA Corp, Tesla Motors, Meta Platforms, Inc., Apple, Marathon, Amazon.com, American Airlines, Advanced Micro Devices, Archer-Daniels Midland

Top 10 bearish stocks: Intel, Walt Disney, Paramount Global, Citigroup, Bank of America, Newmont Mining, PayPal, Ford, Verizon, General Motors

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments