(Reuters) - BP reported on Tuesday fourth-quarter earnings of $3 billion, exceeding forecasts thanks to strong gas trading, as the energy company increased the pace of its share repurchases.

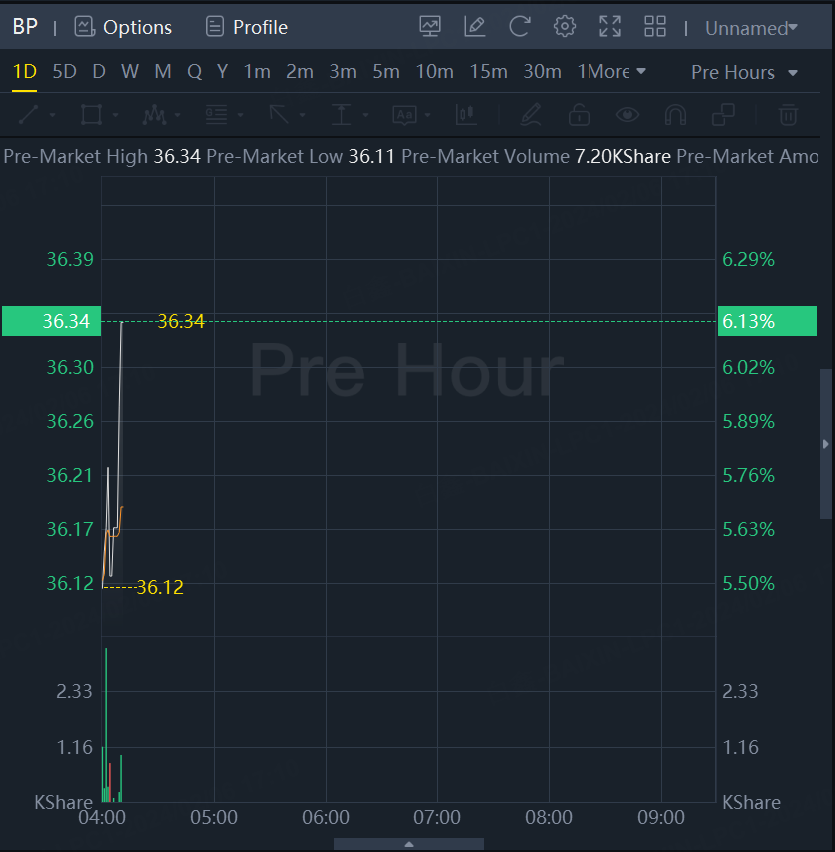

BP shares jumped over 6% on the news.

The quarterly results lifted the energy giant's 2023 profit to $13.8 billion, a 50% drop from a year earlier as oil and gas prices cooled and refining profit margins weakened.

The strong quarterly profit will come as a relief to CEO Murray Auchincloss after the company had substantially missed forecasts in the previous two quarters.

BP maintained its dividend at 7.27 cents per share and increased the rate of its share buyback programme to $1.75 billion over the next three months from $1.5 billion in the previous three months.

The company said it was committed to repurchasing $3.5 billion of shares in the first half of 2024.

BP's fourth-quarter underlying replacement cost profit, the company's definition of net income, reached $2.99 billion, exceeding forecasts of $2.77 billion in a company-provided survey of analysts.

That compared with a $3.3 billion profit in the third quarter and $4.8 billion a year earlier.

BP said the quarterly results reflected strong gas trading results and higher oil and gas prices which were nevertheless offset by "significantly lower" refining margins, weak oil trading and exploration impairments.

Rivals Exxon Mobil , Chevron , and Shell last week beat profit expectations on the back of a mix of strong trading results and higher oil and gas production while refining margins weighed on the sector amid sluggish global economic activity.

Comments