- XPeng press release: Q3 Non-GAAP EPADS of -$0.36 misses by $0.08.

- Revenue of $960M (+19.3% Y/Y) misses by $35.53M.

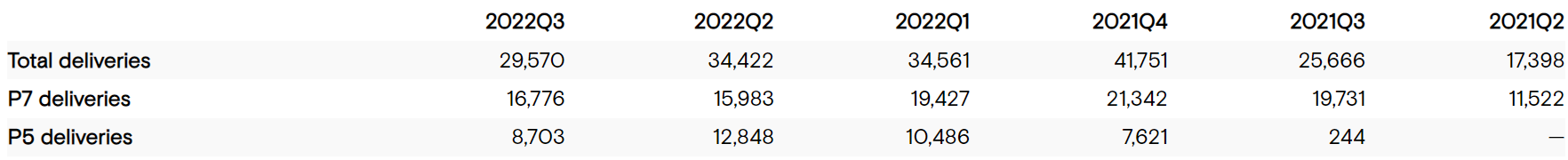

- Quarterly vehicle deliveries reached 29,570, a 15% increase Y/Y.

- Quarterly gross margin was 13.5%, a decrease of 0.9 percentage point Y/Y.

- Deliveries of the P7 smart sports sedan were 16,776 in the third quarter of 2022, representing a decrease of 15% from 19,731 in the corresponding period of 2021.

- Deliveries of the P5 smart family sedan were 8,703 in the quarter.

- As of October 31, 2022, year-to-date total deliveries reached 103,654, representing a 56% increase Y/Y.

- For Q4, the company expects deliveries of vehicles between 20,000 and 21,000, decrease of approximately 49.7% to 52.1% Y/Y.

- Total revenues for the quarter to be between RMB4.8B and RMB5.1B decrease of approximately 40.4% to 43.9% Y/Y.

XPeng Inc.(“XPENG” or the “Company,” NYSE: XPEV and HKEX: 9868), today announced its unaudited financial results for the third quarter of 2022.

Operational and Financial Highlights for the Three Months EndedSeptember 30, 2022

- Total deliveries of vehicles were 29,570 in the third quarter of 2022, representing an increase of 15% from 25,666 in the corresponding period of 2021.

- Deliveries of the P7 smart sports sedan were 16,776 in the third quarter of 2022, representing a decrease of 15% from 19,731 in the corresponding period of 2021.

- Deliveries of the P5 smart family sedan were 8,703 in the third quarter of 2022.

- XPENG’s physical sales network continued expansion with a total of 407 stores, covering 143 cities as ofSeptember 30, 2022.

- XPENGself-operated charging station network further expanded to 1,011 stations, including 806XPENGself-operated supercharging stations and 205 destination charging stations as ofSeptember 30, 2022.

- Total revenues were RMB6.82 billion(US$0.96 billion) for the third quarter of 2022, representing an increase of 19.3% from the same period of 2021, and a decrease of 8.2% from the second quarter of 2022.

- Revenues from vehicle sales were RMB6.24 billion(US$0.88 billion) for the third quarter of 2022, representing an increase of 14.3% from the same period of 2021, and a decrease of 10.1% from the second quarter of 2022.

- Gross margin was 13.5% for the third quarter of 2022, compared with 14.4% for the same period of 2021 and 10.9% for the second quarter of 2022.

- Vehicle margin,which is gross profit of vehicle sales as a percentage of vehicle sales revenue, was 11.6% for the third quarter of 2022, compared with 13.6% for the same period of 2021 and 9.1% for the second quarter of 2022.

- Net loss was RMB2.38 billion(US$0.33 billion) for the third quarter of 2022, compared withRMB1.59 billionfor the same period of 2021 andRMB2.70 billionfor the second quarter of 2022. Excluding share-based compensation expenses, non-GAAP net loss was RMB2.22 billion(US$0.31 billion) in the third quarter of 2022, compared withRMB1.49 billionfor the same period of 2021 andRMB2.46 billionfor the second quarter of 2022.

- Net loss attributable to ordinary shareholders of XPENG was RMB2.38 billion(US$0.33 billion) for the third quarter of 2022, compared withRMB1.59 billionfor the same period of 2021 andRMB2.70 billionin the second quarter of 2022. Excluding share-based compensation expenses, non-GAAP net loss attributable to ordinary shareholders of XPENG was RMB2.22 billion(US$0.31 billion) for the third quarter of 2022, compared withRMB1.49 billionfor the same period of 2021 andRMB2.46 billionfor the second quarter of 2022.

- Comprehensive loss attributable to ordinary shareholders ofXPENGwasRMB0.69 billion(US$0.10 billion) for the third quarter of 2022, compared withRMB1.62 billionfor the same period of 2021 andRMB0.78 billionfor the second quarter of 2022.

- Basic and diluted net loss per American depositary share (ADS) were bothRMB2.77(US$0.39) for the third quarter of 2022. Non-GAAP basic and diluted net loss per ADS were bothRMB2.59(US$0.36) for the third quarter of 2022. Each ADS represents two Class A ordinary shares.

- Cash and cash equivalents, restricted cash, short-term investments and time deposits wereRMB40.12 billion(US$5.64 billion) as ofSeptember 30, 2022, compared withRMB41.34 billionas ofJune 30, 2022. Time deposits include short-term deposits, current portion and non-current portion of long-term deposits.

Business Outlook

For the fourth quarter of 2022, the Company expects:

- Deliveries of vehicles to be between 20,000 and 21,000, representing a year-over-year decrease of approximately 49.7% to 52.1%.

- Total revenues to be betweenRMB4.8 billionandRMB5.1 billion, representing a year-over-year decrease of approximately 40.4% to 43.9%.

XPeng shares fluctuated greatly after reporting quarter results.

Comments