Market Overview

U.S. stocks closed lower on Wednesday (August 9), the day after a report showed Americans borrowed more than ever on their credit cards in the last quarter, and a day ahead of U.S. Consumer Price Index (CPI) inflation data that could influence Federal Reserve interest rate decisions.

Regarding the options market, a total volume of 40,261,937 contracts was traded, up 10% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, NVDA, AAPL, VIX, IWM, PLTR, AMC, AMZN

Options related to equity index ETFs are still popular with investors, with 8.72 million SPDR S&P500 ETF Trust (SPY) and 4.13 million Invest QQQ Trust ETF (QQQ) options contracts trading on Wednesday.

Palantir Technologies Inc. stock has fallen 10.5% to $15.25 on Wednesday, its biggest drop since November 2022. With that decline, shares are now below their 50-day moving average, at $16.16, for the first time May. A lot of technical damage has been done. It's broken its uptrend line, which sat around $17, and its first level of support, near $16. Worse still, the stock has fallen for six straight days and is 22% during its losing streak, the worst six-day stretch since May 2022.

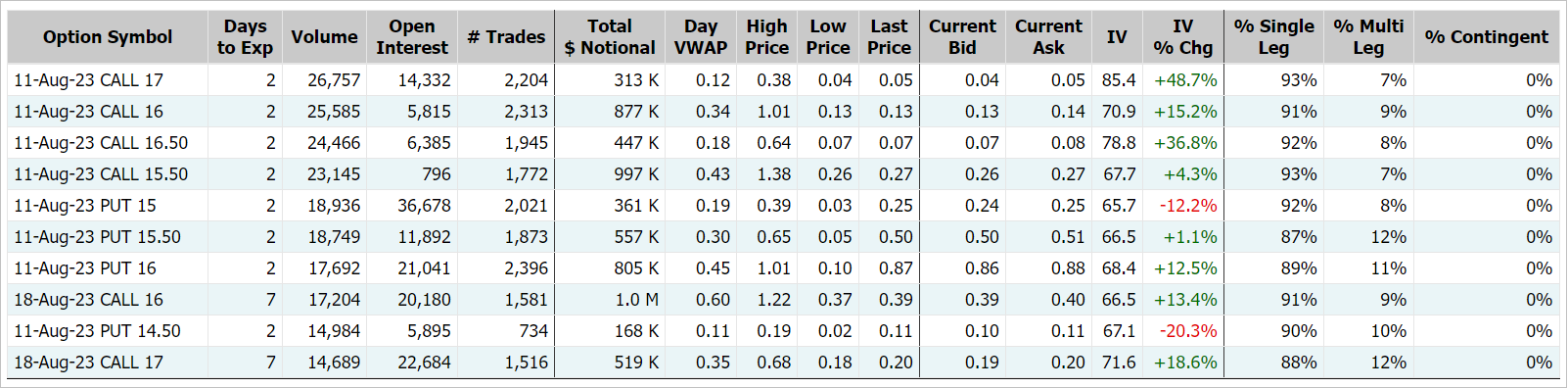

There are 639.6K Palantir option contracts traded on Wednesday, down 29% from the previous trading day. Call options account for 60% of overall option trades. Particularly high volume was seen for the $17 strike call option expiring August 11, with 26,757 contracts trading. PLTR 20230811 17.0 CALL

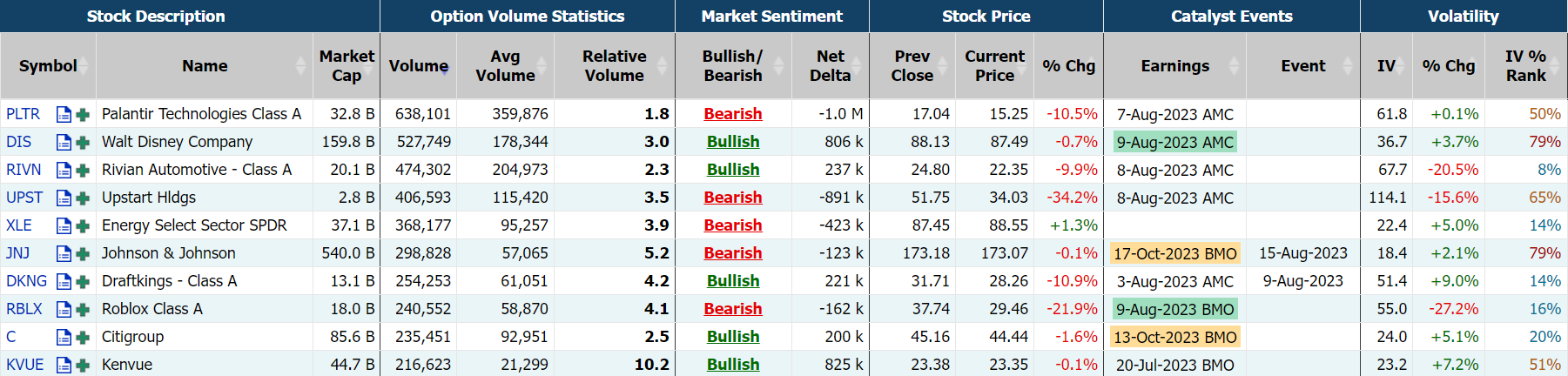

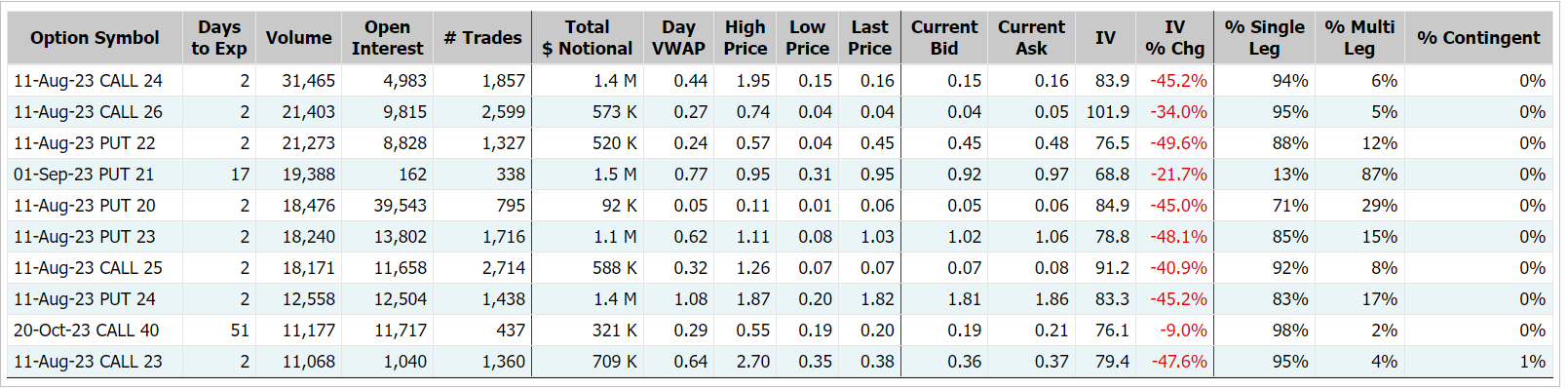

Most Active Equity Options

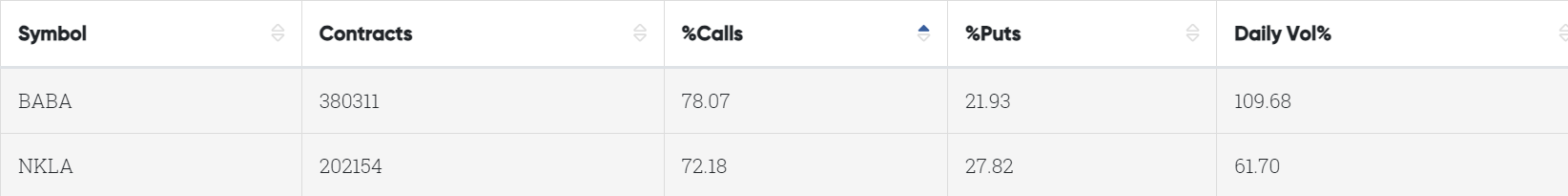

Special %Calls >70%: Alibaba, Nikola Corporation

Unusual Options Activity

Walt Disney CEO Bob Iger acknowledged that the entertainment company faces a “challenging environment” in the near term on Wednesday, but he emphasized progress in cutting costs and focusing on creativity, even as quarterly results showed Disney's soft spots. Disney’s stock rose more than 2% in after-hours trading, as Iger touted $1 billion in operating-income improvement at the company’s streaming business over the last three quarters, which is aiming for profitability in 2024.

There are 535K Disney option contracts traded on Wednesday, up 202% from the previous trading day. Call options account for 57% of overall option trades. Particularly high volume was seen for the $85 strike put option expiring August 11, with 15,665 contracts trading. DIS 20230811 85.0 PUT

Upstart Holdings, Inc.’s breakneck rally is losing momentum after the lending platform that uses artificial intelligence provided a disappointing outlook. Shares dropped 34% on Wednesday, the worst tumble since May 2022, after its third-quarter revenue forecast fell short of consensus estimates. The stock’s recent weakness has sawed off more than half of a 2023 rally that at one point reached 445%.

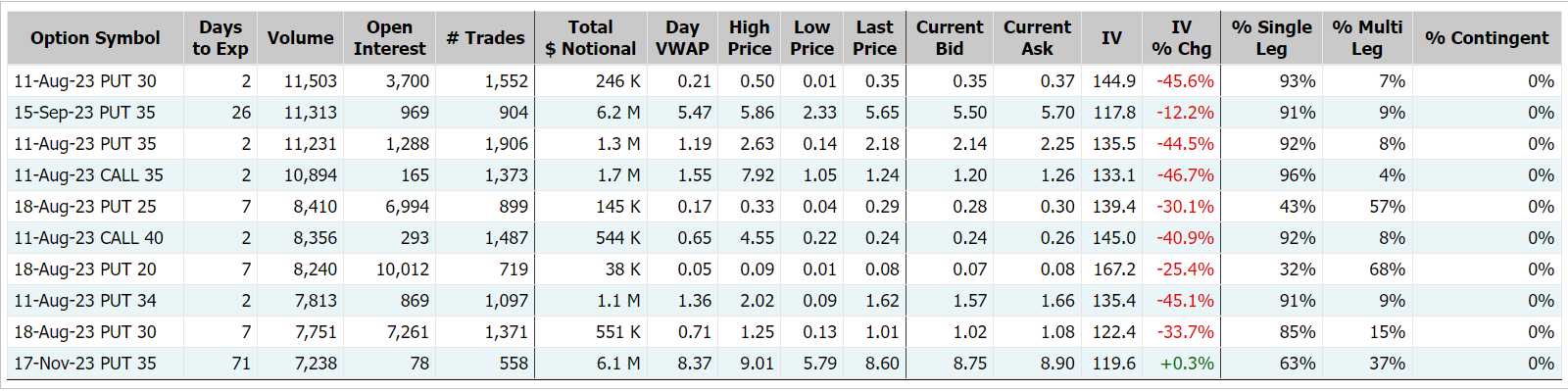

There are 412K Upstart option contracts traded on Wednesday, up 140% from the previous trading day. Put options account for 57% of overall option trades. Particularly high volume was seen for the $30 strike put option expiring August 11, with 11,503 contracts trading. UPST 20230811 30.0 PUT

Rivian Automotive, Inc.’s better-than-expected quarterly results failed to boost the EV maker’s stock on Wednesday, with most analysts keeping their cautious view on the company and on the direction of the stock in the near term. Rivian’s shares dropped 9.9% on Wednesday, a day after the company reported second-quarter results that topped Wall Street views and raised its production guidance for the year to 52,000 vehicles, from 50,000.

There are 499.7K Rivian option contracts traded on Wednesday, up 29% from the previous trading day. Call options account for 60% of overall option trades. Particularly high volume was seen for the $24 strike call option expiring August 11, with 31,465 contracts trading. RIVN 20230811 24.0 CALL

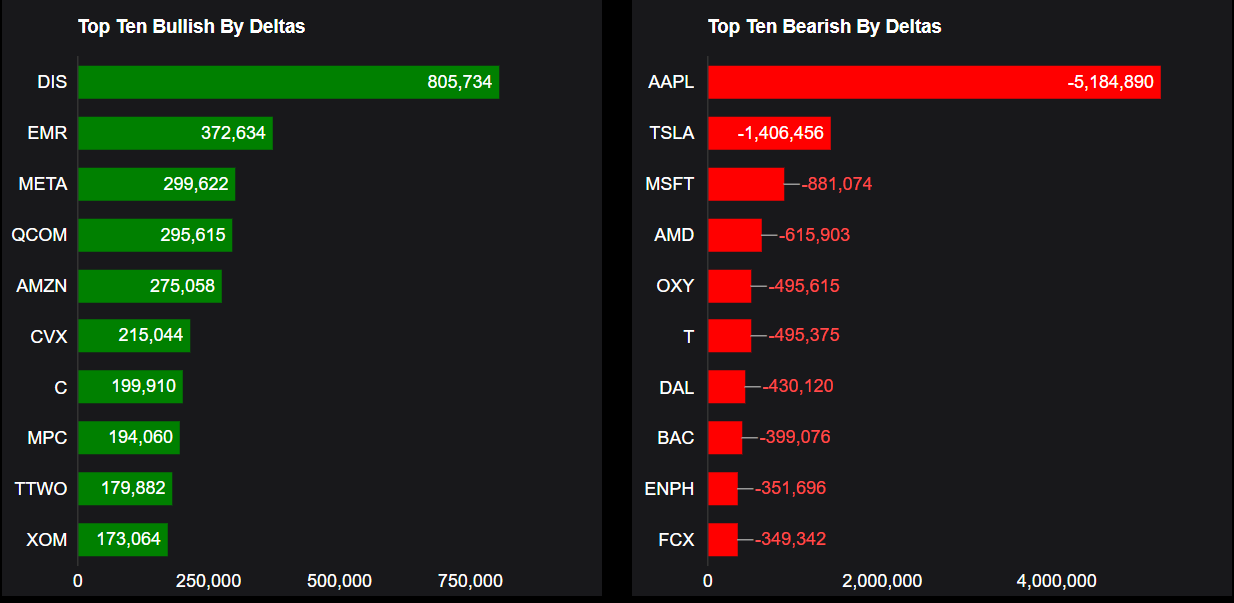

TOP 10 Bullish & Bearish S&P 500

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Based on Apple option delta volume, traders sold a net equivalent of -5,184,890 shares of stock. The largest bearish delta came from selling calls, suggesting that the stock may decline. The largest delta volume came from the 11-Aug-23 180 Call, with traders getting short 3,602,962 deltas on the single option contract. AAPL 20230811 180.0 CALL

Top 10 bullish stocks: DIS, EMR, META, QCOM, AMZN, CVX, C, ENPH, FCX, XOM

Top 10 bearish stocks: AAPL, TSLA, MSFT, AMD, OXY, T, DAL, BAC, ENPH, FCX

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments