U.S. stocks closed near flat on Tuesday (Feb. 27th) ahead of inflation and other economic data that could shed light on the possible timing of a Federal Reserve interest rate cut. The technology-heavy Nasdaq Composite resumed its climb Tuesday, closing within striking distance of a record high hit in 2021.

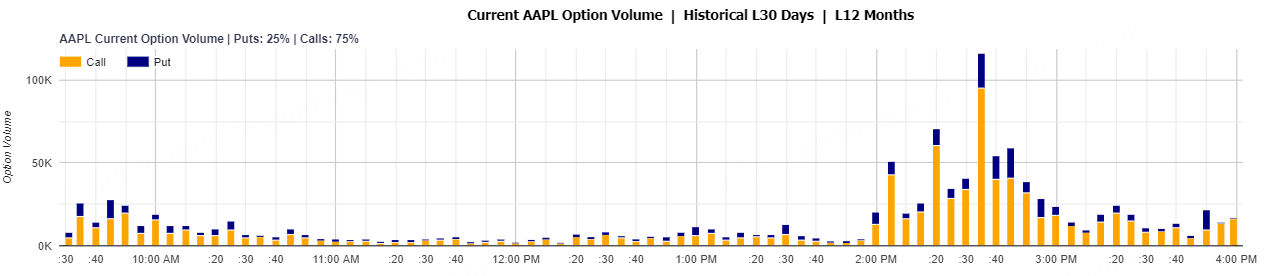

Regarding the options market, a total volume of 38,145,861 contracts was traded on Tuesday.

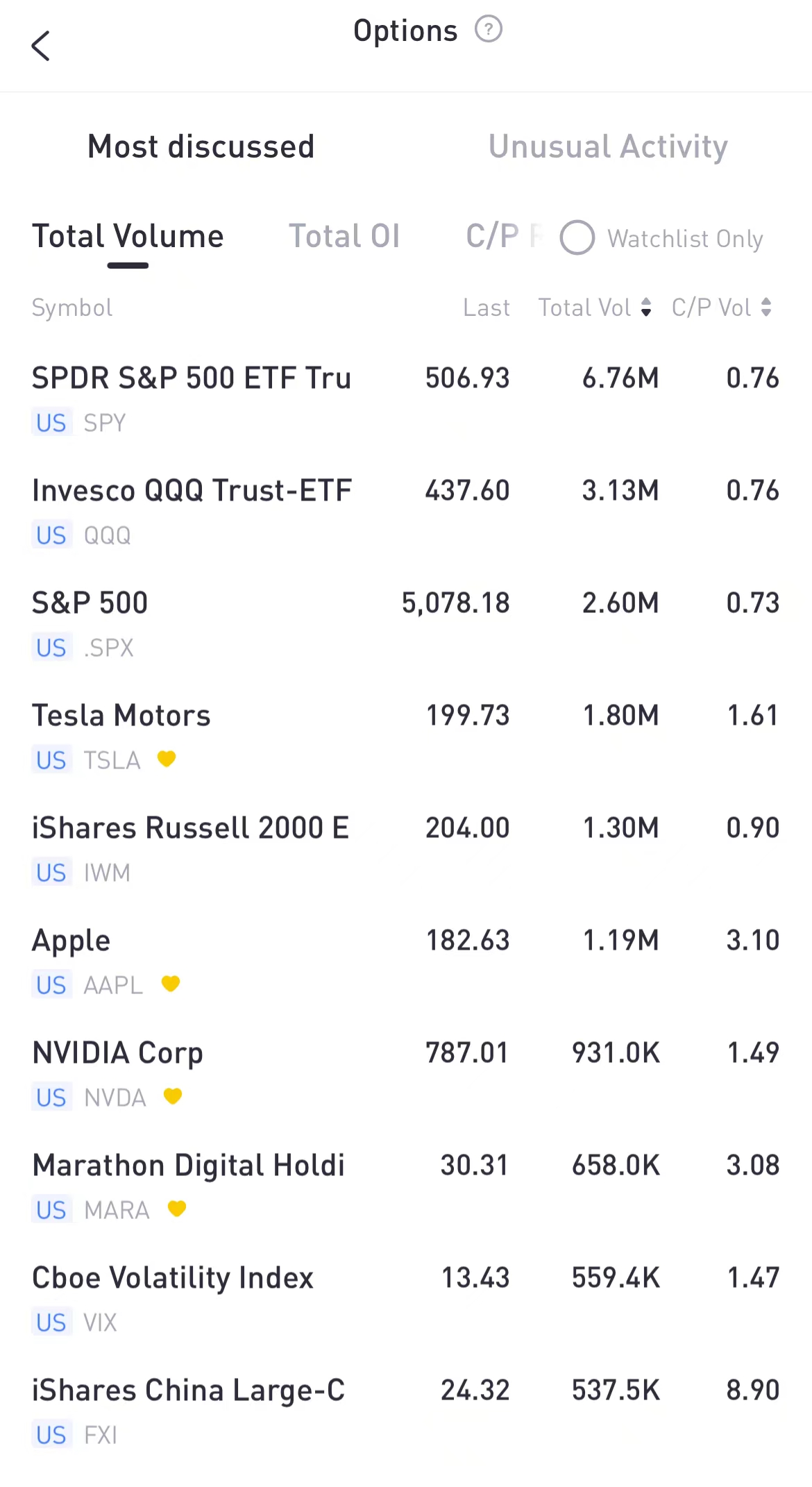

Top 10 Option Volumes

Top 10: SPY; QQQ; SPX; TSLA; IWM; AAPL; NVDA; MARA; VIX; GOOGL;

Source: Tiger Trade App

Apple told employees it was winding down the car project and reassigned some of the staff to its AI efforts. The decision followed months of frenzied meetings between top executives and the company’s board over how to proceed. Chief Operating Officer Jeff Williams and project head Kevin Lynch broke the news to the roughly 2,000-member team during a meeting that lasted less than 15 minutes.

Apple stock closed 0.81% higher on Tuesday. Investors and analysts applauded the move, which lets Apple avoid an electric-vehicle market that’s grown more perilous in recent months. Shifting resources toward generative AI is the right call “given the long-term profitability potential of AI revenue streams versus cars.

A total number of 1.19 million options related to Apple was traded, of which 75% were call options. A particularly high trading volume was seen for the $182.5 strike call option expiring this Friday, with a total number of 160,580 options contracts trading as of Tuesday.

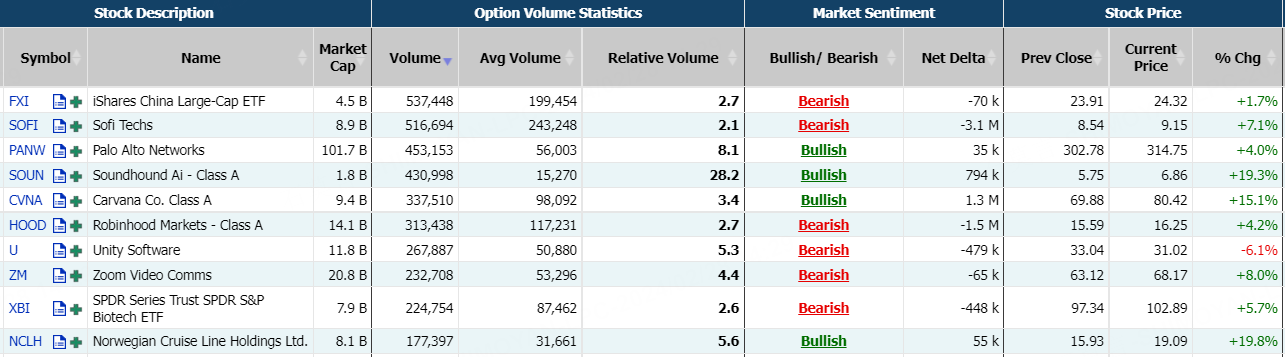

Unusual Options Activity

SoundHound AI stock continued to soar another 19% on Tuesday after a 46.7% rally on Monday. SoundHound AI is surging thanks to an announcement that Nvidia has formed a new partnership with other influential hardware and software players to advance AI technologies in the telecommunications industry. The news could bode well for SoundHound's voice-based assistant business.

SoundHound AI will report its 2023 fourth quarter and full year financial results on Thursday, February 29, 2024 after market close.

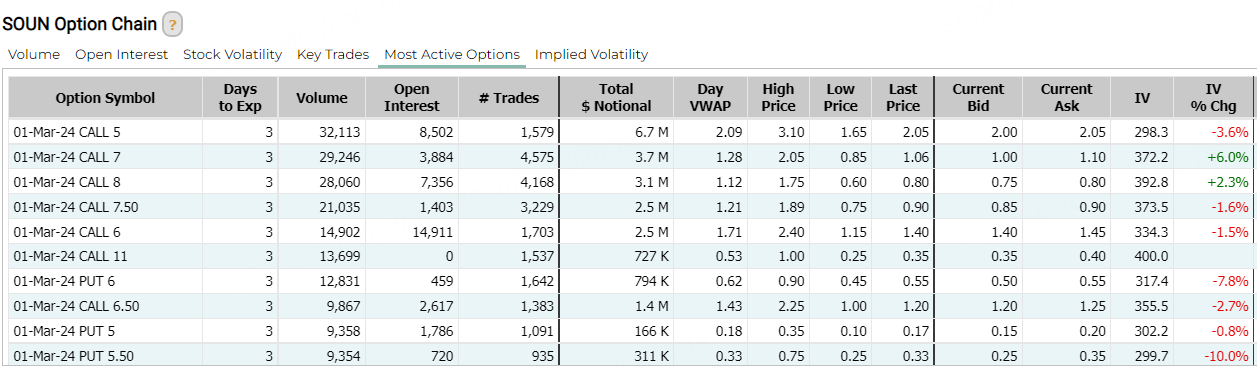

A total number of 430,998 options related to SoundHound AI was traded on Tuesday, 28.2 times higher than the 90-day average volume. Among the total options trading volume, 74% were call options. A particularly high trading volume was seen for the $5 strike call option expiring this Friday, with a total number of 32,133 options trading on Tuesday.

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: MARA; CVNA; BBAI; VKTX; PLTR; SOUN; DNA; MDRX; PTON; RKLB

Top 10 bearish stocks: AAPL; SOFI; RIVN; TSLA; CCL; BHC; MSFT; AMZN; U

Based on option delta volume, traders bought a net equivalent of 2,425,247 shares of Marathon Digital stock. The largest bullish delta came from buying calls.

The largest delta volume came from the 01-Mar-24 $30 Call, with traders getting short 196,982 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments