Inflation rose in February but was in line with expectations, providing a key input into whether the Federal Reserve continues to raise interest rates.

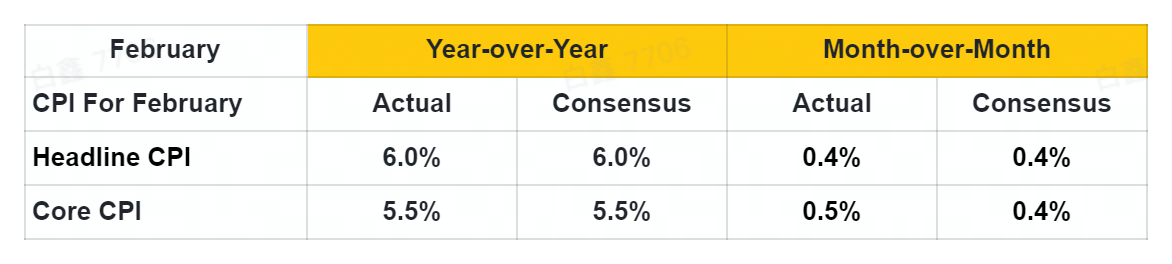

The consumer price index increased 0.4% for the month, putting the annual inflation rate at 6%, the Labor Department reported Tuesday. Both readings were exactly in line with Dow Jones estimates. The 6% jump in inflation marks the slowest annual increase in consumer prices since September 2021.

Excluding volatile food and energy prices, core CPI increased 0.5% in February and 5.5% on a 12-month basis. The monthly reading was slightly ahead of the 0.4% estimate, but the annual level was in line.

Heading into the release, markets had widely expected the Fed to approve another 0.25 percentage point increase to its benchmark federal funds rate.

However, banking sector turmoil in recent days has kindled speculation that the central bank could signal that it soon will halt the rate hikes as officials observe the impact that a series of tightening measures have had over the past year.

Markets Tuesday morning were pricing a peak, or terminal, rate of about 4.92%, which would mean the upcoming increase would be the last. Futures pricing is volatile, though, and unexpectedly strong inflation reports this week likely would cause a repricing.

Either way, market sentiment has shifted dramatically.

Fed Chairman Jerome Powell last week told two congressional committees that the central bank is prepared to push rates higher than expected if inflation does not come down. That set off a wave of speculation that the Fed could be teeing up a 0.5 percentage point hike next week.

However, the collapse of Silicon Valley Bank and Signature Bank over the past several days paved the way for a more restrained view for monetary policy.

Comments