The three major U.S. stock indexes ended down more than 1% each on Thursday, led by a drop in the Nasdaq after this week's sharp gains and as investors were nervous ahead of Federal Reserve Chair Jerome Powell's speech Friday.

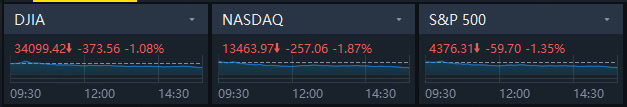

Market Snapshot

The Dow Jones Industrial Average fell 373.56 points, or 1.08%, to 34,099.42, the S&P 500 lost 59.7 points, or 1.35%, to 4,376.31 and the Nasdaq Composite dropped 257.06 points, or 1.87%, to 13,463.97.

Market Movers

Nvidia (ticker: NVDA) was up 0.1% after the graphics-chip maker reported second-quarter revenue of $13.5 billion, smashing estimates of $11.2 billion. Data-center revenue soared 141% to $10.32 billion. Adjusted earnings of $2.70 a share also easily beat expectations of $2.08. Nvidia said it expects third-quarter revenue of $16 billion at the midpoint of its range, well above analysts’ consensus of $12.6 billion. CEO Jensen Huang credited a dramatic shift toward adoption of artificial intelligence for the robust results. Related stocks traded lower. Taiwan Semiconductor (TSM) fell 1.8%, Advanced Micro Devices (AMD) fell 7%, Marvell Technology (MRVL) was down 6.9%, and Palantir Technologies (PLTR) slid 7.6%.

AMC Entertainment (AMC) fell 26%. The movie-theater chain’s 10-for-1 reverse stock split went into effect Thursday.

Petco Health (WOOF) slid 21% after the pet goods retailer cut its earnings guidance for the fiscal year.

Splunk (SPLK) reported second-quarter adjusted earnings of 71 cents a share, easily surpassing analysts’ estimates. Revenue in the period rose 14% to $910.6 million, while cloud revenue jumped 29% to $445 million. Splunk said it expects third-quarter revenue of between $1.02 billion and $1.035 billion, topping analysts’ estimates of $982 million. Shares of the software company rose 13%.

Boeing (BA) declined 4.9% over worries about a quality issue linked to supplier Spirit AeroSystems (SPR) that affects some 737 models. Boeing said the issue didn’t create an immediate safety problem, but “will impact near-term 737 deliveries.” Spirit AeroSystems fell 13%.

Dollar Tree (DLTR) dropped 13% after the discount retailer tightened its earnings outlook for the fiscal year. It highlighted pressure on profits from inventory loss and consumers turning to lower-priced products. The stock was the worst performer in the S&P 500.

Vizio Holding (VZIO) dropped 10% after BofA analysts double downgraded the entertainment platform to Underperform from Buy.

Burlington Stores (BURL) fell 9% after the discount retailer cut its adjusted earnings guidance for the fiscal year.

Autodesk (ADSK) posted second-quarter adjusted profit and revenue that topped Wall Street forecasts. The software company’s stock rose 2.1%.

T-Mobile (TMUS) shares fell 2.2% after the mobile carrier disclosed in a filing that it will cut 5,000 positions, or a little under 7% of its total workforce.

Guess (GES) jumped 26% after second-quarter adjusted earnings at the retailer beat analysts’ expectations and revenue rose 3% to $664.5 million, also higher than forecasts. The company said it expects third-quarter revenue to increase between 2.5% and 4.5%.

Vinfast surged 32.33% on Thursday since the company went public through a special-purpose acquisition company deal last week, taking its market capitalization to levels well beyond established automakers such as Ford Motor Co. and General Motors Co, and only less than Tesla and Toyota.

Market News

Domo, Inc. (NASDAQ:DOMO) tumbled 22% in extended trading; It reported Q2 EPS of ($0.02), $0.07 better than the analyst estimate of ($0.09). Revenue for the quarter came in at $79.7 million versus the consensus estimate of $78.9M. Domo, Inc. sees Q3 2024 EPS of ($0.10)-($0.14), versus the consensus of ($0.06). Domo, Inc. sees Q3 2024 revenue of $78.5-79.5M, versus the consensus of $82M. Domo, Inc. sees FY2024 EPS of ($0.39)-($0.47), versus the consensus of ($0.35). Domo, Inc. sees FY2024 revenue of $316-320M, versus the consensus of $326M.

Affirm Holdings Inc (NASDAQ:AFRM) gained 7% in extended trading; It reported Q4 EPS of ($0.69), $0.18 better than the analyst estimate of ($0.87). Revenue for the quarter came in at $446M versus the consensus estimate of $406.13M. Affirm Holdings sees Q1 2024 revenue of $430-455M, versus the consensus of $429.9M.

Nordstrom (NYSE:JWN) slid 4% in extended trading; It reported Q2 EPS of $0.81, $0.36 better than the analyst estimate of $0.45. Revenue for the quarter came in at $3.62 billion versus the consensus estimate of $3.68B. Reaffirms fiscal 2023 revenue and adjusted earnings outlook. Nordstrom sees FY2024 EPS of $1.80-$2.20, versus the consensus of $1.99.

Workday (NASDAQ:WDAY) rose 3% in extended trading; It reported Q2 EPS of $1.43, $0.17 better than the analyst estimate of $1.26. Revenue for the quarter came in at $1.79B versus the consensus estimate of $1.77B.

Hawaiian Electric Industries (NYSE:HE) slid 3% in extended trading; The Board of Directors has determined that, to further increase its cash position, it will suspend the quarterly cash dividend on the company’s common stock, beginning with the third quarter of 2023.

Intuit (NASDAQ:INTU) slid 2% in extended trading; It reported Q4 EPS of $1.65, $0.22 better than the analyst estimate of $1.43. Revenue for the quarter came in at $2.7B versus the consensus estimate of $2.64B. Intuit sees Q1 2024 EPS of $1.94-$2.00, versus the consensus of $1.99. Intuit sees FY2024 EPS of $16.17-$16.47, versus the consensus of $15.95. Intuit sees FY2024 revenue of $15.89-16.105B, versus the consensus of $15.99B.

Gap Inc (NYSE:GPS) rose 1% in extended trading; It reported Q2 EPS of $0.34, $0.24 better than the analyst estimate of $0.10. Revenue for the quarter came in at $3.55B versus the consensus estimate of $3.58B.

The former vice president of autonomous driving at Chinese electric vehicle maker Xpeng, Wu Xinhou, is joining U.S. artificial intelligence giant Nvidia, he said on Thursday.

Comments