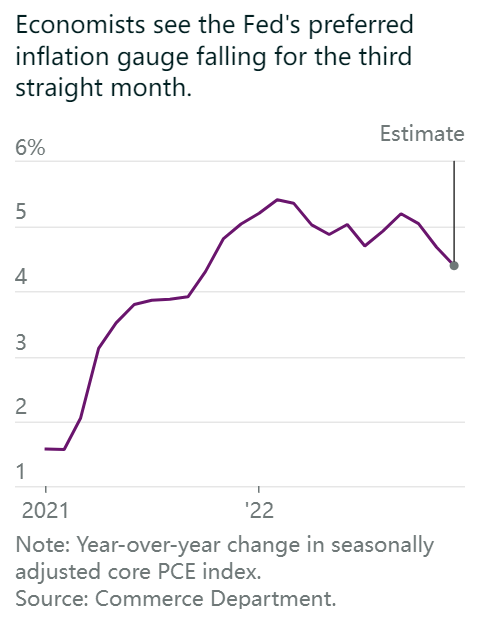

The Federal Reserve’s preferred measure of rising prices is set to show that inflation continues to trend downward, supporting the narrative that the central bank could soon ease up in its battle against elevated prices.

The core personal-consumption expenditures price index is expected to have climbed 4.4% year over year in December, based on consensus estimates of economists surveyed by FactSet, a slight slowdown from November’s 4.7% growth. On a month-over-month basis, the index is projected to have advanced by 0.3%. This index, also known as the core PCE deflator, gauges the prices that U.S. consumers are paying for goods and services, excluding food and energy.

Meanwhile, the headline PCE deflator, which includes food and energy, is estimated to be flat month over month. Both measures are set to be released at 8:30 a.m. Eastern on Friday.

The indicators should confirm recent data at the consumer level that suggest inflation is past its peak. That should relieve some pressure on the Fed, which embarked on a determined campaign of tightening financial conditions over the past year to combat elevated consumer prices. It should also relieve pressure on investors: The Fed’s seven interest-rate increases in 2022—including its largest in decades—were a major headwind for the stock market, with the S&P 500 tumbling nearly 20% in 2022.

Nevertheless, Fed officials have telegraphed that fighting inflation remains a priority and that the central bank will continue to lift interest rates in 2023. Futures markets are pricing in a 25 basis-point rate increase next week, when the Fed’s rate-setting committee meets on Jan. 31 and Feb. 1. That would mark the central bank’s smallest rate increase since it first began tightening financial conditions last March. The PCE prints will be the last pieces of holistic inflation data Fed officials will review before that monetary policy decision.

Investors are going into Friday with some clarity at least, because PCE data on the quarterly level were included in the fourth-quarter U.S. gross domestic product report released Thursday.

Core PCE increased 3.9% in the fourth quarter of 2022, according to the GDP report. While there could be revisions to November data influencing that figure, analysts are still able to crunch the numbers to produce a December estimate. It looks like consensus is about spot-on.

“The core PCE data imply a 0.28% increase in the December number, in line with the consensus for tomorrow’s report, but that assumes no revisions to prior data,” said Ian Shepherdson, the chief economist at Pantheon Macroeconomics, in a note. “We expect a 0.2% December increase and a small upward revision to November. Either way, the trend is slowing.”

While PCE is the Fed’s preferred inflation measure, it doesn’t offer the whole story as the central bank mulls its monetary policy path forward. Fed Chairman Jerome Powell and other officials have said they are also closely watching tightness in the labor market as a barometer for the health of the U.S. economy. Weekly labor data out Thursday confirmed that jobless claims continue to trend downward, and Fed officials will also be able to review to employment cost index (ECI) data on Jan. 31, the day before they announce their next rate decision.

“It is difficult to see unemployment rising to the required rate to moderate wage inflation at these levels of growth,” Alexandra Wilson-Elizondo, head of multi-asset retail investing at Goldman Sachs Asset Management, said in a note after Thursday’s GDP release. “We need activity weakness to translate to job losses to address Powell’s preferred services ex-shelter inflation metric, where wages are the primary driver.”

Comments