Market Overview

Wall Street's main indexes ended lower on Wednesday (May 24) as talks between the White House and Republican representatives on raising the U.S. debt ceiling dragged on without a deal.

Regarding the options market, a total volume of 37,492,116 contracts was traded, up 2% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY; QQQ; TSLA; IWM; NVDA; AMZN; AAPL; VIX; NU, AMD

Options related to equity index ETFs are still popular with investors, with 9.01 million SPDR S&P500 ETF Trust (SPY) and 3.13 million Invest QQQ Trust ETF (QQQ) options contracts trading on Wednesday.

NVIDIA Corp on Wednesday forecast second-quarter revenue more than 50% above Wall Street estimates, and said it is boosting supply to meet surging demand for its artificial-intelligence chips, which are used to power ChatGPT and many similar services.

Shares of Nvidia, the world's most valuable listed semiconductor company, rocketed as much as 25% after the bell to trade at $380.65, a record high. The gain increased Nvidia's stock market value by about $200 billion to over $950 billion, extending the Silicon Valley company's lead as the world's most valuable chipmaker and Wall Street's fifth-most-valuable company.

Option traders placed bets in advance on Nvidia's earnings. There are 930.7K Nvidia option contracts traded on Wednesday. Call options account for 54% of overall option trades. Particularly high volume was seen for the $335 strike call option expiring May 26, with 25,707 contracts trading.

Most Active Options

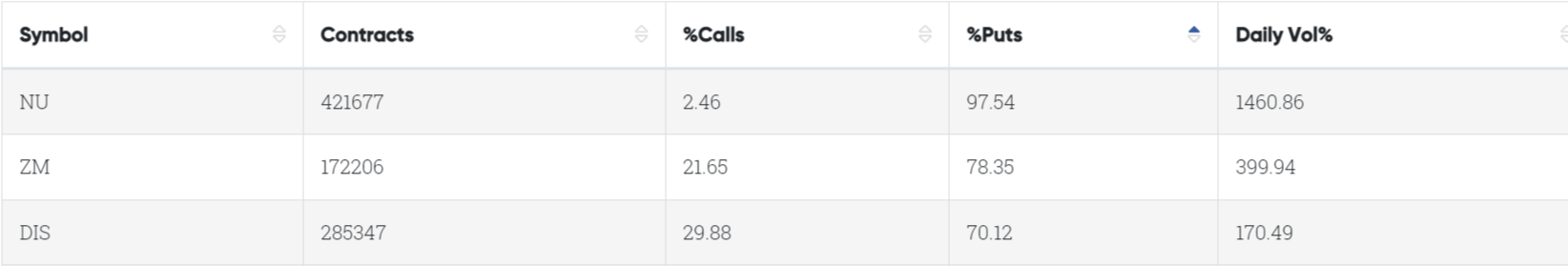

1. Most Active Trading Equities Options:

Special %Puts >70%: Nu Holdings Ltd., Zoom, Walt Disney

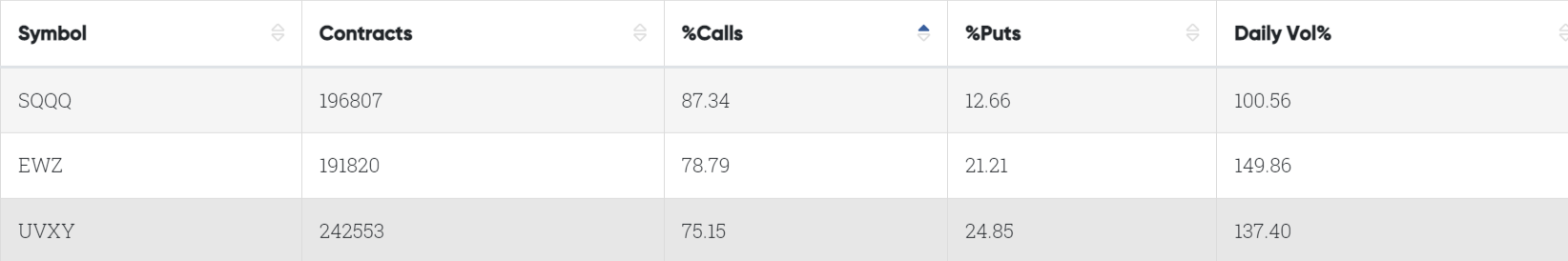

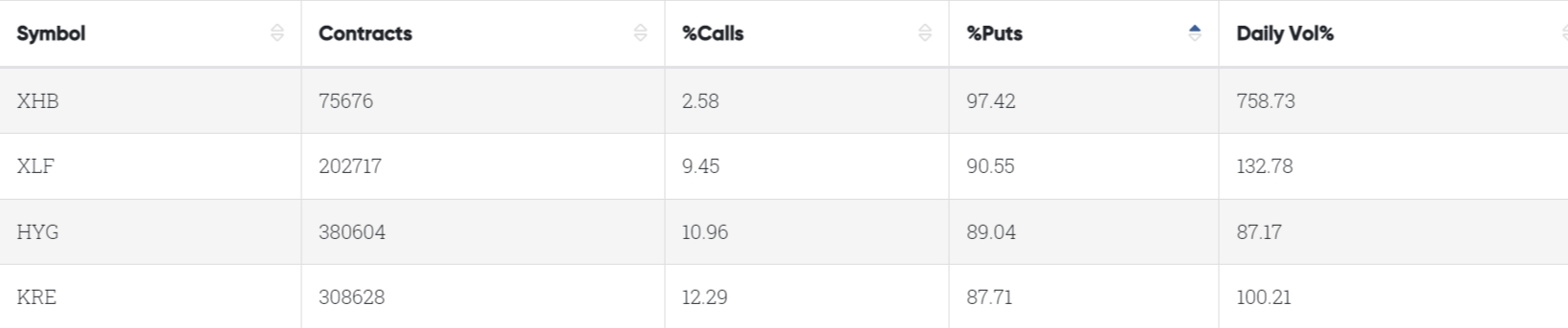

2. Most Active Trading ETFs Options

Special %Calls >70%: Nasdaq100 Bear 3X ETF, iShares MSCI Brazil ETF, VIX Short-Term Futures 1.5X ETF

Special %Puts >70%: SPDR S&P Homebuilders ETF, Financial Select Sector SPDR Fund, $iShares iBoxx High Yield Corporate Bond ETF, SPDR S&P Regional Banking ETF

Unusual Options Activity

Buffett-backed Nu Holdings Ltd. attracted the attention of option traders, although there has been little significant news lately. The Brazilian digital lender jumped about 32% in May and have risen over 67% so far this year.

Speaking at an event marking Nubank's 10 years of operations last week, Chief Executive David Velez said the bank has always seen itself as a "technology company" and hopes AI will help relationship with clients to go beyond its app in coming years.

Citi last week downgraded Nu Holdings to Neutral from Buy with a price target of $6.10, down from $7. The analyst sees "several headwinds ahead" for the company, including a slowdown in cards payment volume, caps in pre-paid card interchange, potential changes in revolving lines, lower interest rates and higher capital requirements. Nu's new initiatives, like Mexico and Payroll, should not be enough to offset such headwinds in the short term, leading to a material deceleration in sales, the analyst tells investors in a research note. As such, the firm sees limited room for a further re-rating in the stock's current valuation.

There are 421.7K Nu Holdings option contracts traded on Wednesday. Put options account for 98% of overall option trades. Particularly high volume was seen for the $5.5 strike put option expiring October 20, with 203,767 contracts trading. The next is the $4.5 strike put option expiring October 20, with 200,984 contracts trading.

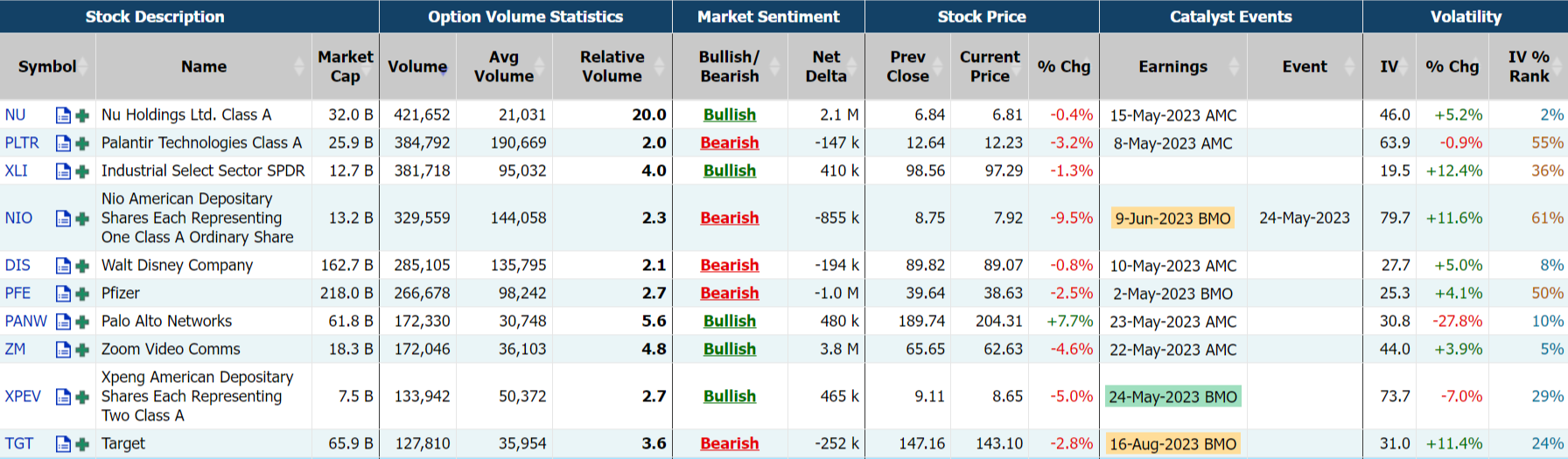

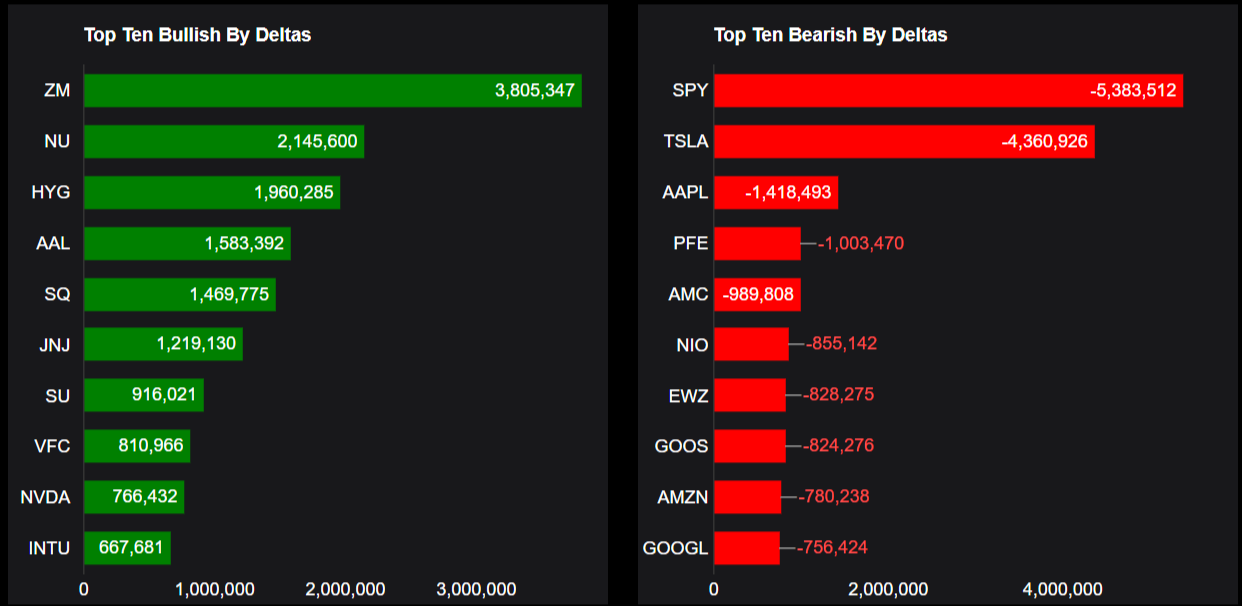

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: ZM, NU, HYG, AAL, SQ, JNJ, SU, VFC, NVDA, INTU

Top 10 bearish stocks: SPY, TSLA, AAPL, PFE, AMC, NIO, EWZ, GOOS, AMZN, GOOGL

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments