Virgin Galacticstock tumbled Friday after the space tourism companypushed backthe launch of commercial service to the second quarter of 2023.

The new delay also prompted a ratings downgrade from a Wall Street analyst.

Virgin Galactic last said it expected to start commercial space-tourism service in the first quarter of 2023. That was after pushing back the launch to the fourth quarter of 2022.

It isn’t the delay investors have had to deal with. Back when the company was raising money by merging with a special purpose acquisition company, its target day for the commencement of commercial service was 2020.

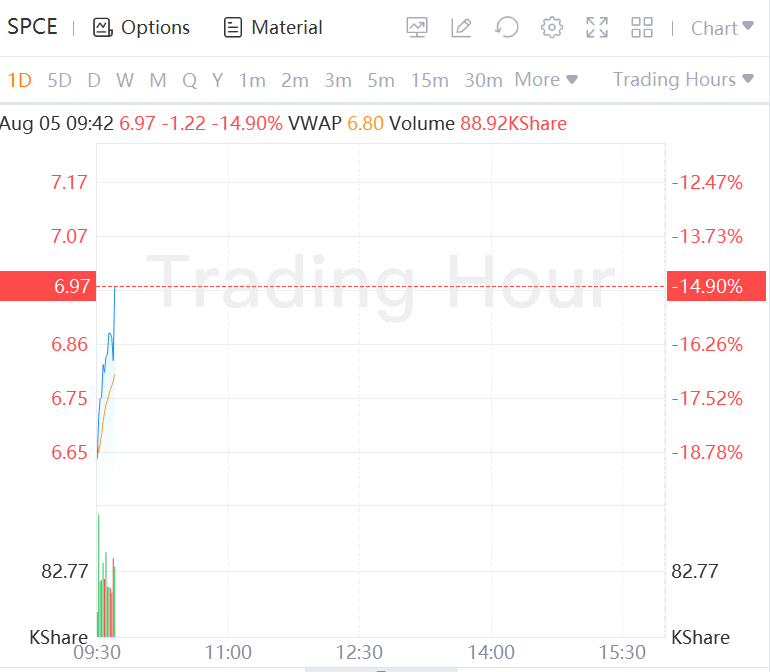

Virgin Galactic stock slid about 10% early in the premarket session Friday. Then Truist analystMichael Ciarmolicut his rating on the stock to Sell from Hold, and lowered his price target to $5 a share from $8. Soon after opening for trading, the stock tumbled almost 19% to $6.64.

TheS&P 500was down 1% and theDow Jones Industrial Averagedeclined 0.7%.

Cash burn is a concern for the analyst, especially with revenue-generating flights delayed again. The company still has about $1.1 billion on its balance sheet. Virgin Galactic has burned through about $160 million so far in 2022. Analysts project the company will burn through about $550 million through the rest of 2022 and 2023 combined. Those burn estimates might rise given the new delay.

Virgin Galactic said in its second-quarter earnings release the latest delay was “due to extended completion dates within the mothership enhancement program.”

CEO Michael Colglazier added: “While our short-term plans now call for commercial service to launch in the second quarter of 2023, progress on our future fleet continues and many of the key elements of our roadmap are now in place to scale the business in a meaningful way.”

Virgin Galactic announced last month that it was partnering withBoeing’s(BA) Aurora Flight Sciences to design the company’s next-generationmotherships.

A mothership is the airplane that takes a spaceship up to about 45,000 feet before dropping it. After separation, the spaceship engine starts and takes passengers to the edge of space.

Along with the delay, Virgin Galactic reported a second-quarter loss of 43 cents a share on revenue of $357,000, down from $571,000 last year.

With the downgrade, four out of 12, or 33%, of analysts covering the stock rate it Sell. TheaverageSell-rating ratio for stocks in the S&P 500 is less than 10%. There are still two Buy ratings on Galactic shares, along with six Hold ratings.

Comments