Market Overview

The Dow Jones Industrial Average led Wall Street higher on Monday (July 24) and notched its longest winning streak in six years as investors bet on sectors beyond technology in a week filled with earnings reports and a Federal Reserve meeting.

Regarding the options market, a total volume of 35,817,772 contracts was traded, down 16% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY; QQQ; AMC; TSLA; AAPL; NVDA; VIX; IWM; AMZN; NIO;

Options related to equity index ETFs are still popular with investors, with 6.48 million SPDR S&P500 ETF Trust (SPY) and 2.95 million Invest QQQ Trust ETF (QQQ) options contracts trading on Monday.

U.S.-listed shares of Chinese companies like Alibaba and JD.com rose 4.5% and 3.5% respectively on Friady as its top leaders announced economic policy adjustments to expand domestic demand. Shares of NIO Inc. are experiencing a surge 10.9% after news broke that the Chinese government is determined to boost the growth of clean energy businesses. The National Development and Reform Commission (NDRC), a government agency responsible for economic development in China, expressed interest in bringing private capital to support major projects in various sectors including transportation and clean energy.

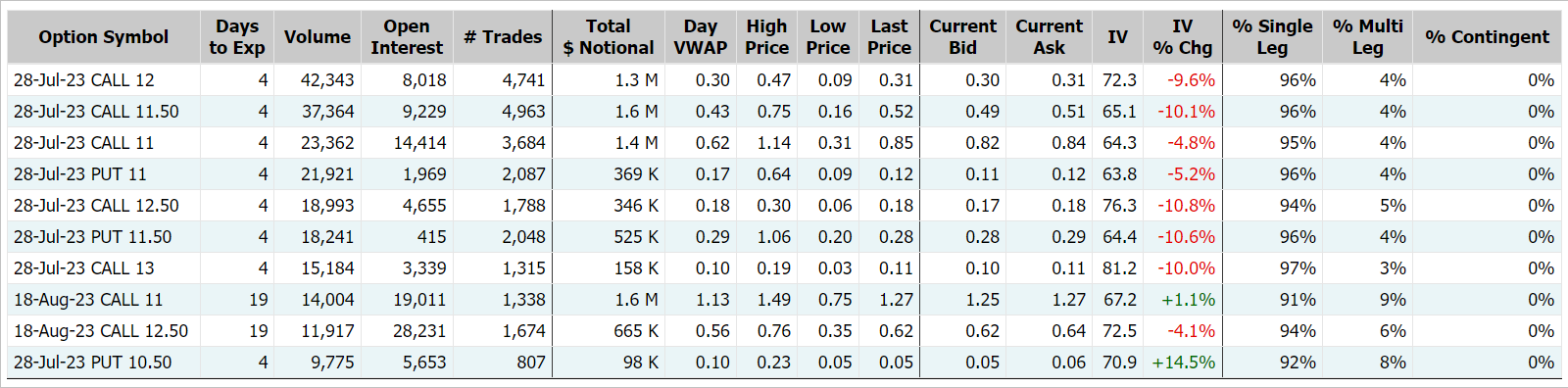

There are 480.1K NIO option contracts traded on Monday, approximately 2.5 times the 90-day average trading volume. Call options account for 77% of overall option trades. Particularly high volume was seen for the $12 strike call option expiring July 28, with 42,343 contracts trading. NIO 20230728 12.0 CALL

Most Active Equity Options

Special %Calls >70%: Alibaba, Walt Disney, NIO Inc., Verizon, Palantir Technologies Inc., Alphabet

Unusual Options Activity

AMC Entertainment shares jumped about 33% on Monday after a judge blocked the theater chain's stock conversion plan that risked diluting investors' holdings in the company. AMC's preferred shares closed flat.

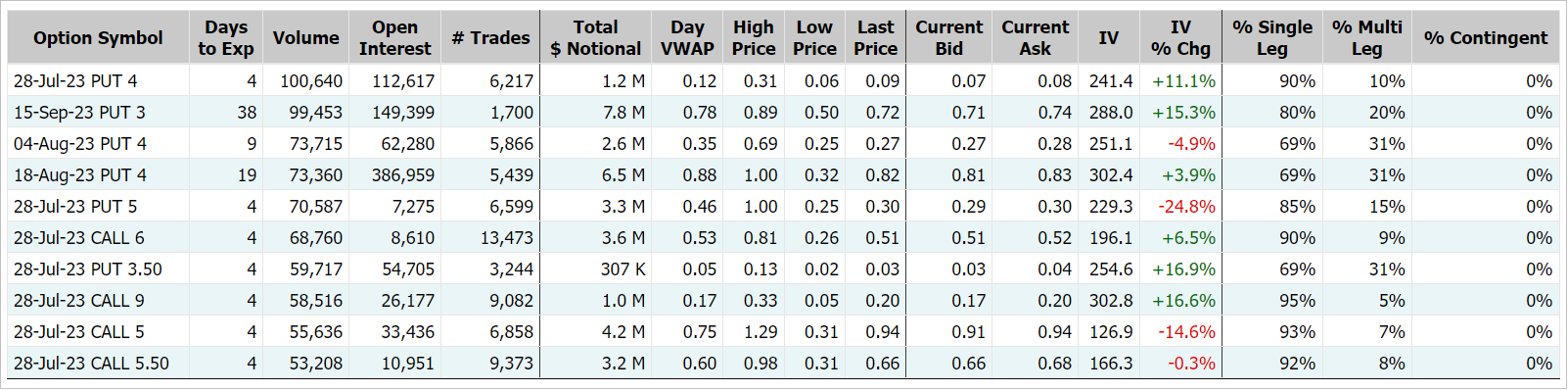

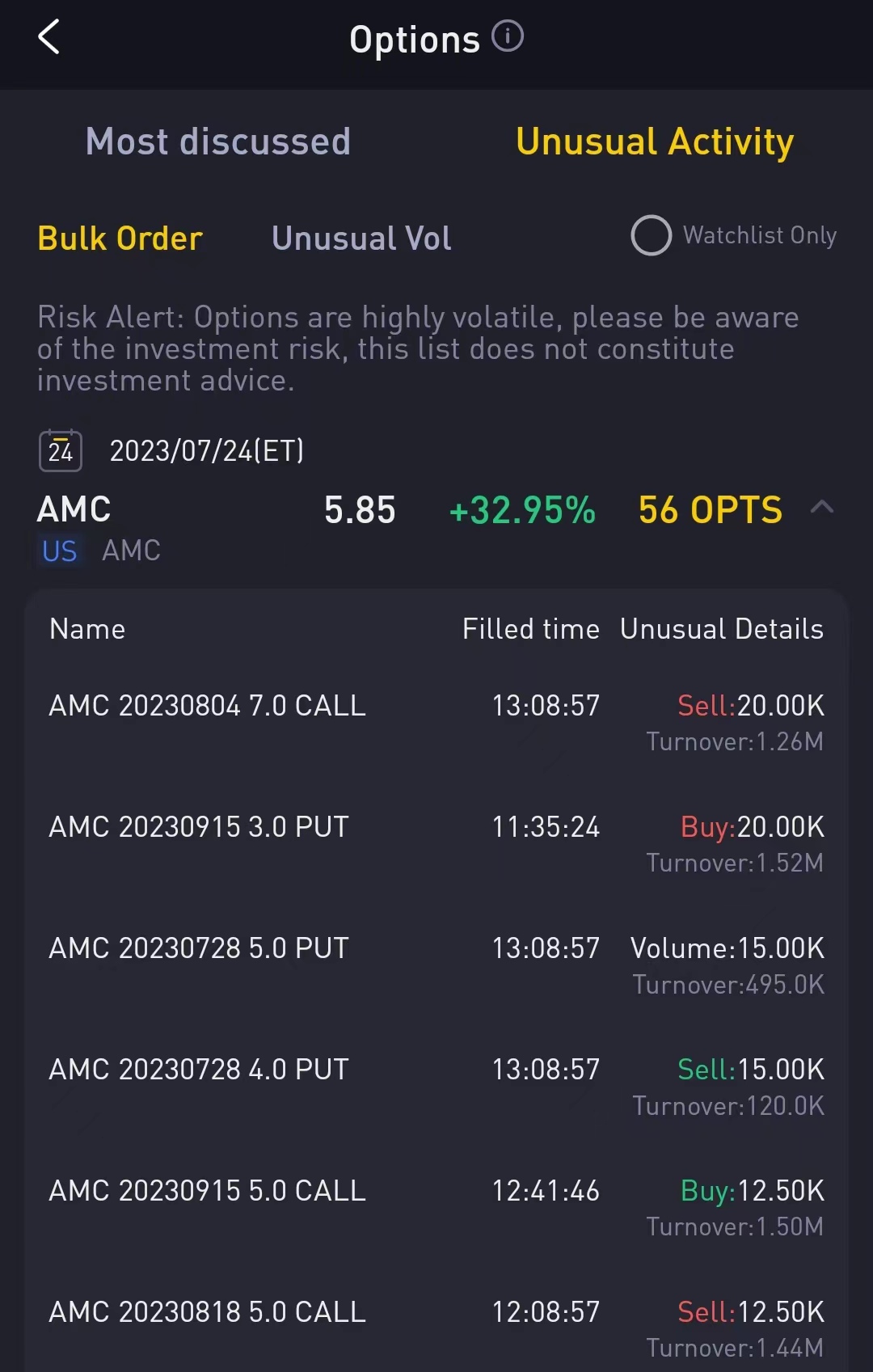

There are 1.97 million AMC Entertainment option contracts traded on Monday, approximately 2.5 times the previous trading day. Put options account for 51% of overall option trades. Particularly high volume was seen for the $4 strike put option expiring July 28, with 100,640 contracts trading. AMC 20230728 4.0 PUT

In addition, AMC has also seen some orders with amounts exceeding $1 million.

TOP 10 Bullish & Bearish S&P 500

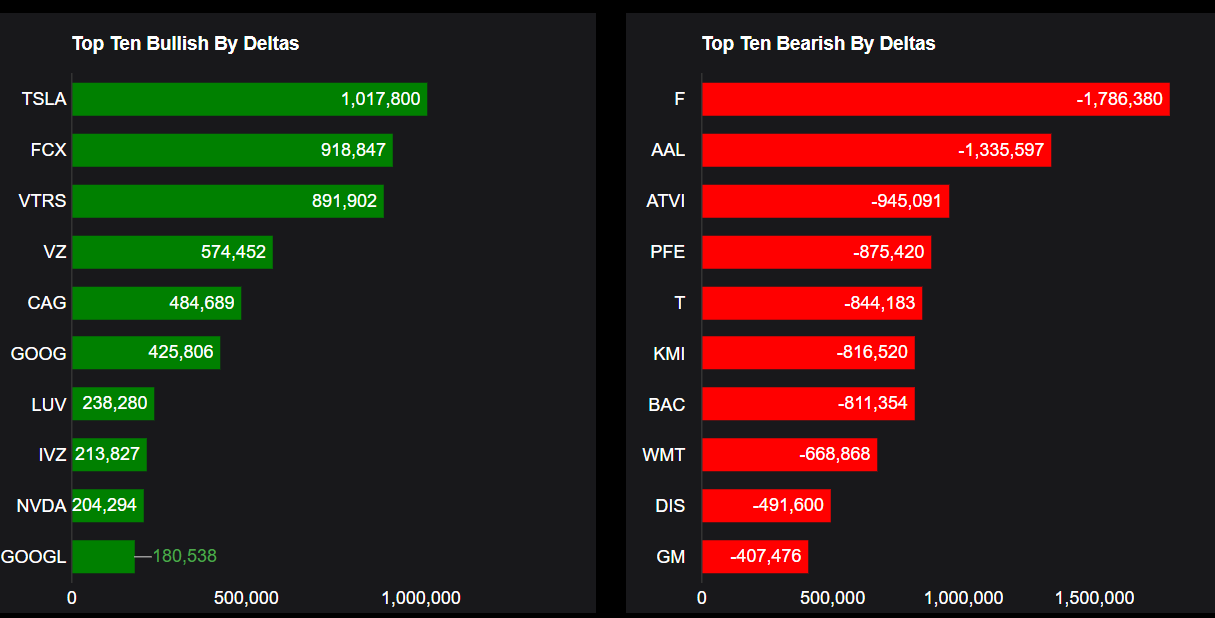

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Based on option delta volume, traders bought a net equivalent of 1,017,800 shares of Tesla stock. One of the largest bullish delta comes from buying calls, which means that Tesla has risen sharply, and the market has taken profits in the current period, but at the same time continues to be optimistic about the future trend.

Top 10 bullish stocks: TSLA, FCX, VTRS, VZ, CAG, GOOG, LUV, IVZ, NVDA, GOOGL

Top 10 bearish stocks: F, AAL, ATVI, PFE, T, KMI, BAC, WMT, DIS

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments