Market Overview

Wall Street advanced on Friday (Jan. 27), marking the end of an rocky week in which economic data and corporate earnings guidance hinted at softening demand but also economic resiliency ahead of this week's Federal Reserve monetary policy meeting. The Dow Jones Industrial Average rose 0.08%, the S&P 500 gained 0.25%, and the Nasdaq Composite added 0.95%.

Regarding the options market, a total volume of 53,317,405 contracts was traded on Friday. Tesla has 7.2 million contracts exchanged, breaking the previous record of 5.2 million contracts set earlier this month and accounting for nearly 13% of all options trading. Intel saw unusual options activity after giving one of the gloomiest quarterly forecasts in its history.

Top 10 Option Volumes

Top 10: SPY, TSLA, QQQ, AMZN, AAPL, INTC, NVDA, LCID, ARKK, HYG

Options related to equity index ETFs are popular with investors, with 9.58 million SPDR S&P500 ETF Trust (SPY) and 3.45 million Invest QQQ Trust ETF (QQQ) options contracts trading on Friday. 53% of SPY trades bet on bearish options.

Tesla shares surged 33% last week, marking their best weekly performance since May 2013 and second best on record. The stock rose 11% on Friday to close at $177.90. Tesla's rally was aided by an upbeat fourth-quarter earnings report.

Friday was the busiest day on record for Tesla traders: 7.2 million contracts were exchanged, according to Cboe Global Markets data, breaking the previous record of 5.2 million contracts set earlier this month and accounting for nearly 13% of all options trading.

Activity in Tesla options has surged in recent months. Nearly three million contracts now change hands on an average day, up from 1.5 million a year ago and more than any other stock. Only wagers on the SPDR S&P 500 ETF outpace those on Tesla.

On Friday, traders cashed out of bets that Tesla shares would breach $175 by the end of the day, taking advantage of a burgeoning trend of using ultrashort-dated options to turbocharge wagers.

There are 7.19 million Tesla option contracts traded on Friday. Call options account for 60% of overall option trades. Particularly high volume was seen for the $180 strike call option expiring January 27, with 382,846 contracts trading. The next just is the $175 strike call option expiring January 27, with 241,694 contracts trading.

Unusual Options Activity

Intel fell 6.4%, the most since September, on Friday after giving one of the gloomiest quarterly forecasts in its history. The company predicted a surprise loss in the current period and a sales range that missed analysts’ estimates by billions of dollars, the result of a personal-computer slump that has ravaged the chipmaker’s business. At the low end of Intel’s projections, revenue would be the smallest quarterly total since 2010.

Intel's option trading is in a fierce battle between long and short. There are 973.7K Intel option contracts traded on Friday. Call options account for 53% of overall option trades. Particularly high volume was seen for the $28 strike put option expiring January 27, with 54,309 contracts trading. The next are the $28 strike call option expiring January 27, with 53,924 contracts trading.

TOP Bullish & Bearish Single Stocks

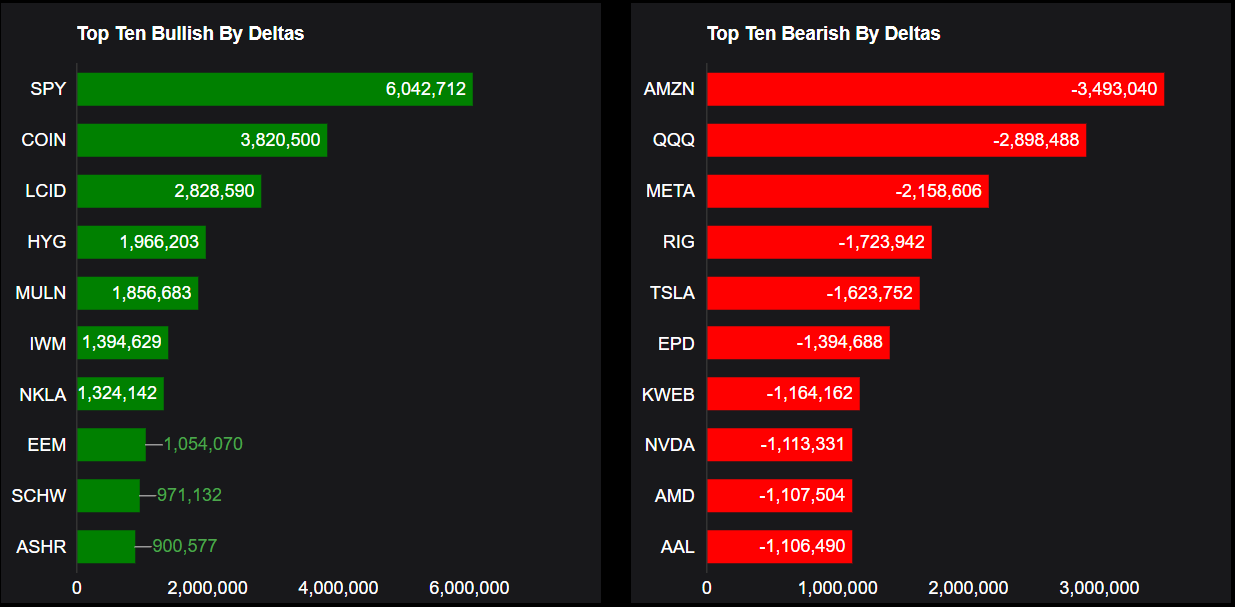

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: SPY, COIN, LCID, HYG, MULN, IWM, NKLA, EEM, SCHW, ASHR

Top 10 bearish stocks: AMZN, QQQ, META, RIG, TSLA, EPD, KWEB, NVDA, AMD, AAL

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments