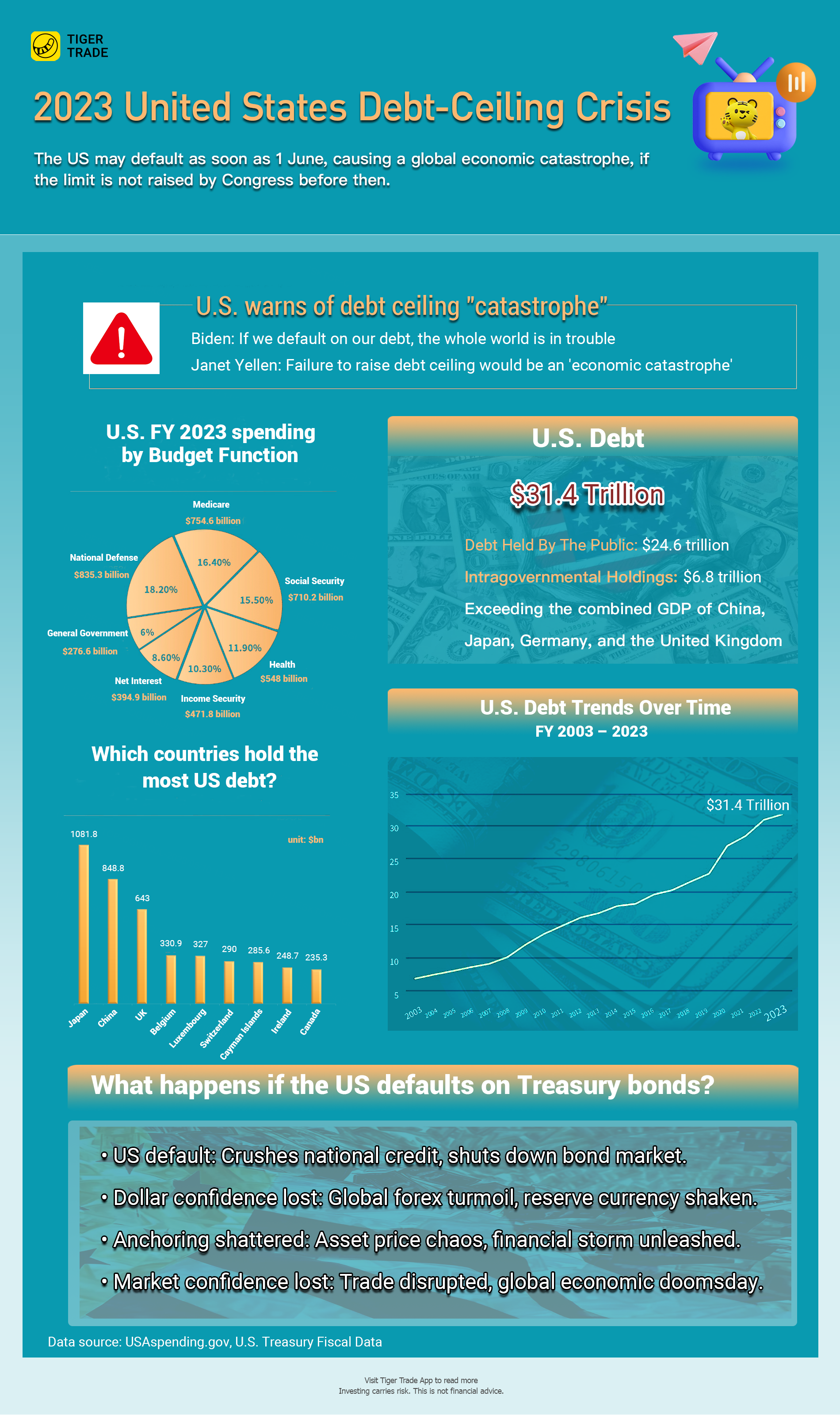

US federal debt currently stands at a staggering $31.4 trillion, the highest it’s ever been. That matters because it’s approaching the maximum limit that the government is legally allowed to borrow.

The debt ceiling is the government's borrowing limit that can only be raised through congressional authorization. That money, according to the U.S. Treasury Department, is needed for the government to meet its existing legal obligations, including social security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments.

A critical week for negotiations on raising the debt ceiling got off to a rocky start as White House talks ended with no agreement.

The US may default as soon as 1 June, causing a global economic catastrophe, if the limit is not raised by Congress before then.

Democratic leaders are calling for the limit to be raised, but Republicans want spending cuts and other conditions to be agreed first.

President Joe Biden said a US default would drag the country into a recession and have devastating repercussions across the global economy as he sought to ramp up pressure on Republicans to strike a deal to raise the US debt limit.

Treasury Secretary Janet Yellen also warned of an “economic catastrophe” if the U.S. fails to raise its debt ceiling in the coming weeks.

The closer the nation approaches to the edge of the debt limit brink, the more skittish US and global financial markets may become. The last time this happened, the US saw its credit rating downgraded and interest rates on its existing debt go up. Even if the nation avoids tumbling over the fiscal cliff, the US economy could suffer.

What happens if the US defaults on Treasury bonds?

If the United States were to default on its Treasury bonds, it would have serious consequences for both the U.S. economy and the global financial system. Here are some potential effects:

Financial market disruption: U.S. Treasury bonds are considered one of the safest investments in the world. If the U.S. defaults, it would undermine investor confidence and cause severe disruptions in global financial markets. Interest rates would rise sharply, bond prices would plummet, and investors would demand higher yields to compensate for the increased risk.

Loss of investor confidence: Defaulting on Treasury bonds would damage the reputation of the United States as a reliable borrower. This loss of confidence could lead to higher borrowing costs for the government in the future, making it more expensive to finance deficits and carry out essential functions.

Economic contraction: A default would likely trigger a significant economic downturn in the United States. Interest rates on mortgages, car loans, and other forms of credit would rise, making it more expensive for businesses and individuals to borrow. Reduced consumer spending and business investment could lead to job losses, lower economic growth, and increased unemployment.

Global economic impact: The U.S. dollar is the world's reserve currency, and U.S. Treasury bonds are held by central banks and investors worldwide. A default could undermine confidence in the U.S. dollar, causing it to depreciate and creating global financial instability. It could also spark a broader economic crisis, impacting trade, investment, and the stability of other economies.

Legal and political consequences: A default on Treasury bonds would likely result in legal challenges from bondholders seeking to recover their investments. It would also have significant political ramifications, potentially leading to public outrage, loss of trust in the government, and even political instability.

It is important to note that the likelihood of the United States defaulting on its Treasury bonds is extremely low. The U.S. government has a long history of meeting its debt obligations, and even during periods of political gridlock or financial strain, steps have been taken to avoid default. Nonetheless, the consequences of such an event would be severe, and it is in the interest of the government and the global financial system to prevent it from happening.

Comments