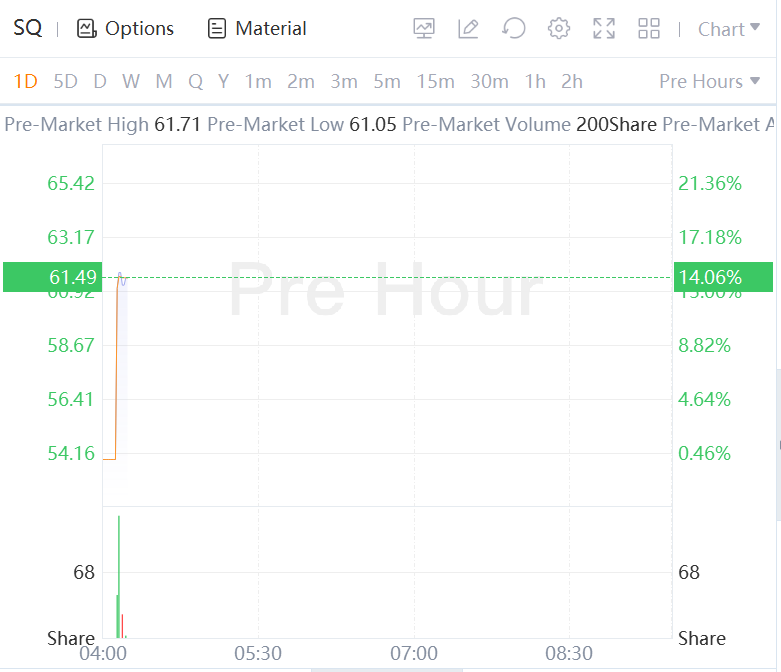

Block stock gained 14% in premarket trading after the payment tech company's Q3 earnings and revenue exceeded Wall Street expectations as gross profit at both its Cash App and Square ecosystem units climbed from the prior quarter and a year ago.

Q3 gross payment volume of $54.4B from $52.5B in Q2 and from $45.4B in Q3 2021.

Q3 adjusted EPS of $0.42 vs. $0.23 consensus, $0.18 in Q2 and $0.25 in the year-ago quarter.

Q3 total net revenue of $4.52B, vs. $4.47B consensus, $4.40B in the prior quarter and $B in the year-ago period.

Excluding bitcoin (BTC-USD) and BNPL, total net revenue was $2.54B vs. $2.41B in Q2 and rose 25% Y/Y.

Transaction-based revenue of $1.52B increased 17% Y/Y and rose from $1.48B in Q2.

Cash App generated $2.68B of revenue in Q3, up from $2.62B in the prior quarter and rose 12% Y/Y. Cash App generated $1.76B of bitcoin revenue compared with $1.79B in the previous quarter, while bitcoin gross profit of $37M fell 12% Y/Y. Cash App gross profit of $774M increased from $705M in the prior quarter and from $512M in Q3 2021.

The Square ecosystem generated $1.77B revenue in Q3 vs. $1.73B in Q2. Its gross profit of $783M increased from $755M in Q2 and from $606M in Q3 2021.

Q3 adjusted EBITDA of $327M vs. $187M in Q2 and $233M in Q3 2021.

Buy Now Pay Later platform contributed $210M in revenue in Q2 vs. $208M in Q2 and $150M of gross profit, the same as in the previous quarter.

For Q4, Block (SQ) is expecting non-GAAP operating expenses of $1.47B, up $206M from Q3. Excluding BNPL, it expects non-GAAP operating expenses of $1.25B, up $162M from the prior quarter.

On a GAAP basis, it expects to incur ~$57M quarterly expenses related to amortization of intangible assets through the remainder of 2022 and over the next few years, the same as its estimate in August.

Earlier, Block (SQ) non-GAAP EPS of $0.42 beats by $0.19, revenue of $4.52B beats by $50M.

Comments