Fueled by China's stock market stimulus policies, these ETFs have attracted billions in inflows over the past month.

Driven by stimulus measures in China's stock market, ETFs tracking the Chinese market have shown robust growth. Over the past month, U.S.-listed China ETFs have attracted a total of $13.3 billion in inflows, fully reversing the outflows seen earlier this year.

According to Bloomberg data, China ETFs have seen a net inflow of $8.2 billion year-to-date in 2024.

FXI: The Market Leader

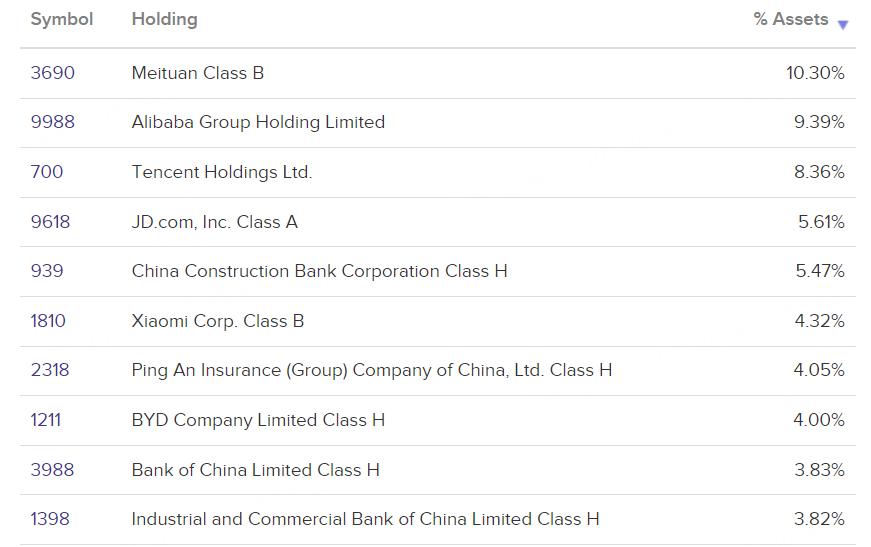

The iShares China Large Cap ETF (FXI) is the biggest winner in terms of inflows, drawing $6.1 billion over the past month and $5.1 billion for the year as a whole. FXI holds a basket of large-cap Chinese stocks listed on the Hong Kong Stock Exchange, with top holdings including Meituan, Alibaba (BABA), Tencent (00700), China Construction Bank (601939), and JD.com (JD).

The fund does not include stocks listed on the Shenzhen or Shanghai Stock Exchanges.

YINN: The Surge of Leveraged Funds

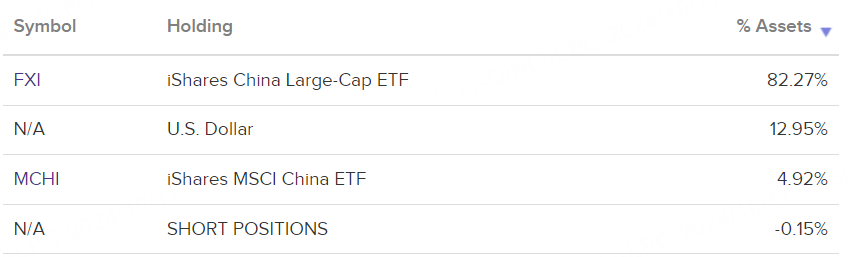

The Direxion Daily FTSE China Bull 3x Shares (YINN) ranks second, pulling in $1.5 billion over the past month and $1.4 billion year-to-date. As a triple-leveraged ETF tied to the FTSE China 50 Index, YINN is highly volatile, and the fund is up 105% year-to-date.

KWEB and ASHR: Popular Internet and A-Share ETFs

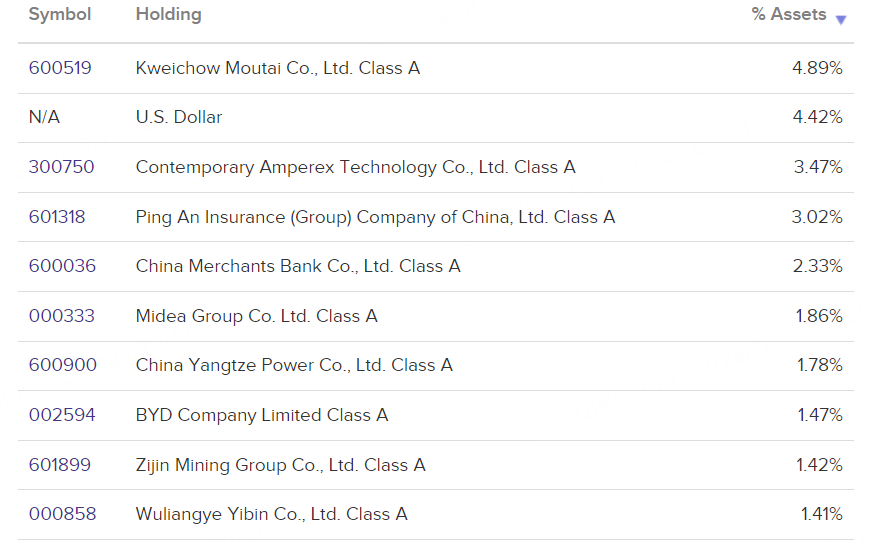

The Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) and KraneShares CSI China Internet ETF (KWEB) have also gained popularity, attracting $1.7 billion and $2 billion in inflows, respectively, over the past month. Year-to-date inflows for these funds are $1 billion and $909 million, respectively.

ASHR tracks the CSI 300 Index, which consists of the top 300 stocks listed on the Shenzhen and Shanghai Stock Exchanges. KWEB tracks the CSI Overseas China Internet Index, which includes internet companies listed on the Hong Kong Stock Exchange, Nasdaq, or New York Stock Exchange.

Currently, there are 44 U.S.-listed China ETFs, with a combined $34.3 billion in assets under management. While not a massive category, it's growing fast thanks to renewed interest in China's stock market.

Comments