Amazon's 3Q results are likely to focus on the pace of recovery in the AWS business, which saw stabilizing gains last quarter.

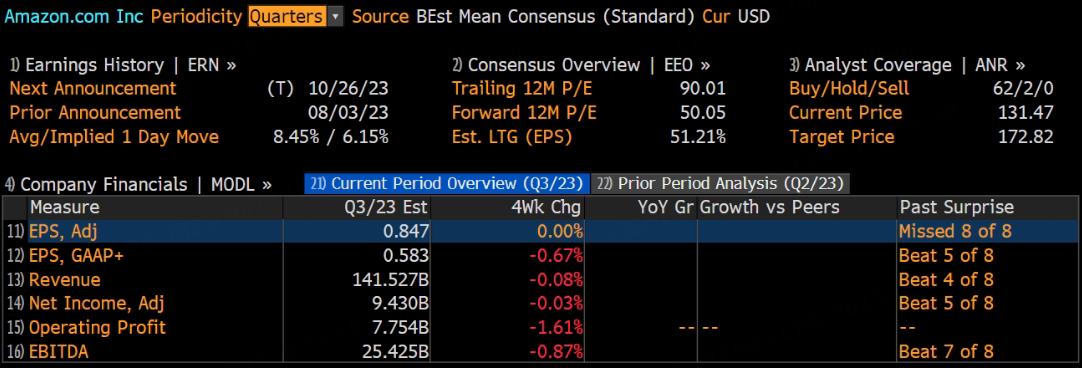

Amazon will report its third quarter 2023 financial results after the US markets close on 26 October. The tech giant's previous earnings release was a surprising outperformance and investors want more of the same.

Key metrics to watch in Amazon's upcoming earnings release include revenue growth, AWS revenue, advertising revenue, operating income and diluted earnings per share (EPS).

Q2 Review

Amazon reported second-quarter earnings that sailed past analysts’ estimates and issued guidance that points to accelerating revenue growth.

EPS: 65 cents vs. 35 cents expected, according to analysts surveyed by Refinitiv

Revenue: $134.4 billion vs. $131.5 billion expected, according to analysts surveyed by Refinitiv

Amazon Web Services: $22.1 billion vs. $21.8 billion in revenue, according to StreetAccount

Advertising: $10.7 billion vs. $10.4 billion in revenue, according to StreetAccount

It was Amazon’s biggest earnings beat since its report for the fourth quarter of 2020. The blowout profit indicates that CEO Andy Jassy’s ongoing cost-cutting efforts are beginning to bear fruit.

What to expect in Q3

Amazon.com's 3Q results may register in line with consensus for a low-double-digit sales gain, with the focus likely staying on the pace of recovery in the AWS business, which saw stabilizing gains last quarter. Bloomberg don't see cloud momentum accelerating materially until mid-next year and continue to estimate low-double-digit gains in 2H. In 3Q, currency-neutral AWS sales may grow 12.5%.

On the retail side, the normalization of online shopping trends should pave the way, with year-over-year gains as third-party sales continue to outpace first-party.

Advertising revenue may continue to grow at a 20%-plus clip as Amazon takes market share given its more than 200 million global prime subscribers.

Revenue Growth

Amazon is a growth stock, so Wall Street expects double-digit, year-over-year revenue increases. Without that ongoing growth performance, investors will be less willing to spend the premium required to buy AMZN.

Note that the stock currently trades at a P/E ratio of 105, which is Amazon's highest P/E since 2017.

AWS Revenue

AWS is Amazon's cloud computing business. The segment has historically been fast-growing and very profitable.

A year and a half ago, in the first quarter of 2022, Amazon delivered quarter-over-quarter AWS revenue growth of 37%, excluding foreign exchange impacts. Unfortunately, the growth has fallen every quarter since. Last quarter, AWS revenue grew just 12%. Investors are craving a return to AWS' former growth rates.

Advertising Revenue

Advertising is an up-and-coming growth engine for Amazon. In recent quarters, Amazon's advertising revenue growth has exceeded 20%. That outpaces advertising rivals Google and Facebook.

Analyst opinion

Analysts have differing opinions on Amazon's upcoming financial report.

UBS's Lloyd Walmsley lowered their price target on Amazon by 1.1% from $180 to $178 on 2023/10/17. The analyst maintained their Strong Buy rating on the stock. In a preview of Amazon's Q3 2023 earnings, Walmsley highlighted potential near-term headwinds. This comes as UBS's research indicates that cloud expenditure in September 2023 was tougher than anticipated. Despite these challenges, Walmsley remains optimistic about the company's prospects.

While Wedbush said Amazon's earnings next week will be better than investors fear. Analysts Scott Devitt reiterated their Buy rating on Amazon. The analyst also maintained a $180 price target. “We think the company is broadly better positioned than investors fear, and we see catalysts ahead as retail margins continue to rise and AWS growth accelerates against easing comps.”

Q3 Forecast by Bloomberg

Earnings Per Share: $0.847

Revenue: $141.53 billion

Net Income: $9.43 billion

Comments