Market Overview

U.S. stocks ended down on Wednesday(Feb. 8), paring most of the previous session's strong gains, with tech-focused shares leading the way lower. The Dow Jones Industrial Average fell 0.61%, the S&P 500 lost 1.11% and the Nasdaq Composite dropped 1.68%.

Regarding the options market, a total volume of 40,127,954 contracts was traded, down 6% from the previous trading day.

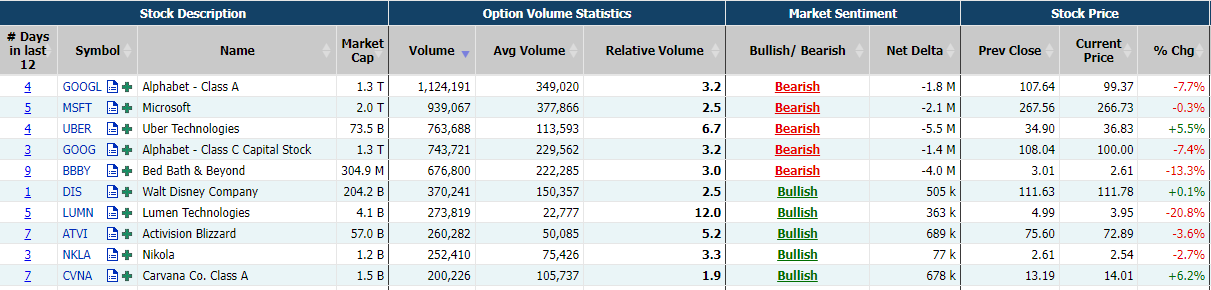

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, GOOGL, MSFT, AMZN, AAPL, NVDA, Uber, GOOG

Options related to equity index ETFs are still popular with investors, with 8.76 million SPDR S&P500 ETF Trust and 2.84 million Invest QQQ Trust ETF options contracts trading on Wednesday.

Total trading volumes for SPY and QQQ were down about 14% and 12%, respectively, from the previous day. 51% of SPY trades bet on bearish options.

Alphabet Inc was the biggest drag on the S&P 500 and Nasdaq. Its shares sank 7.7% after its new AI chatbot Bard delivered an incorrect answer in an online advertisement.

There were 1.13M Alphabet options(GOOGL) trading on Wednesday, of which call options accounted for 62%. A particularly high volume was seen for the $105 strike call option expiring February 10, with 51,810 contracts trading on Wednesday.

Unusual Options Activity

Uber Technologies (UBER) posted record quarterly and full-year revenue, and CEO Dara Khosrowshahi said that the drop-off in ridership caused by the COVID-19 pandemic is over. Uber stock jumped 5.53% on Wednesday.

There were 773.1K Uber options trading on Wednesday, of which call options accounted for 75%. A particularly high options trading volume was seen for the $36 strike call option expiring February 10, with 36,444 contracts trading on Wednesday.

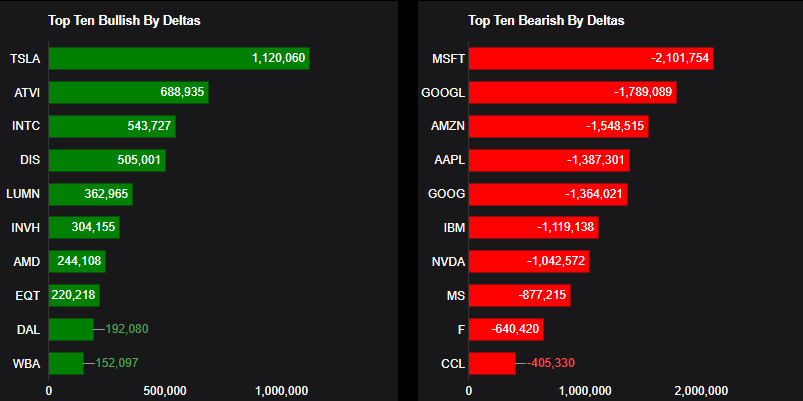

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: TSLA, ATVI, INTC, DIS, LUMN, INVH, AMD, EQT, DAL, WBA

Top 10 bearish stocks: MSFT, GOOGL, AMZN, AAPL, GOOG, IBM, NVDA, MS, F, CCL

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments