Alphabet shares rose 1.3% to a new high.

By and large, investors know Alphabet Inc. (GOOGL) as the parent company of the search engine that everybody and their uncle uses: Google. I am definitely bullish on GOOGL stock.

Amazingly, the Google search portal is so famous that in the popular lexicon, “Google” is both a noun and a verb.

It’s perfectly fine to invest in GOOGL stock because so many people use the company’s search engine. However, stock traders might also choose to look at other angles when considering an investment.

As we’ll see, the stock could actually be considered a bargain. Moreover, Google’s products give customers what they want: the latest in cutting-edge communications technology.

A Quick Look at GOOGL Stock

At first glance, it might seem ridiculous to say that GOOGL stock is cheap. After all, this is a stock that costs nearly $3,000 per share.

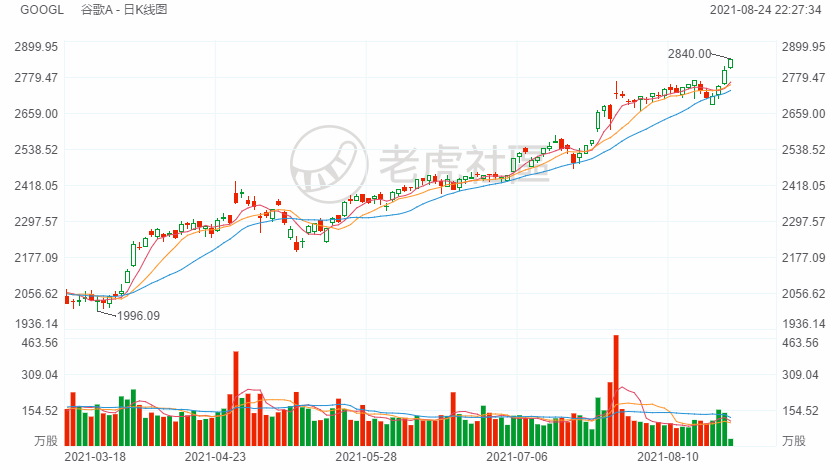

Moreover, GOOGL stock reached a new 52-week high of $2,817.49 on Monday. It has steadily gone up over the past year, with hardly any breaks or corrections.

That should be fine for momentum-focused traders, but value-oriented investors might think that GOOGL stock is too expensive to buy now.

Yet, let’s consider a different angle. If the company’s earnings are robust, then the high price tag of the stock might be fully justified.

As it turns out, Alphabet’s trailing 12-month price-to-earnings ratio is 30.5. That’s not too bad, especially for a technology stock in 2021.

So, just maybe, GOOGL stock is still a bargain after all.

Meet the New Google Meet

If you’re going to take away anything from this, it should be that there’s more to Google than its search engine.

One example would be Google Meet, the company’s video-conferencing software.

Without a doubt, Google would like to capture a bigger share of the visual-communication software market.Fortune Business Insightsreported that this market was worth $5.77 billion in 2020.

Furthermore, this market is projected to reach $6.28 billion in 2021, and $12.99 billion in 2028, thereby exhibiting a CAGR of 10.9% from 2021 to 2028.

Google Meet’s new features should help the company take a bigger slice of this rich pie.

The new features include the ability to add up to 25 co-hosts for meetings. Furthermore, hosts and co-hosts will be able to limit the number of users who can share screens, send messages, and mute others.

An Affordable Smartphone

Let’s face it: not everyone is ready to buy a $1,200 smartphone.

At the same time, people want high quality. Now, with the launch of the Google Pixel 5a, shoppers don’t have to compromise quality or affordability.

Granted, Google already unveiled its Pixel 6 and Pixel Pro smartphones, but those are high-end and pricier. There’s a market for lower-priced smartphones, and Google is aggressively pursuing this market with the Pixel 5a.

We’re talking about a $449 price tag, which is less than half the price of the most expensive smartphones on the market today.

Some of the phone’s features include 5G functionality, a dual-camera system, and IP67 water and dust resistance.

Wall Street Weighs In

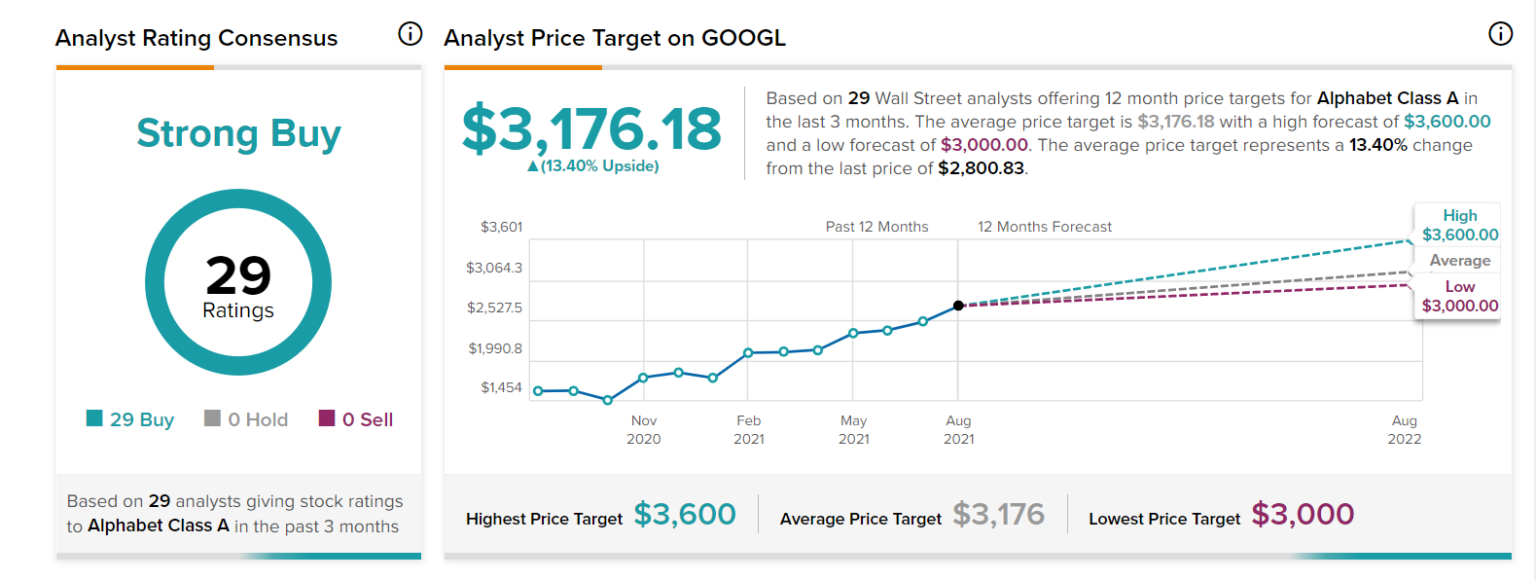

According to TipRanks’ analyst rating consensus, GOOGL is a Strong Buy, based on 29 unanimous Buy ratings. The average Alphabet price target is $3,176.18, implying 13.4% upside potential.

Takeaways

While GOOGL stock might seem expensive — and there’s no denying that it’s pricey — a valuation analysis reveals that it’s also a pretty good bargain.

Just as importantly, Alphabet shouldn’t be pigeonholed as just a search-engine provider.

The company is expanding quickly into other value-added markets with intriguing products and services, which prospective investors should take into consideration.

Comments