- U.S. crude stocks build unexpectedly, up 4.5 mln bbls -EIA

- OPEC+ decides on small 100,000 bpd increase to output target

- U.S. had pushed for more meaningful supply boost

- Iranian and U.S. negotiators travel to Vienna for talks

(Reuters) - Oil prices slid more than % on Wednesday as U.S. crude stockpiles unexpectedly surged higher last week and after OPEC+ said it would raise its oil output target by only 100,000 barrels per day (bpd).

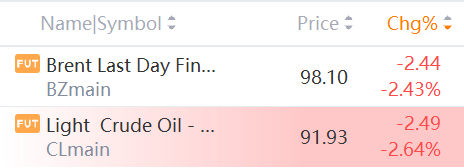

Brent crude futures were down $2.44, or 2.43%, at $98.1 a barrel. West Texas Intermediate (WTI) crude futures slipped by $2.49, or 2.64%, to $91.93. Both contracts had seesawed previously.

The premium for front-month Brent futures over barrels loading in six months' time is at a three-month low, indicating concern over tight supply are abating. The premium for WTI futures for the same months touched a near four-month low.

U.S. crude stocks rose 4.5 million barrels last week to 426.55 million barrels, according to data from the U.S. Energy Information Administration, compared with an analyst forecast for a draw of 600,000 barrels.

Industry data late Tuesday showed a smaller weekly U.S. crude build of 2.2 million barrels, traders said.

Ministers for the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, known as OPEC+, agreed to the small increase to the group's output target, equal to about 0.1% of global oil demand.

Comments