The S&P 500 ended nearly flat on Friday (August 18th) as gains in defensive sectors and energy offset weakness in megacap growth stocks, while investors looked toward next week's speech by Federal Reserve Chair Jerome Powell.

Megacap technology-related growth stocks dipped, with Alphabet down 1.9% and Tesla falling 1.7%, as investors fretted that interest rates could stay higher for longer.

Monthly stock-market options for August expired on Friday. A total volume of 46,379,904 contracts was traded, up 4.3% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY; QQQ; TSLA; NVDA; AAPL; IWM; AMC; VIX; AMZN; META

Source: Tiger Trade App

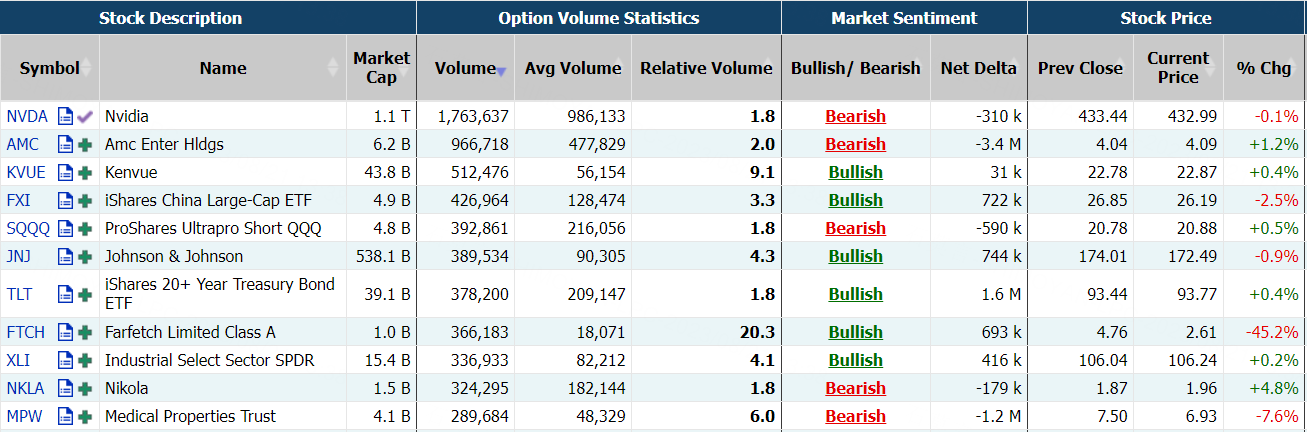

Nvidia is scheduled to announce Q2 earnings results after the market closes on Wednesday, Aug 23. ET. Nvidia’s shares rebounded nearly 200% this year after a brutal 2022 and it topped a $1 trillion market cap in late May.

Analysts expect Nvidia to post revenue of $11.045 billion, operating profit of $5.937 billion, and adjusted EPS of $2.072 for the quarter, according to Bloomberg consensus.

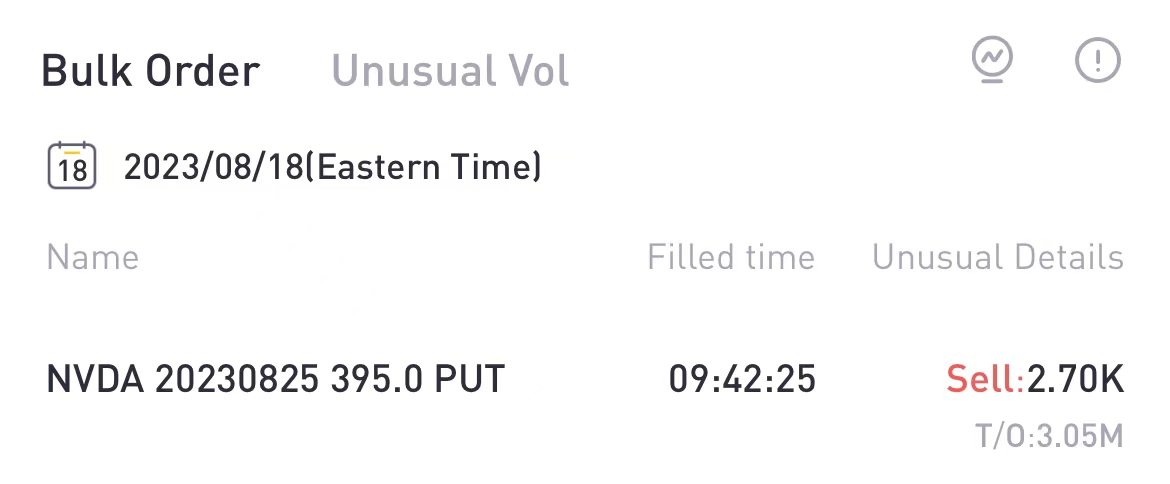

A total number of 1.77 million options related to Nvidia was traded, up 90.5% from the previous trading day. A particularly high trading volume was seen for the $442.5 strike sell put options expiring August 25th, with a total number of 2.7K option contracts trading on Friday.

Source: Tiger Trade App

Most Active Options

Most Active Trading Equities Options:

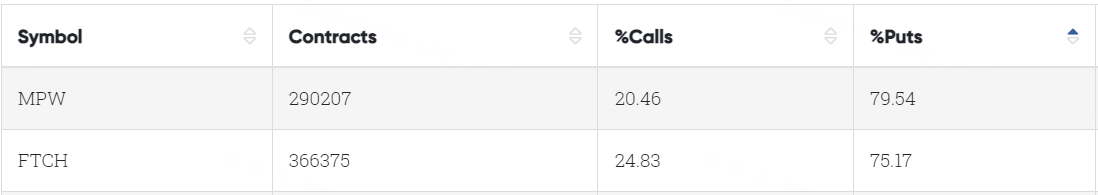

Special %Puts>70%: Medical Properties; Farfetch

Data From CBOE Trader Alert, as of 21 August 2023 EDT

Unusual Options Activity

Source: Market Chameleon

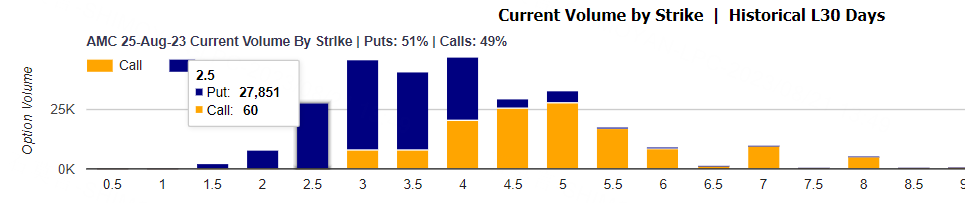

AMC Entertainment stock had its price target cut to $1.55 by Citigroup analyst Jason Bazinet. The analyst also kept his "sell" rating for AMC stock.

A Delaware Chancery Court approved AMC’s settlement with common stockholders on Aug. 11. APE shareholders launched their suit against the conversion on Aug. 14.

A total number of 966,718 options related to AMC was traded. A particularly high trading volume was seen for the $2.5 strike put options expiring August 25, with a total number of 27,851 option contracts trading on Friday.

Source: Market Chameleon

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: AAPL; JNJ; FTCH; NSPR; RXT; AMD; MSFT; CM; AMZN; AUPH

Top 10 bearish stocks: AMC; GOSS; MPW; AVPT; BAC; PLTR; SOFI; GOOGL; PFE; PYPL

Based on option delta volume, traders bought a net equivalent of 2,757,757 shares of Apple stock. The largest bullish delta came from selling the 18-Aug-23 175 Put, with traders getting long 1,122,300 deltas on the single option contract.

Source: Market Chameleon

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments