Market Overview

The S&P 500 closed slightly higher last Friday(Sep. 8), with trading choppy toward the session's end and all three of Wall Street's major averages showed weekly declines.

The Dow Jones Industrial Average rose 0.22%, the S&P 500 gained 0.14%, and the Nasdaq Composite added 0.09%.

Regarding the options market, a total volume of 38,109,331 contracts was traded.

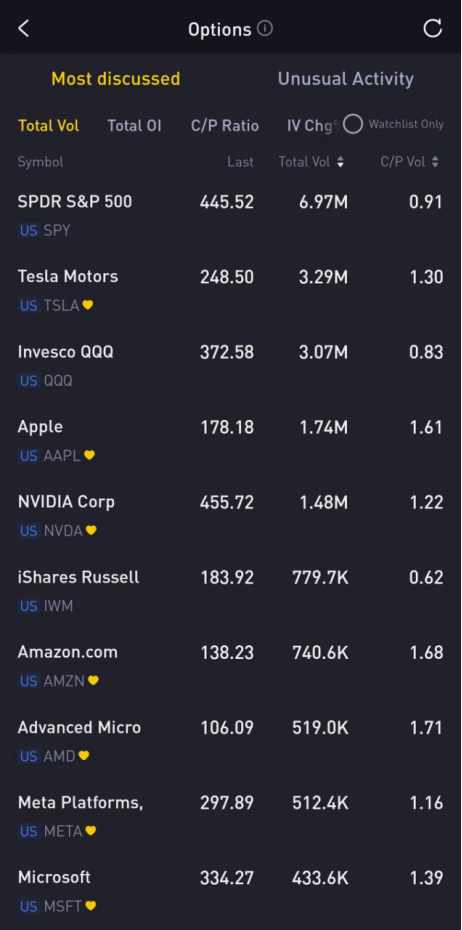

Top 10 Option Volumes

Top 10: SPDR S&P 500 ETF Trust, Tesla Motors, Invesco QQQ Trust-ETF, Apple, NVIDIA Corp, iShares Russell 2000 ETF, Amazon.com, Advanced Micro Devices, Meta Platforms, Inc., Microsoft

Intel slid 0.45% last Friday after ending rising nine days straight for a 16.63% gain. Before that, chief financial officer said the company is experiencing a data-center sales tailwind from enthusiasm around artificial intelligence but will probably not record AI sales in the nine-figure range until 2024.

There were 370,281 Intel option contracts traded last Friday. Call options account for 76% of overall option trades. Particularly high volume was seen for the $38.5 strike call option expiring September 15, with 93,905 contracts trading.$INTC 20230915 38.5 CALL$

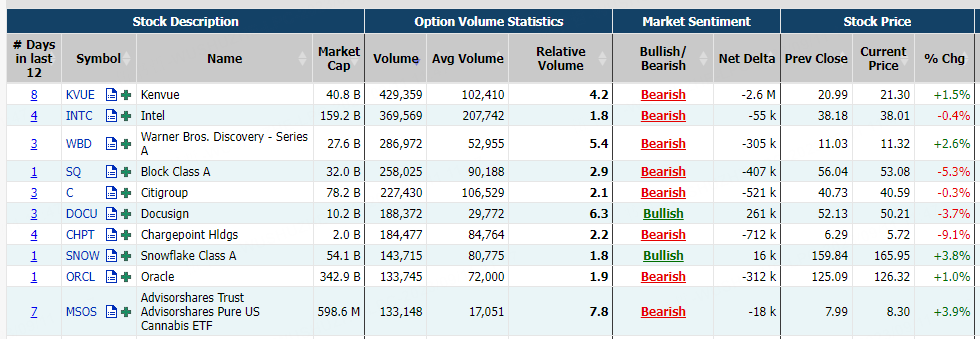

Most Active Trading Equities Options

Special %Calls >70%: Intel

Unusual Options Activity

Snowflake rose 3.82% last Friday as DA Davidson initiated coverage on the stock with a buy rating and a $200 price target.

There were 370,281 Snowflake option contracts traded last Friday, soaring over 150% from the previous day. Call options account for 63% of overall option trades. Particularly high volume was seen for the $170 strike call option expiring September 15, with 3,312 contracts trading.$SNOW 20230915 170.0 CALL$

Block was down 5.28% last Friday as the company said last Thursday night that it was experiencing a disruption that was impacting some services.

There were 370,281 Block option contracts traded last Friday, doubling from the previous day. Put options account for 53% of overall option trades. Particularly high volume was seen for the $55 strike call option expiring September 15, with 9,408 contracts trading.$SQ 20230915 55.0 CALL$

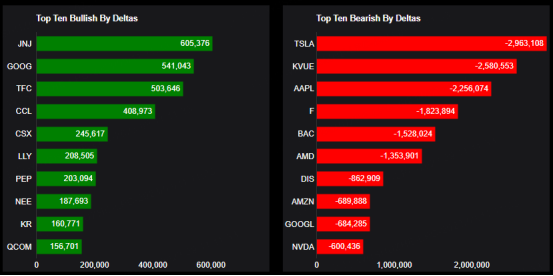

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Based on option delta volume, traders sold a net equivalent of 2,963,108 shares of Tesla Motors stock. The largest bearish delta came from selling calls.

The largest delta volume came from the 08-Sep-23 255 Call, with traders getting short 5,603,702 deltas on the single option contract.

Top 10 bullish stocks: Johnson & Johnson, Alphabet, Truist Financial Corp, Carnival, CSX Corp, Eli Lilly, Pepsi, NextEra, Kroger, Qualcomm

Top 10 bearish stocks: Tesla Motors, Kenvue Inc, Apple, Ford, Bank of America, Advanced Micro Devices, Walt Disney, Amazon.com, Alphabet

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments