Market Overview

U.S. stocks eked out a slight gain on Monday (Feb. 27) as investors engaged in some bargain hunting after last week's losses, the biggest percentage declines of 2023 for Wall Street's main benchmarks, as jitters persisted about coming interest rate hikes to tame stubbornly high inflation. The Dow Jones Industrial Average rose 0.22%, the S&P 500 gained 0.31%, and the Nasdaq Composite added 0.63%.

Regarding the options market, a total volume of 33,334,717 contracts was traded on Monday, down 19% from the previous trading day. Tesla's option trading remained active, and Musk became the richest man again. ProShares Ultra Bloomberg Natural Gas has attracted attention as the price of natural gas rose. AMC Entertainment, Fisker and Zoom saw unusual activities before or earnings.

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, AMC, AAPL, NVDA, IWM, AMZN, VIX, GOOG

Options related to equity index ETFs are popular with investors, with 8.64 million SPDR S&P500 ETF Trust (SPY) and 2.26 million Invest QQQ Trust ETF (QQQ) options contracts trading on Monday.

Total trading volume for SPY and QQQ decreased by 8% and 28%, respectively, from the previous day. 57% of SPY trades bet on bearish options.

Elon Musk has regained his spot as the world’s richest person, after briefly losing the title to France’s Bernard Arnault. Tesla shares jumped 5.5% on Monday and surged almost 70% this year. Tesla is hosting a highly anticipated investor event on March 1.

There are 1.84 million Tesla option contracts traded on Monday. Call options account for 57% of overall option trades. Particularly high volume was seen for the $210 strike call option expiring March 3, with 107,959 contracts trading.

AMC Entertainment Holdings stock surged 22.7% on Monday, as traders piled in ahead of the firm’s earnings report on Tuesday and after a Delaware Chancery Court filing indicated that a potential dilutive share authorization could be delayed.

There are 1.82 million AMC option contracts traded on Monday. Put options account for 58% of overall option trades. Particularly high volume was seen for the $4 strike put option expiring April 21, with 113,220 contracts trading.

Most Active Options

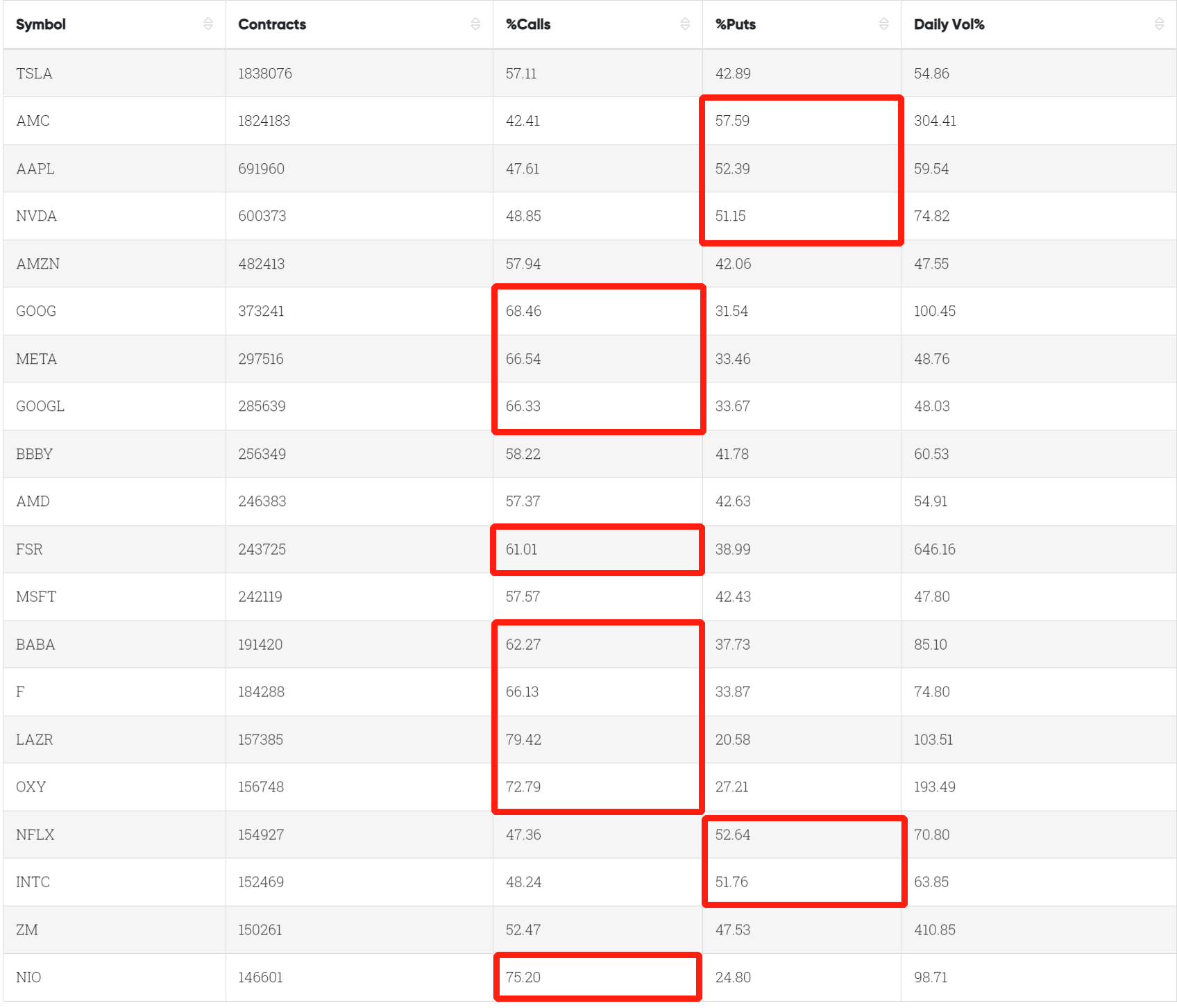

1. Most Active Trading Equities Options:

Special %Calls >60%: GOOG, META, GOOGL, FSR, BABA, F, LAZR, OXY, NIO

Special %Puts >50%: AMC, AAPL, NVDA, NFLX, INTC

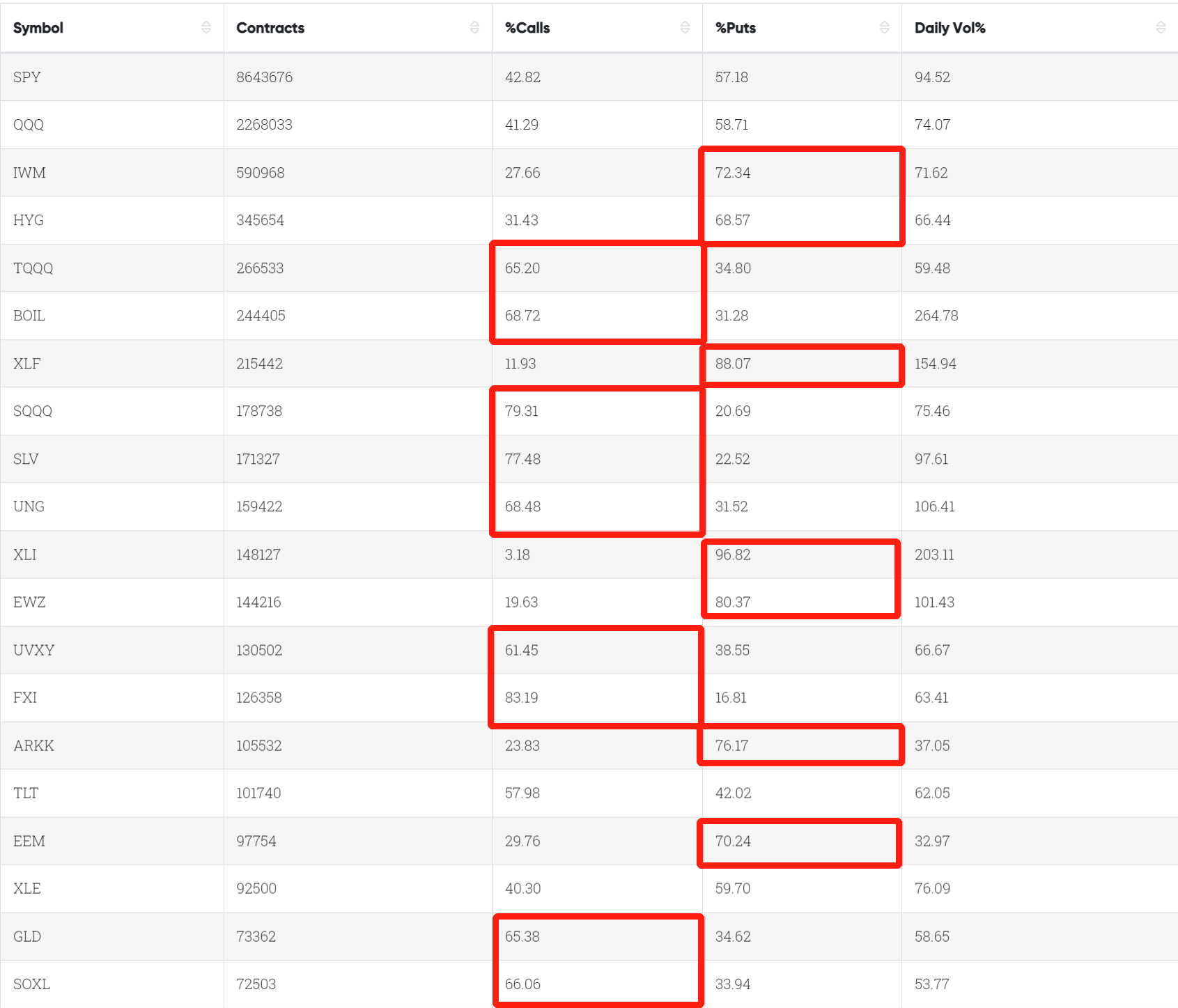

2. Most Active Trading ETFs Options

Special %Calls >60%: TQQQ, BOIL, SQQQ, SLV, UNG, UVXY, FXI, GLD, SOXL

Special %Puts >60%: IWM, HYG, XLF, XLI, EWZ, ARKK, EEM,

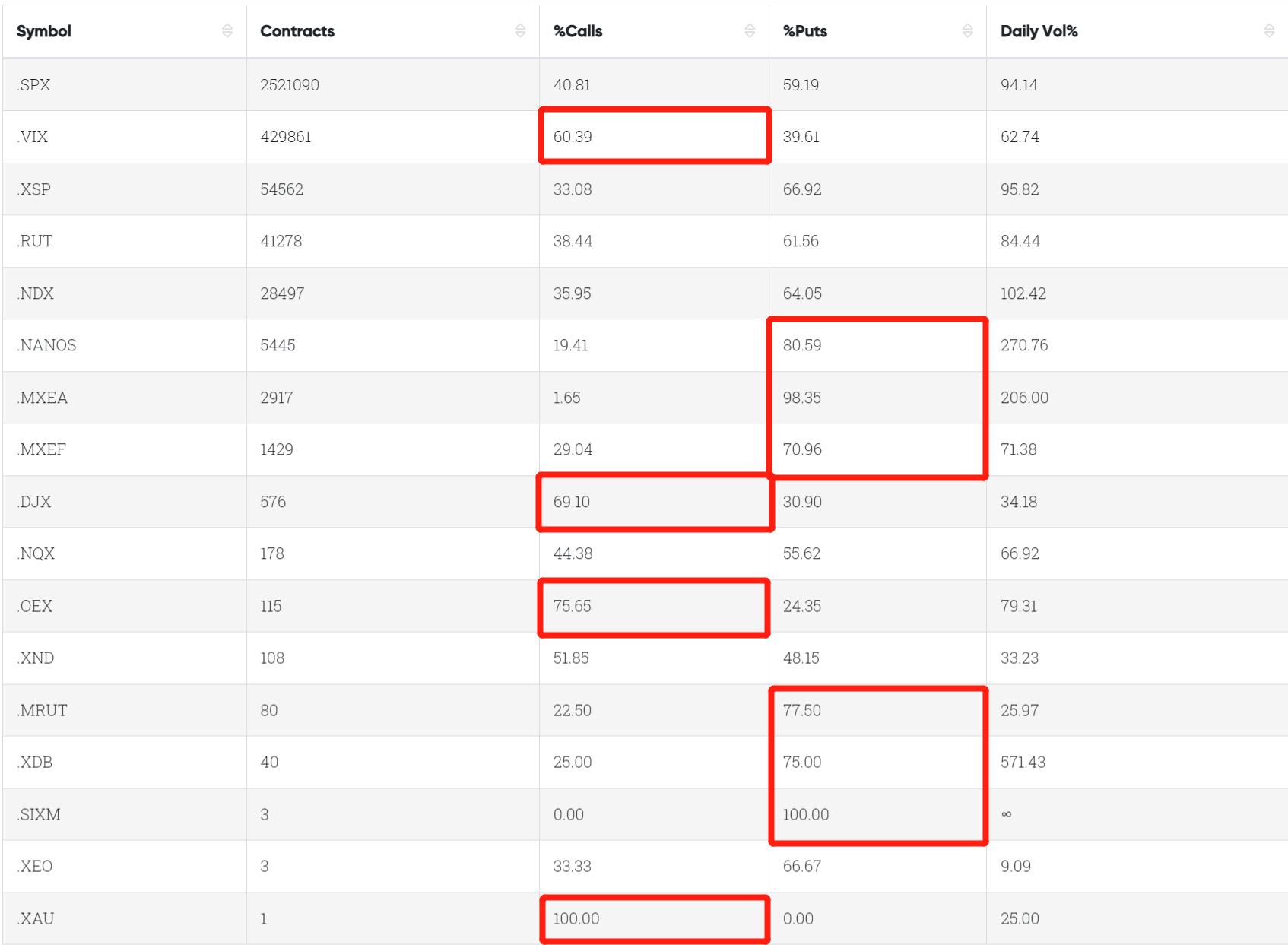

3. Top 10 Most Active Trading Indexes options

Special %Calls >60%: VIX, DJX, OEX, XAU

Special %Puts >70%: NANOS, MXEA, MXEF, MRUT, XDB, SIXM

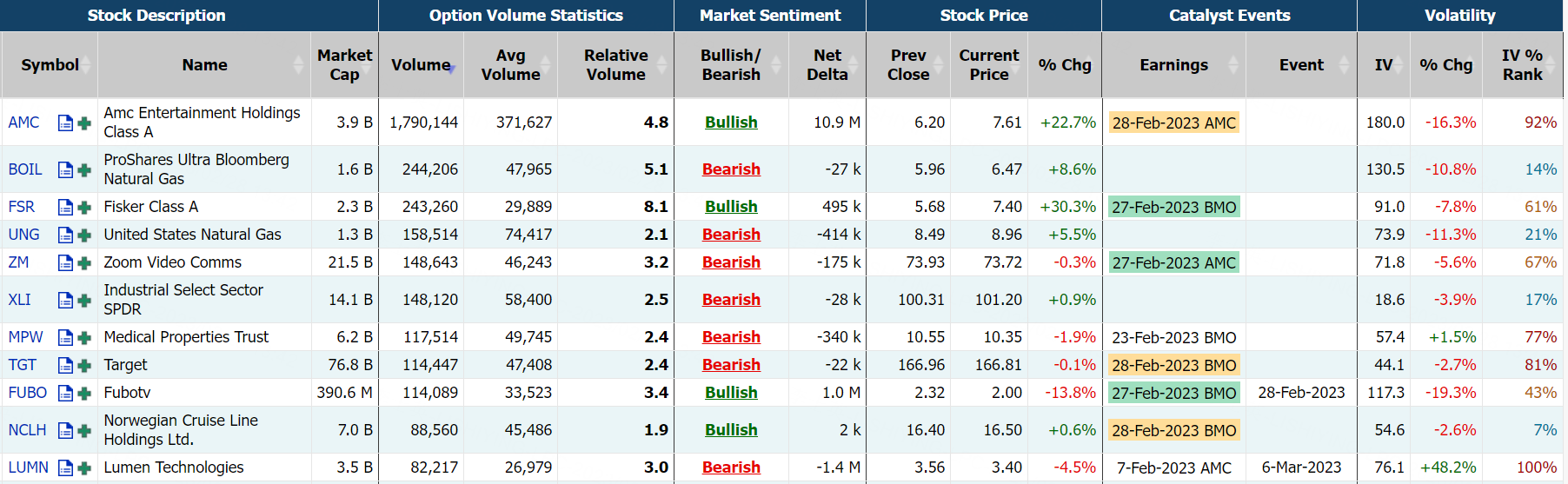

Unusual Options Activity

U.S. natural gas futures hit a one-month high on Monday on forecasts for colder weather next week and a rise in LNG exports. European natural gas prices could more than double in 2024, Goldman Sachs says. The region's energy crisis will not find a 'sustainable solution' until 2025, says investment bank.

ProShares Ultra Bloomberg Natural Gas (BOIL) related to natural gas has attracted the attention of option investors. There are 244.4K BOIL option contracts traded on Monday. Call options account for 69% of overall option trades. Particularly high volume was seen for the $6.5 strike call option expiring March 10, with 43,893 contracts trading.

Electric-vehicle startup Fisker Inc on Monday flagged increased orders for its sports utility vehicle Ocean and maintained its production forecast for the year, sending its shares soaring as much as 30.3%. Raymond James analyst Pavel Molchanov called the stock rise "a classic example of a relief rally," adding, "I think there were some fears that the production startup of the sport utility vehicle Ocean was getting delayed."

There are 247.3K Fisker option contracts traded on Monday. Call options account for 61% of overall option trades. Particularly high volume was seen for the $6.5 strike put option expiring March 23, with 21,514 contracts trading. The next are the $8 and $7 strike call option expiring March 23, with both more than 20,000 contracts trading.

Zoom Video Communications Inc said on Monday it will integrate more artificial intelligence into its products and forecast annual profit above Wall Street estimates, sending the company's shares up 7.4% in extended trading.

Investors has bet Zoom ahead of earnings. There are 150.3K Zoom option contracts traded on Monday. Call options account for 52% of overall option trades. Particularly high volume was seen for the $90 strike call option expiring March 17, with 6,625 contracts trading.

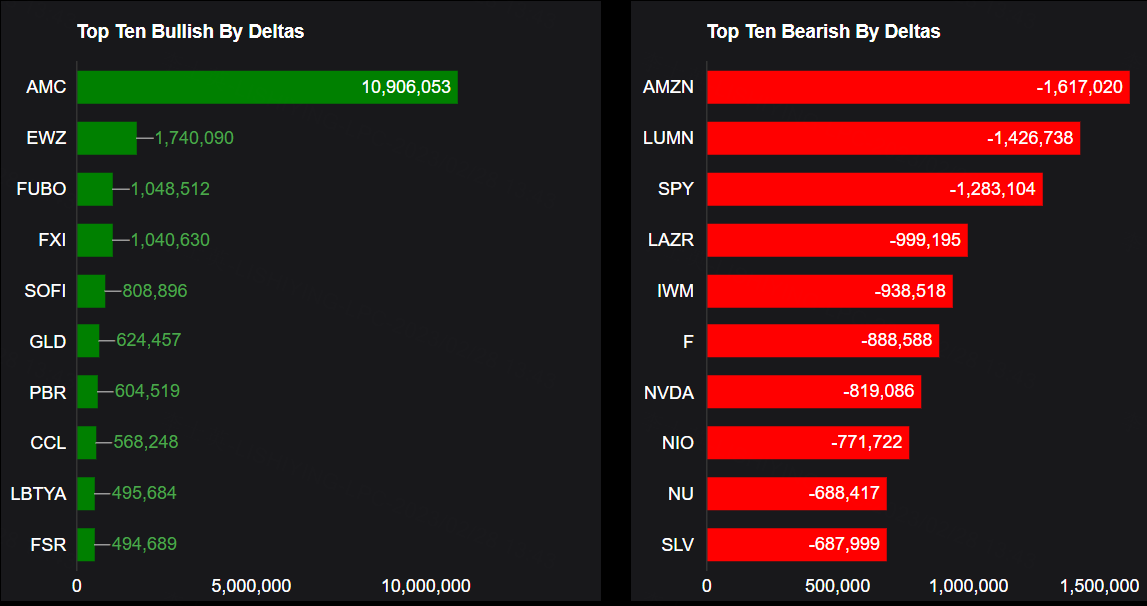

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: AMC, EWZ, FUBO, FXI, SOFI, GLD, PBR, CCL, LBTYA, FSR

Top 10 bearish stocks: AMZN, LUMN, SPY, LAZR, IWM, F, NVDA, NIO, NU, SLV

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments