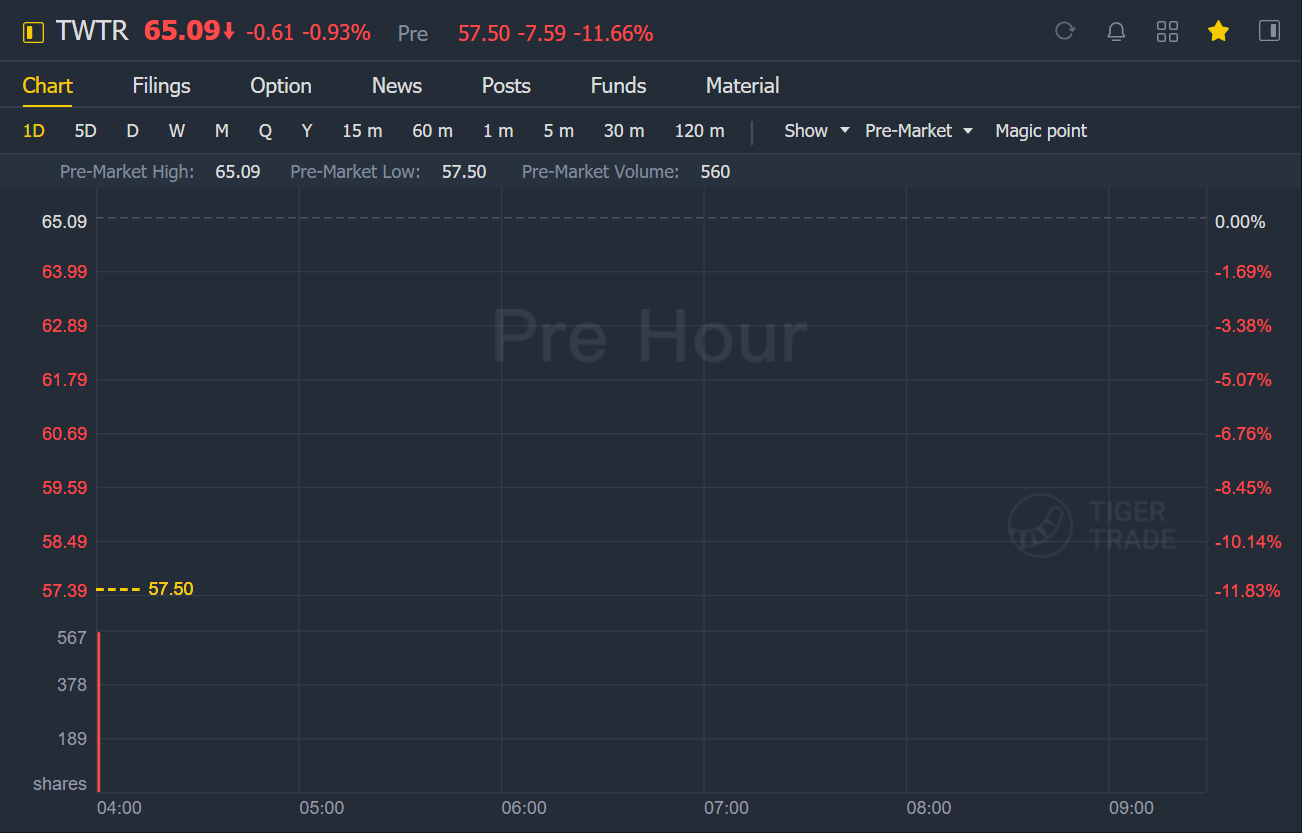

Twitter fell more than 11% in premarket trading, and the number of daily active activities in the first quarter fell short of market expectations.

Twitter stock sinks as revenue, earnings beat but user numbers miss expectations

Twitter Inc. on Thursday reported increased quarterly revenue on the strength of ad sales, but its user numbers fell short of expectations.

The San Francisco-based company said its average monetizable daily active users increased 20% year over year to 199 million, but analysts had expected that number to grow to 200 million.

The microblogging company reported first-quarter net income of $68 million, or 8 cents a share, compared with a loss of $8.3 million, or 1 cent a share, in the year-ago period. Adjusted for stock-based compensation and other expenses, earnings were 16 cents a share. Revenue rose to $1.04 billion from $807.6 million in the year-ago quarter.

Analysts surveyed by FactSet had forecast adjusted earnings of 14 cents a share on revenue of $1.03 billion.

Ad revenue climbed 32% year over year to $899 million.

The company said its user growth in the U.S. was 13%, and 22% internationally. While U.S. revenue outdid international revenue $556 million to $480 million, revenue growth followed the user-growth trend, with U.S. revenue growing 19% and international revenue rising 41% year over year.

Ned Segal, chief financial officer of Twitter, said on the company’s earnings call that revenue growth, which was down sequentially in the U.S. more than last year, was affected by the COVID-19 pandemic. “Remember COVID had a varied impact in different parts of the world at different times of the year,” he said.

Asked about how big the U.S. market can grow for Twitter, Chief Executive Jack Dorsey said on the call with analysts that he thinks it can be “quite large.” He said the company hasn’t done enough to get people to what they’re interested in fast enough, but that with new products like Topics, “everything we’re doing is around serving [the] two core jobs” of informing users about what’s happening and enabling them to talk about it.

Twitter expects a second-quarter GAAP loss of $170 million to $120 million on revenue of $980 million to $1.08 billion. Analysts had forecast adjusted earnings of 16 cents a share and a GAAP loss of 4 cents a share on revenue of $1.06 billion.

Shares of Twitter have risen 20% year to date, and are up nearly 127% in the past 52 weeks. By comparison, the S&P 500 IndexSPX,+0.68%has increased about 12% so far this year, and is up nearly 45% in the past year.

Comments