U.S. stocks finished sharply lower Wednesday (September 21) after the Federal Reserve said it would raise interest rates again and signaled the need for further rate increases in the months ahead.

All three benchmarks finished more than 1.7% down, with the Dow posting its lowest close since June 17, with the Nasdaq and S&P 500, respectively, at their lowest point since July 1, and June 30.

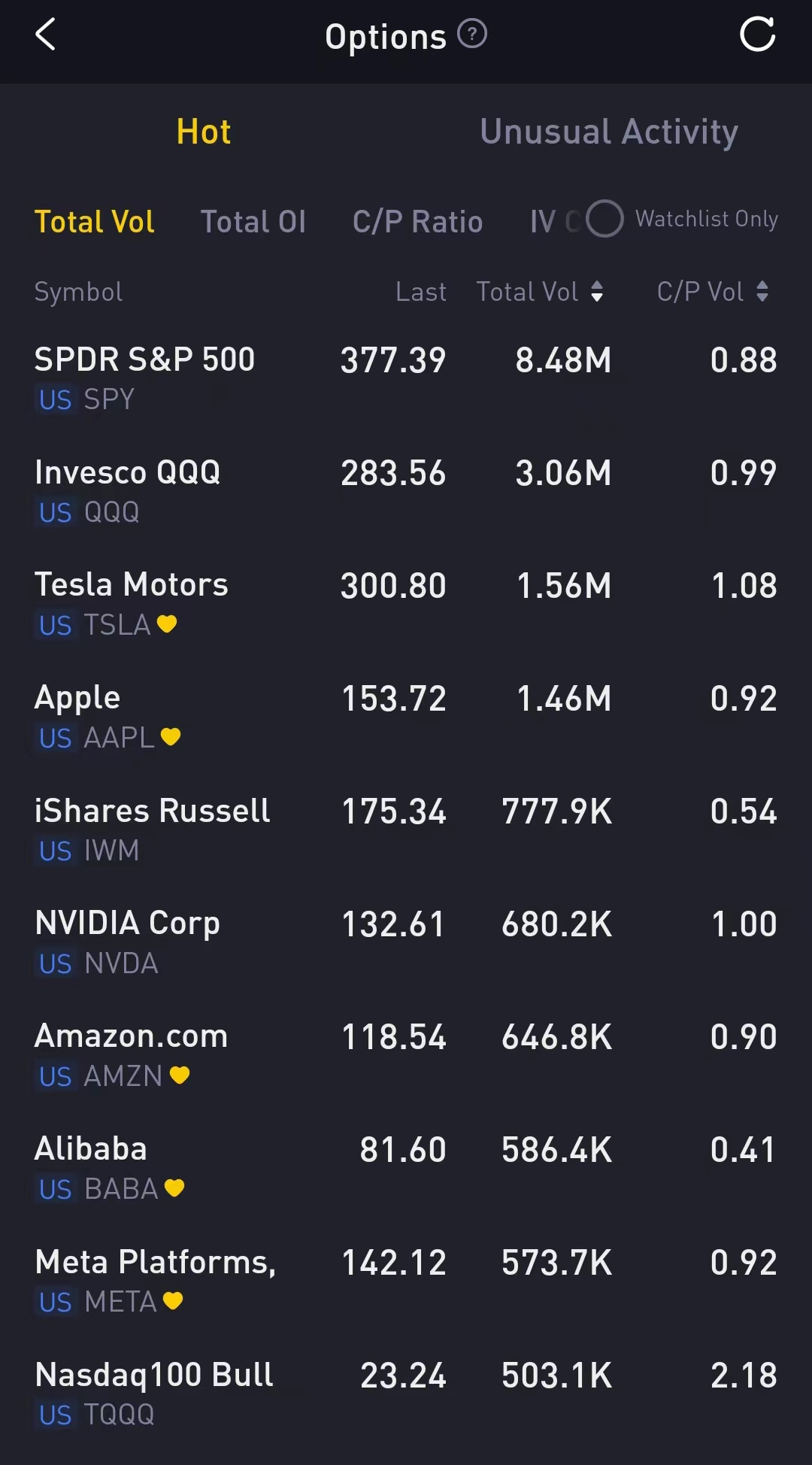

Options Broad View

A total volume of 37,925,119 contracts was traded on Wednesday, up 23% from the previous trading day. Call options account for 51% of total options trades.

There were 8.48 million SPDR S&P500 ETF Trust options traded on Wednesday, of which put options account for 54%.

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, AAPL, IWM, NVDA, AMZN, BABA, META, TQQQ

Options related equity indexes are still top choices for investors, with 3.06 million Invest QQQ Trust ETF options contracts trading on Wednesday.

Total trading volume for SPY and QQQ surged 24.5% and 61%, respectively, from the previous trading day.

The latest rate hike came with a bit of collateral damage. Fears regarding the Fed's continued rate hikes and lower growth forecasts succeeded in dragging technology stocks even lower.

With that as a backdrop, shares of Tesla slipped as much as 2.57% to $300.80, Amazon stock was down as much as 2.99% to $118.54, and Meta Platforms slipped as much as 2.72% to $142.12.

Meta Platforms plans to reduce its expenses by at least 10% by the end of the year. Given the positive nature of these developments, today's stock price declines were no doubt related to the economy.

A total volume of 573.7K option contracts related to Meta was traded on Wednesday, of which put options account for 51%. Particularly high volume was seen for the $140.0 strike put option expiring September 23, with 12,106 contracts trading on Wednesday.

Regarding Amazon stock, A total volume of 646.8K option contracts was traded on Wednesday, of which put options account for 52%.

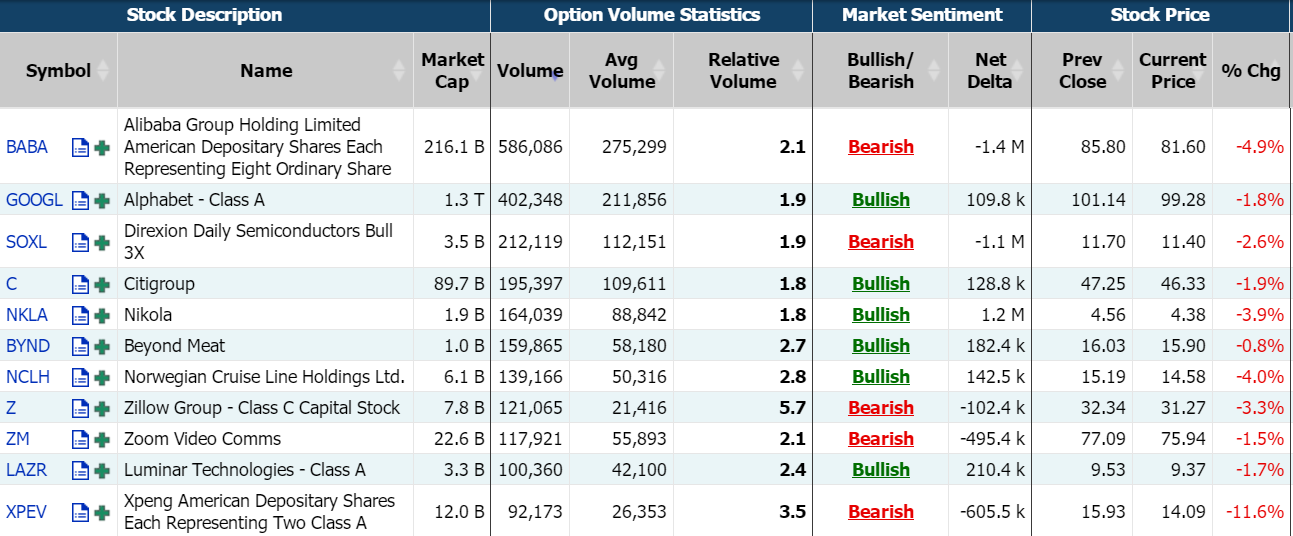

Unusual Options Activity

A total volume of 586, 086 option contracts related Alibaba was traded on Tuesday, of which PUT options account for 71%. Shares of Alibaba slipped as much as 4.9% to $81.60.

Consumer spending is the bedrock of the economy and if people decide to rein in spending, it will no doubt be reflected in lower e-commerce purchases, pressuring the results of both Alibaba and Amazon. Furthermore, it's well documented that companies tend to slash marketing spend when the economy goes south, as it's an area that's easy to speed up or slow down.

EV company XPeng also saw unusual option activities, with a total volume of 92,173 option contracts trading on Wednesday. Particularly high volume was seen for the $19 strike CALL option expiring October 21, with 10,373 contracts trading on Wednesday, representing approximately 1,037,300 underlying shares of XPEV.

XPeng shares tumbled 11.55% to $14.09, while Nio shed over 10.34%. Li Auto shares lost 8.84%. Higher interest rates mean buying cars would take more money out of a consumer’s pocket in terms of monthly installments.

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: INTC, NKLA, GOOG, DIS, MTCH, CMCSA, TWTR, GSK, ADBE, NU

Intel had the highest bearish wagers, with traders buying 1,595,108 deltas on balance.

Top 10 bearish stocks: AAPL, F, IPOF, BABA, TSLA, AAL, GOLD, AMZN, SNAP, SOFI

Apple had the highest bearish wagers, with traders selling 1,673,462 deltas on balance.

Apple stock slid 2.03% to $153.72 on Wednesday. The broad-based sell-off appears to be largely due to global investors' fears that the US Federal Reserve will continue to raise interest rates aggressively in the future to curb inflation.

The Fed raised rates by 75 basis points overnight as expected, raising the target range for the federal funds rate from 2.25 percent to 2.50 percent to 3.00 percent to 3.25 percent.

This is the Fed's fifth consecutive rate hike since January this year, and since June, the last three the Federal Open Market Committee (FOMC) meetings have decided to raise rates by 75 basis points each time.

Comments