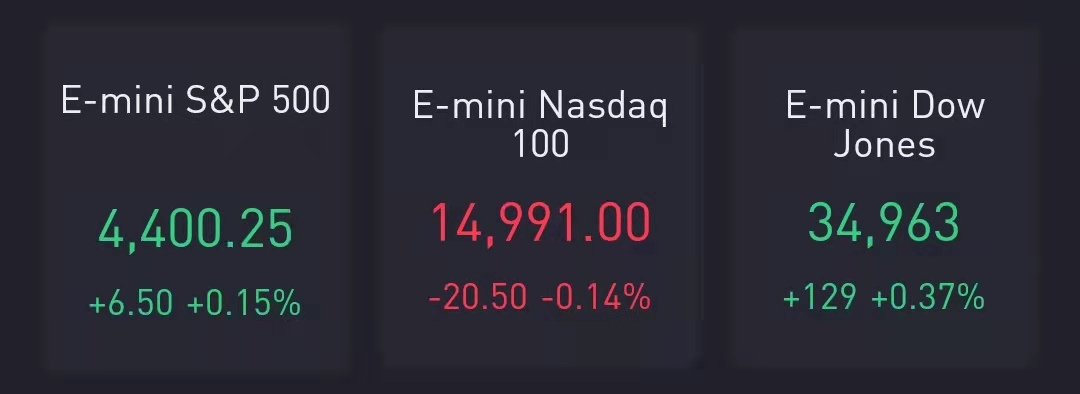

- US futures mixed

- U.S. GDP increased 6.5% in the second quarter, well below expectations

Futures tracking the Dow and the S&P 500 rose on Thursday as comments from the Federal Reserve that the U.S. economic recovery was on track lifted economically sensitive stocks, while Ford jumped after raising its profit outlook for the year.

At 8:00 a.m. ET, Dow e-minis were up 129 points, or 0.37%, S&P 500 e-minis were up 6.5 points, or 0.15%, and Nasdaq 100 e-minis were down 20.50 points, or 0.14%.

Facebook Inc fell 3% as it warned revenue growth would "decelerate significantly" following Apple Inc's(AAPL.O)recent update to its iOS operating system that would impact Facebook's ability to target ads.

The U.S. economy accelerated at a strong pace in the second quarter in a sign that the U.S. has escaped the shackles of the Covid-19 pandemic, the Commerce Department reported Thursday.Gross domestic product, a measure of all goods and services produced during the April-to-June period, accelerated 6.4% on an annualized basis.However, the gain was considerably less than the 8.4% Dow Jones estimate.

A separate data point reported Thursday showed that 400,000 people filed initial claims for unemployment benefits for the week ended July 24. That level is nearly double the pre-pandemic norm.

Stocks making the biggest moves premarket:

Facebook(FB) – Facebook shares fell 3% in premarket trading after the company said revenue growth will slow during the second half of the year as a change inApple’s (AAPL) privacy policies will hurt Facebook’s ability to target ads. For the second quarter, Facebook reported earnings of $3.61 per share compared to a consensus estimate of $3.03, with revenue also topping Wall Street forecasts.

Ford(F) – Ford surprised analysts with an adjusted quarterly profit of 13 cents per share. The automaker had been expected to report a second-quarter loss of 3 cents per share, due in large part to a chip shortage crimping production. However, Ford said it expected that situation to improve in the second half, and it raised its full-year outlook. Ford jumped 4.3% in the premarket.

PayPal(PYPL) – PayPal beat estimates by 3 cents with adjusted quarterly earnings of $1.15 per share, with the payment service’s revenue essentially in line with analyst projections. However, shares came under pressure after it gave a lower-than-expected outlook, as former PayPal parenteBay(EBAY) continues its transition to its own payment platform. The stock slid 5.5% in premarket trading.

Uber Technologies(UBER) – Uber dropped 5.3% in premarket trading after sources told CNBC that Japanese investment giant Softbank is selling a chunk of its stake in Uber to cover losses related to its investment in another ride-hailing company,Didi Global(DIDI). Didi itself is in the news, denying an earlier Wall Street Journal report that it was considering going private. Didi had been up well over 30% in the premarket before that denial, before trimming that still-large gain to 17.5%.

Qualcomm(QCOM) – Qualcomm reported adjusted quarterly earnings of $1.92 per share, beating the $1.68 consensus estimate, with the chip maker’s revenue also exceeding Street forecasts. Qualcomm also gave an upbeat forecast as it expects supply chain disruptions to ease. Qualcomm added 3% in the premarket.

Comcast(CMCSA) – Comcast rose 2.3% in the premarket after reporting adjusted quarterly earnings of 84 cents per share, beating the consensus estimate of 67 cents. The NBCUniversal parent also reported better-than-expected revenue, helped by a rebound in ad sales and a reopening of theme parks.

Merck(MRK) – The drug maker matched estimates with adjusted quarterly profit of $1.31 per share, with revenue beating Street forecasts. Sales of cancer drug Keytruda jumped 23%, in line with expectations. Merck fell 1.3% in premarket trading.

Tempur Sealy(TPX) – The mattress maker earned an adjusted 79 cents per share for its latest quarter, 22 cents above estimates, with revenue topping forecasts as well. Tempur Sealy also raised its full-year outlook, and the stock jumped 4.9% in premarket action.

Yum Brands(YUM) – The parent of KFC, Taco Bell and Pizza Hut came in 20 cents ahead of estimates with adjusted quarterly earnings of 1.16 per share, and revenue also beating analyst projections. Results got a boost from restaurant reopenings as well as continued strong demand in online orders. Yum rallied 2.6% in premarket trading.

Molson Coors(TAP) – Molson Coors added 2% in the premarket after its adjusted quarterly earnings of $1.58 per share beat the consensus estimate of $1.34. The beer brewer’s revenue was above Wall Street forecasts as well.

Northrup Grumman(NOC) – The defense contractor reported adjusted quarterly earnings of $6.42 per share, beating the $5.84 consensus estimate, with revenue also topping estimates. The company was helped by continued strength in its satellite and missile-making units, and the stock rose 1% in premarket trading.

iRobot(IRBT) – iRobot shares plunged 11% in premarket trading after it reported a second-quarter loss and cut its full-year outlook. The maker of the Roomba robotic vacuum cleaner said the worldwide chip shortage would continue to hurt its ability to fulfill orders during the second half of the year.

Comments