U.S. stock index futures edged lower on Wednesday after sharp gains on Wall Street in the previous session as investors assessed better-than-expected earnings reports against the backdrop of a gloomy economic outlook. Fresh uncertainties stemming from the war in Ukraine also weighed on sentiment.

Electric-vehicle maker Tesla Inc gained 1% ahead of its earnings report after market close, while shares of Apple Inc, Amazon.com Inc and Meta Platforms Inc added between 0.1% and 0.6%.

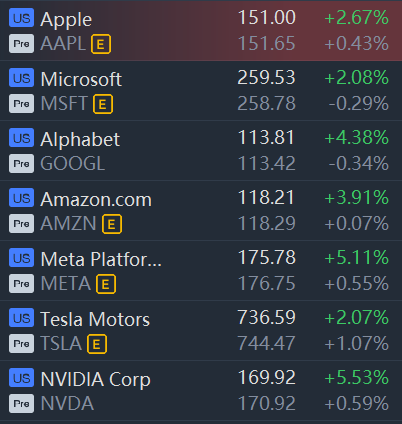

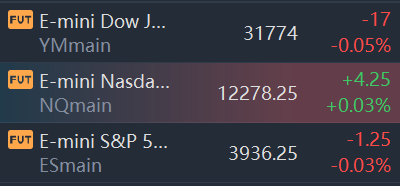

Market Snapshot

At 8:10 a.m. ET, Dow e-minis were down 17 points, or 0.05%, S&P 500 e-minis were down 1.25 points, or 0.03%, and Nasdaq 100 e-minis were up 4.25 points, or 0.03%.

Pre-Market Movers

Netflix (NFLX) – Netflix jumped 6.3% in premarket trading after reporting subscriber losses that were substantially below expectations. The streaming service also said it would add a net 1 million new subscribers this quarter. Netflix reported better-than-expected quarterly earnings, though revenue did fall slightly shy of Wall Street estimates.

ASML (ASML) – ASML slid 1.1% in the premarket after the Netherlands-based semiconductor manufacturing equipment maker cut its full-year sales outlook. ASML reported better-than-expected quarterly earnings but said its customers are turning somewhat cautious in anticipation of slowing chip demand.

Biogen (BIIB) – Biogen shares were flat in premarket action after reporting an adjusted profit of $5.25 per share for the second quarter. That was well above the consensus estimate of $4.06, and revenue also topped forecasts. The beat came even as Biogen said it faces increasing generic and biosimilar competition for its Tecfidera and Rituxan drugs.

Baker Hughes (BKR) – The oilfield services company reported second-quarter adjusted earnings of 11 cents per share, just half of what analysts had forecast. Revenue also fell below estimates, with Baker Hughes citing various challenges including component shortages and supply chain inflation. Baker Hughes tumbled 5.4% in premarket trading.

Casino Stocks – Shares of casino operators rose in premarket action following a Reuters report that Macau would reopen casinos on Saturday amid a drop in Covid infections. Las Vegas Sands (LVS) gained 1.4% while Wynn Resorts (WYNN) rose 2.2%.

Merck (MRK) – Merck fell 1% in premarket trading after its Keytruda cancer drug failed to meet its goal in a late-stage study focused on head and neck cancer patients.

Cal-Maine Foods (CALM) – Cal-Maine rose 1% in the premarket after beating Street forecasts on the top and bottom lines for its latest quarter. The nation’s largest egg producer was helped by higher egg prices, but also saw increases in feed costs that it expects to continue in fiscal 2023.

Elevance Health (ELV) – The health care and insurance company, formerly known as Anthem, beat top and bottom line second-quarter estimates and raised its full-year outlook. Elevance’s profits got a boost from a strong performance in its pharmacy benefits management unit.

Omnicom Group (OMC) – Omnicom beat top and bottom line estimates for its latest quarter, with the ad agency operator also raising its organic revenue growth forecast for the year. Omnicom also said it is maintaining a “healthy level of caution” to deal with challenging macroeconomic conditions. The stock onec surged 7.3% in the premarket.

Comerica (CMA) – The bank’s stock gained 1% in the premarket after it reported better-than-expected profit and revenue for the second quarter. Results were helped by strong loan growth as well as a rising interest rate environment.

Market News

Blackstone Sees Fed Funds Rate Near 5% on Longer Hiking Cycle

The Federal Reserve will need to go on a longer tightening cycle and raise interest rates well into next year to control inflation that Blackstone Group sees as “more deeply entrenched” in the US.

“My own view is the Fed funds rate could exceed 4%. I think they could go above 4.5%, maybe even closer to 5%,” Joseph Zidle, chief investment strategist in Blackstone’s Private Wealth Solutions group, said in a Bloomberg Television interview and in emailed comments.

Bernstein Strategists Say Stocks Have Yet to See Capitulation

Stock markets are yet to see full capitulation from investors, raising the risk of more declines in the short term, according to Sanford C. Bernstein strategists.

“We have not yet seen capitulation in outflows from equity funds,” strategists Mark Diver and Sarah McCarthy wrote in a note on Wednesday. “In fact outflows, excluding Europe, have only just begun.”

Bernstein’s comments stand in contrast with the findings of the Bank of America Corp.’s July global fund manager survey, which signaled that full capitulation has been reached after investor allocation to stocks plunged to the lowest since October 2008 while exposure to risk assets dropped to levels not seen even during the global financial crisis.

Russia Likely to Restart Gas Exports From Nord Stream 1 on Schedule

Russian gas flows via the Nord Stream 1 pipeline are likely to restart on time on Thursday after the completion of scheduled maintenance but at lower than its full capacity, two Russian sources familiar with the export plans told Reuters.

The pipeline, which accounts for more than a third of Russian natural gas exports to the European Union, was halted for ten days of annual maintenance on July 11.

Comments