U.S. stock index futures edge up on Wednesday although recent economic data fueled fears of a slowdown ahead of the Federal Reserve's annual conference this week where the central bank is expected to reinforce its commitment to getting inflation under control.

Investor focus will be on the Jackson Hole symposium which begins on Thursday and remarks from Fed Chair Jerome Powell the day after for clues on whether the central bank can achieve a "soft landing".

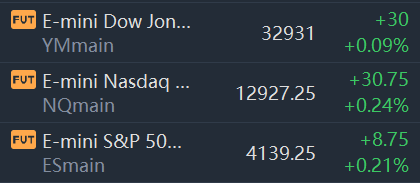

Market Snapshot

At 08:00 a.m. ET, Dow e-minis were up 30 points, or 0.09%, S&P 500 e-minis were up 8.75 points, or 0.21%, and Nasdaq 100 e-minis were up 30.75 points, or 0.24%.

Pre-Market Movers

Bed Bath & Beyond (BBBY) – Bed Bath & Beyond surged 31.8% in premarket action after the Wall Street Journal reported that the housewares retailer had lined up financing to shore up its liquidity.

Nordstrom (JWN) – Nordstrom shares tumbled 13% in the premarket after the retailer cut its full year outlook, saying foot traffic had diminished at the end of its most recent quarter and that it was aggressively working to cut inventory levels. Nordstrom reported better than expected profit and revenue for its second quarter.

Intuit (INTU) – Intuit jumped 5.9% in premarket trading after beating Street forecasts for quarterly profit and revenue and issuing an upbeat forecast. The provider of financial software also raised its quarterly dividend by 15% and increased its share buyback authorization.

Farfetch (FTCH) – The luxury e-commerce specialist's stock soared 18.4% in premarket action, following its deal to buy 47.5% of online fashion retailer YNAP from Switzerland's Richemont for more than 50 million Farfetch shares.

Petco (WOOF) – The pet products retailer fell short of Street forecasts on both the top and bottom lines for its latest quarter, and cut its full year outlook as it faced higher costs. Petco shares fell 5.7% in the premarket.

Brinker International (EAT) –The parent of the Chili’s and Maggiano’s restaurant chains saw its stock slide 7.3% in premarket trading after it missed estimates with its quarterly earnings, impacted by higher costs. It also issued a lower than expected full-year outlook.

Toll Brothers (TOL) – Toll Brothers slid 2.6% in premarket trading after the luxury home builder cut its deliveries guidance for the year amid supply chain issues and labor shortages. For its most recent quarter, Toll Brothers reported better than expected earnings but saw revenue fall short of Street forecasts.

Urban Outfitters (URBN) – Urban Outfitters fell 1.5% in the premarket after the apparel retailer reported lower than expected quarterly profit. Urban Outfitters saw improved sales in its stores as customer traffic increased, but also reported a decline in digital sales.

La-Z-Boy (LZB) – La-Z-Boy shares staged a 6.6% premarket rally after the furniture retailer reported a better than expected quarter and issued an upbeat outlook. It issued cautious comments regarding the possible impact of macroeconomic uncertainty.

Advance Auto Parts (AAP) – Advance Auto Parts stumbled 5.9% in the premarket after missing analyst estimates on both the top and bottom lines for its latest quarter, as well as lowering its outlook. The auto parts retailer said inflation and higher fuel costs had a negative effect on its do-it-yourself business during the quarter.

Market News

Goldman Says Hedge Funds Back Betting Big on Megacap Tech Stocks

Hedge funds ramped up bets on megacap US tech stocks and whittled down overall holdings to focus on favored names last quarter, with conviction climbing back to levels seen at the start of the pandemic, according to Goldman Sachs Group Inc.

Amazon.com Inc. supplanted Microsoft Corp. as the most popular long position, a timely call given that the former has rallied 26% this quarter versus an 8% climb in the latter. The funds also boosted bets on Nvidia Corp., Apple Inc., Atlassian Corp. and Tesla Inc., according to the report.

Julian Robertson, Hedge-Fund Guru to "Tiger Cubs," Dies

Julian Robertson, the billionaire Tiger Management founder who became one of his generation’s most successful hedge-fund managers and a mentor to a wave of investors known as Tiger Cubs, has died. He was 90.

He died Tuesday morning at his home in Manhattan from cardiac complications, according to Fraser Seitel, a longtime spokesman for Robertson.

Comments