Nvidia stock rallied nearly 3% in morning trading. Nvidia will report earnings after the close on Wednesday.

Could Earnings Put NVIDIA Stock Back on Track?

NVIDIA is scheduled to report its first-quarter results on May 25. Here's what to expect.

Down more than 44% in 2022 alone,NVIDIA'sstock is a classic example of a high-multiple stock that has suffered from the market turbulence weighing on growth stocks.

Nvidia has been a growth phenomenon — its earnings have beaten Wall Street expectations for 12 consecutive quarters. And this week, the company will report its first-quarter earnings results, as well as guidance.

Will it be enough to get NVIDIA's stock back on track? Let's take a look at what to expect.

What to Expect for Q1 Earnings

Since January 2019, NVIDIA has not missed a single quarter for beating market estimates, and it is quite likely that streak will continue in the first quarter (Q1).

To beat Q1 market expectations, NVIDIA needs to report earnings per share of $1.30, which would imply 41.6% year-over-year growth, and revenues around $8.09 billion, which would imply nearly 43% year-over-year growth. The consensus for Q1 comes in line with the outlook provided by Nvidia during its last quarter.

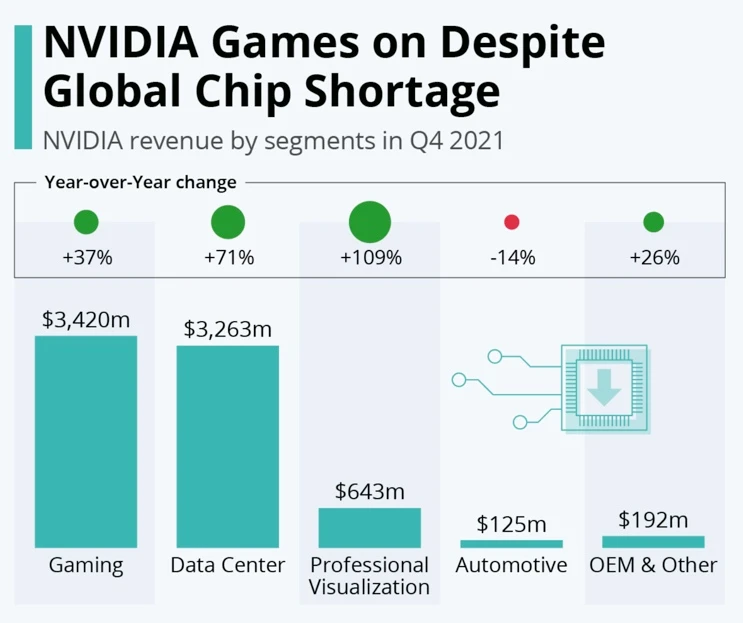

NVIDIA is known primarily for its gaming graphics processing units (GPUs), and about 45% of its revenues come from this business — followed closely by the company's data center solutions business. See the chart below:

Investors will likely be interested in the company's ability to sustain its long-term growth outlook in the face of ongoing supply-chain disruptions and chip shortages.

But another big unknown is the sustainability of the gaming market. The U.S. gaming market is in decline so far in 2022, compared to last year. With Nvidia's data center business growing, it's expected that, eventually, this segment will eclipse NVIDIA's GPU business.

It's worth remembering that NVIDIA is priced like a growth stock. Even minor slowdowns in reported growth tend to weigh on the performance of its shares. The gaming slowdown could make it difficult for NVIDIA shares to regain the levels above $300 they reached in 2021.

The Data Centers Should Save the Day, Says UBS

UBS analyst Timothy Arcuri is a Nvidia bull. However, thanks to the sharp decline in the company's stock, he was forced to lower his price target for NVDA from $350 to $280 ahead of Q1 results.

Arcuri wrote that he is expecting another strong earnings report from NVIDIA. And he believes that the fears many investors have regarding the gaming slowdown are unlikely to materialize yet. But he warned that gaming indicators are "clearly not favorable."

Wells Fargo: Look to Data Center Demand and Hopper Product Cycle

Wells Fargo analyst Aaron Rakers is another NVDA bull. He recently wrote that the Q1 focus should be on NVIDIA's comments regarding its data center business demand visibility, momentum, and the Hopper product cycle, which consists of an architecture breakthrough designed for training AI (artificial intelligence) models.

However, he warned investors that any indications of a slowdown could have a negative effect on NVDA shares. Rakers has set a $250 price target on NVIDIA for the next 12 months.

Wedbush Is Skeptical on GPU Demand Slowing

With a neutral recommendation on NVIDIA's stock, Wedbush analyst Matt Bryson wrote that any downside for the stock will be tied to GPU revenues. The analyst also added that, along with the decline in Ethereum mining, the impact for NVIDIA is difficult to quantify due to several variables.

Comments