Market Overview

The S&P 500 and Nasdaq ended higher on Friday, extending a rally started the day before after a soft inflation reading.

The S&P 500 gained 0.92%, while the Nasdaq Composite gained 1.88%. The Dow Jones Industrial Average rose 0.1%.

Regarding the options market, a total volume of 54,158,114 contracts was traded on Friday, up 2.8% from the previous trading day.

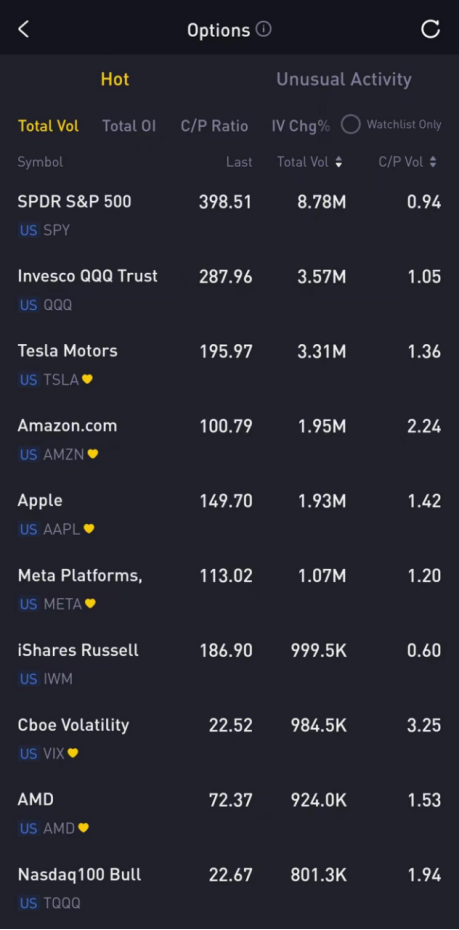

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, AMZN, AAPL, META, IWM, VIX, AMD, TQQQ

Options related to equity index ETFs are top choices for investors, with8.78 million SPY and 3.57 million Invesco QQQ Trust options contracts trading on Friday.

Total trading volume for SPY and Invesco QQQ Trust rose 2.9% and 13.69%, respectively, from the previous day. 52% of SPY trades bet on bearish options.

AMD gained 5.7% on Friday after it launched its latest data center chip and said Microsoft's Azure, Alphabet-owned Google Cloud and Oracle would be some of its customers.

The fourth generation EPYC processor, code named "Genoa", makes significant improvement on performance and energy efficiency compared with its previous chip, said Chief Executive Lisa Su.

There were 924,000 AMD options trading on Friday. Call options account for60% of overall option trades. Particularly high volume was seen for the $75 strike call option expiring November 18th, with 25,151 contracts trading on Friday.

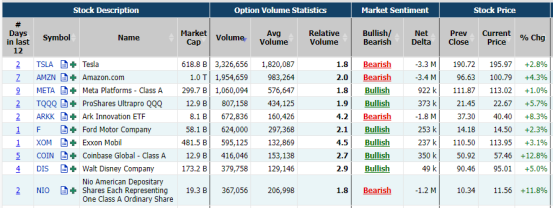

Unusual Options Activity

Coinbase Global, Inc. surged 12.84% on Friday though it cut over 60 jobs in its recruiting and institutional onboarding teams.

Moreover, Sam Bankman-Fried’s crypto empire filed for Chapter 11 bankruptcy in Delaware, capping a rapid downfall for his companies.

There were 412,100 Coinbase Global, Inc. options trading on Friday. Put options account for 66% of overall option trades. Particularly high volume was seen for the $55 strike put option expiring November 18th, with 6,940 contracts trading on Friday.

NIO Inc. soared 11.8% on Friday and rose 24.97% after posting its financial results. It reported a bigger loss forQ3 and expects deliveries to rise as much as 91.7% in the current quarter.

Moreover, China eased some of its COVID-19 rules. The country reduced quarantine by two days for those who come in close contact with infected people, and for inbound travelers, and also scrapped a penalty for airlines for bringing in many cases.

There were 364,700 NIO Inc. options trading on Friday. Call options account for 76% of overall option trades. Particularly high volume was seen for the $12 strike call option expiring November 18th, with 12,773 contracts trading on Friday.

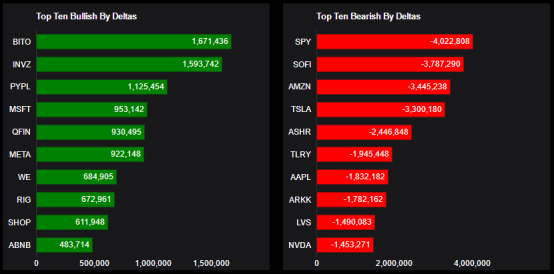

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: BITO, INVZ, PYPL, MSFT, QFIN, META, WE, RIG, SHOP, ABNB

Top 10 bearish stocks: SPY, SOFI, AMZN, TSLA, ASHR, TLRY, AAPL, ARKK, LVS, NVDA

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments