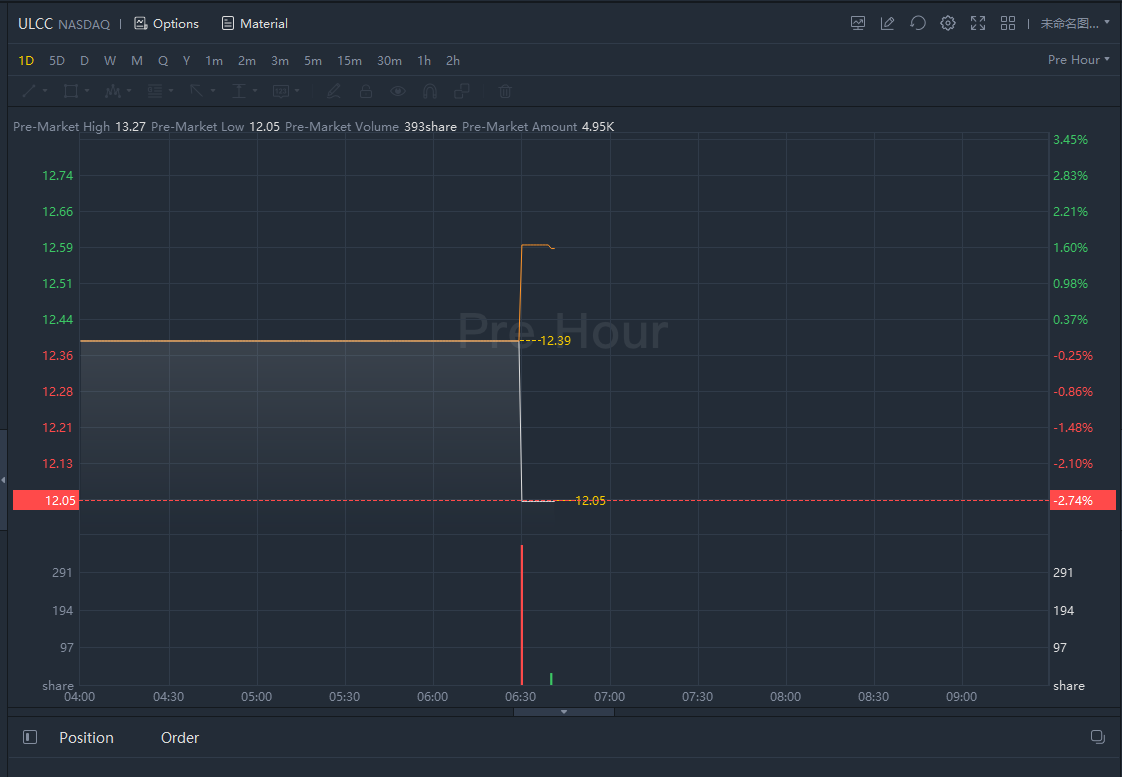

Frontier airlines dropped over 2% in premarket trading with Spirit Airlines, Frontier to merger in a deal valued at $6.6 bln.

Frontier ended 2021 with a total fleet of 110 aircraft, which is six percent higher than the corresponding prior year period and 12 percent higher than the comparable pre-COVID quarter in 2019. Frontier's fleet continues to be the most fuel-efficient of all major U.S. carriers when measured by ASMs per fuel gallon consumed, generating over 100 ASMs per gallon during the fourth quarter and the full year 2021, representing Frontier's commitment to continued fuel efficiency as the airline grows.

On November 13, 2021, Frontier executed an order of 91 additional A321neo aircraft that are scheduled for delivery between 2023 and 2029. These aircraft commitments will enable the airline to significantly increase in size by 2029 while advancing its industry-leading environmental efforts and fuel-efficiency advantage.

Frontier's capacity, measured by ASMs, was four percent higher in the fourth quarter compared to the corresponding 2019 quarter. Frontier continued its domestic and international expansion, opening four new stations and operating an average of over 450 flights per day. This was ten percent higher than the comparable 2019 quarter.

Total revenue per passenger in the fourth quarter was approximately $103. Of this amount, ancillary revenue was $63 per passenger, eight percent higher than the comparable 2019 quarter, supported by the economic recovery and the Company's innovative product offerings. Full year 2021 ancillary revenue per passenger was approximately $61, six percent higher than 2019. Despite the impact of the Delta and Omicron variants, and rising fuel prices, management remained financially disciplined and the Company ended the year in a strong financial position.

“Through out 2021, Frontier displayed its operational and financial resiliency notwithstanding the persistent challenges from COVID-19 variants,” commented Barry Biffle, president and CEO. “During the fourth quarter, we increased our capacity, departures, fuel efficiency and level of ancillary revenue per passenger versus the comparable pre-COVID period. We continue to view the impact of COVID-19 as transient, and remain focused on getting the airline back to full utilization in 2022 while being nimble to counter any further COVID-19 impacts. I want to thank Team Frontier for providing safe and dependable travel to our valued customers, all while fulfilling our ‘Low Fares Done Right’ commitment.”

Fleet

As of December 31, 2021, Frontier had a fleet of 110 Airbus single-aisle aircraft, consisting of 73 A320neos, 21 A321ceos and 16 A320ceos. All aircraft in the fleet are financed with operating leases that expire between 2022 and 2033. Frontier’s fleet is the most fuel-efficient of all major U.S. carriers when measured by ASMs per fuel gallon consumed. This fuel efficiency reflects Frontier’s operation of a large number of aircraft with new generation, fuel-efficient engines, lightweight seats, and an efficient seating layout.

Frontier completed an order of 91 additional A321neo aircraft in November 2021 that are scheduled for delivery between 2023 and 2029. These aircraft commitments bring the Company's total aircraft order as of December 31, 2021 to 234 aircraft to be delivered through 2029, including 76 A320neo aircraft and 158 A321neo aircraft. These aircraft commitments will enable the Company to significantly increase in size by 2029. In addition, the entry into service of the A321neo aircraft in the second half of 2022 will advance Frontier's structural advantage in fuel and operating expense efficiency versus the industry.

Guidance

In consideration of the anticipated merger with Spirit Airlines, Inc. which was also announced today, the Company will not provide guidance for the first quarter or full year 2022 at this time.

Comments