Nvidia is slated to report its second-quarter results for fiscal 2023 (the May to July 2022 period) after the market closes on Wednesday, Aug. 24. An analyst conference call is scheduled for the same day at 5 p.m. ET.

Preliminary Financial Results

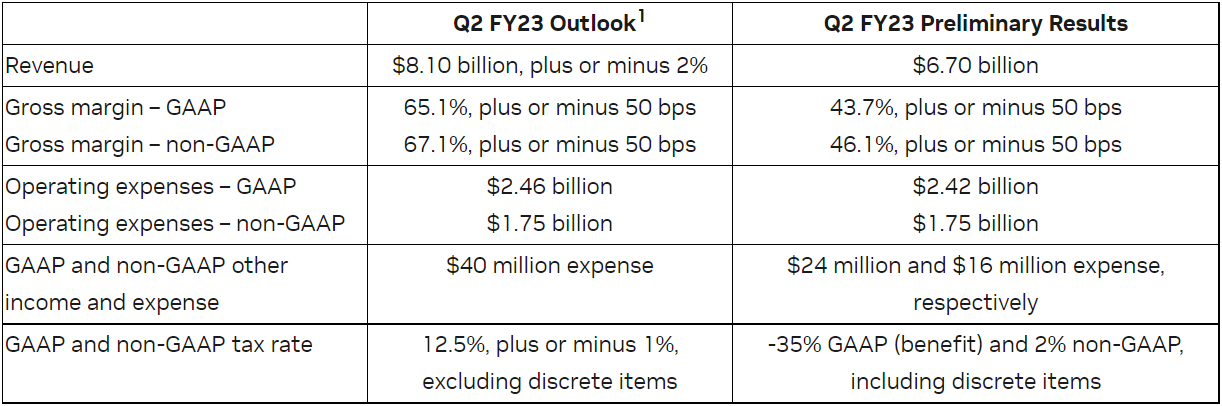

Last week, Nvidia reported preliminary results for its second quarter fiscal 2023. The preliminary results show second quarter revenue to be $6.7 billion versus $8.1 billion as initially projected. This 17% decline in revenue is being attributed to lower sales in its gaming division, which includes chips used for cryptocurrency mining. However, the company believes that its long-term gross margins are intact, which should temper a potential decline in earnings growth.

Despite the difficulty in Nvidia's gaming division, the company overall should be able to continue to grow its revenue, albeit at a more meager rate. At 49 times earnings, this is a more modest valuation than the company's stock has been trading at in the last year.

After the release, the stock traded down around 8% but has since recovered those losses, and then some, due to the broader rally in the market.

That seems like an odd reaction to a terrible announcement, but the market sometimes does strange things. So, was this rally truly deserved, or should buyers beware? Let's find out.

What to Watch in Q2

Here's what to watch in the company's Q2 report.

Nvidia may not have a quick rebound from the substantial 2Q revenue and margincut of its pre-announcement, which may persist for two or more quarters. The continuedpullback in consumer PC and video-console sales, coupled with China's macroeconomic slowdownand the region's crackdown on crypto, could factor into a muted outlook. Still, its data-centersegment, which is more than half of sales, remains a bright spot and sales could stay on a double-digit growth pace amid higher performance compute and AI applications by hyperscaler andenterprise data-center customers.

The gross margin's recovery from a 21-percentage-point guidance cut to 46.1% may be ator near its bottom. But Nvidia may need a few quarters to resolve its inventory glut and help drivemargin higher.

Nvidia's Key Numbers

Here are benchmarks to use to gauge thetech company's results.

| Metric | Fiscal Q2 2022 Result | Nvidia's Fiscal Q2 2023 Preliminary Financial Results | Bloomberg's Fiscal Q2 2023 Consensus Estimate |

|---|---|---|---|

| Revenue | $6.51 billion | $6.70 billion | $6.70 billion |

| Adjusted earnings per share (EPS) | $1.04 | - | $0.51 |

Data Sources: Nvidia and Bloomberg

For context, last quarter, Nvidia's revenue jumped 46% year over year (and 8% sequentially) to a record $8.29 billion. Growth was driven by record revenue in the gaming and data center platforms. EPS on the basis of generally accepted accounting principles (GAAP) declined 16% year over year to $0.64, which includes an after-tax charge of $0.52 related to the termination of the Arm acquisition deal. EPS adjusted for one-time items -- which is the earnings metric investors should focus on -- surged 49% to $1.36.

Wall Street has lowered its forecast for revenue and adjusted EPS of $6.70 billion and $0.51, respectively, to meet the latest situation.

Third-Quarter Guidance

Guidance that's notably different from what Wall Street is expecting will likely move Nvidia stock. For the fiscal third quarter (the August through October period), Nvidia's guidance will be extremely important.

"We are gearing up for the largest wave of new products in our history with new GPU [graphics processing unit], CPU [central processing unit], DPU [data processing unit], and robotics processors ramping in the second half" of the fiscal year, CEO Jensen Huang said in last quarter's earnings release. Investors can expect this topic to be discussed on the upcoming second-quarter earnings call.

As Huang is quoted as saying in a Nvidia blog, "The CPU is for general-purpose computing, the GPU is for accelerated computing, and the DPU, which moves data around the data center, does data processing."

Analyst Views

After Nvidia issued a performance warning, some analysts lowered their target price.

Nvidia price target lowered to $216 from $283 at Truist

Truist analyst William Stein lowered the firm's price target on Nvidia to $216 from $283 but keeps a Buy rating on the shares after its negative Q2 pre-announcement. The magnitude of the magnitude of the shortfall was "surprising", the analyst tells investors in a research note, adding that gaming weakness may persist into Q3 before recovering in the January-April 2023 timeframe. Stein further states that the miss in Data Center and AI segments was related to supply chain, and he sees demand remaining constructive.

Nvidia price target lowered to $210 from $220 at Susquehanna

Susquehanna analyst Christopher Rolland lowered the firm's price target on Nvidia to $210 from $220 and keeps a Positive rating on the shares. The analyst said they preannounced disappointing results and noted they plan to slow opex growth to balance investments but will also continue buybacks as they foresee strong cash flow. In short, the company's weakness further exemplifies his thesis on the weakening PC/Handset/Consumer end-markets as he expects continued softness in 2H.

Nvidia price target lowered to $250 from $290 at Mizuho

Mizuho analyst Vijay Rakesh lowered the firm's price target on Nvidia to $250 from $290 and keeps a Buy rating on the shares following the company's negative preannouncement.

Nvidia price target lowered to $250 from $300 at Oppenheimer

Oppenheimer analyst Rick Schafer lowered the firm's price target on Nvidia to $250 from $300 and keeps an Outperform rating on the shares after the company pre-announced fiscal Q2 results significantly below expectations, stating that its revised outlook reflects weakness primarily in Gaming as declining PC units, a "crypto hangover" and a softening economic environment weighs on demand. Data center was "solid by comparison," but also fell 6% shy of the consensus forecast due to supply chain tightness and Nvidia took a $1.32B charge as it flushes excess inventory ahead of the Lovelace gaming refresh in the second half. While Schafer believe second half gaming-led risk to estimates was "widely anticipated," the "magnitude surprised," though he sees a gaming rebound post the launch of the new Lovelace RTX 40-series that is expected next month.

Craig-Hallum downgrades 'too expensive' Nvidia after guidance cut

Craig-Hallum analyst Richard Shannon downgraded Nvidia to Hold from Buy with a price target of $180, down from $210. The company's preannounced results were much worse than guided and look like a repeat of fiscal Q4 2019 in the Gaming segment, Shannon tells investors in a research note. The stock is trading above most peers today and above its historic 30-times next 12months earnings estimate, which is "too expensive," says the analyst.

Nvidia's recently published second-quarter results are quite disappointing. While this has affected the analyst and investor sentiment for the stock, the company's fundamental story remains strong. Nvidia is a company with a significant technological advantage and a robust balance sheet (cash balance of $20.34 billion and total debt of $11.85 billion at the end of the first quarter). The company plans to repurchase shares worth $15 billion by the end of December 2023, thereby returning significant value to shareholders.

All eyes and ears will be on the official earnings release (these preliminary numbers can still change) on August 24, when management will field questions and give the all-important Q3 projections.

We'll be looking for a few items. First, we'll want to hear management discuss the crypto effect, as they have often shied away from it. Second, we'd like to learn about the future state of the data center division because it keeps Nvidia's results afloat. Finally, we'll be looking for management to lay out a path forward to regain its gross margin, which will boost profits.

Comments