Market Overview

Wall Street's main indexes closed lower on Thursday(Oct 12) after a U.S. Treasury auction sent bond yields higher while investors were already digesting data that showed consumer prices rose more than anticipated in September.

Regarding the options market, a total volume of 40,563,775 contracts was traded, up 18% from the previous trading day.

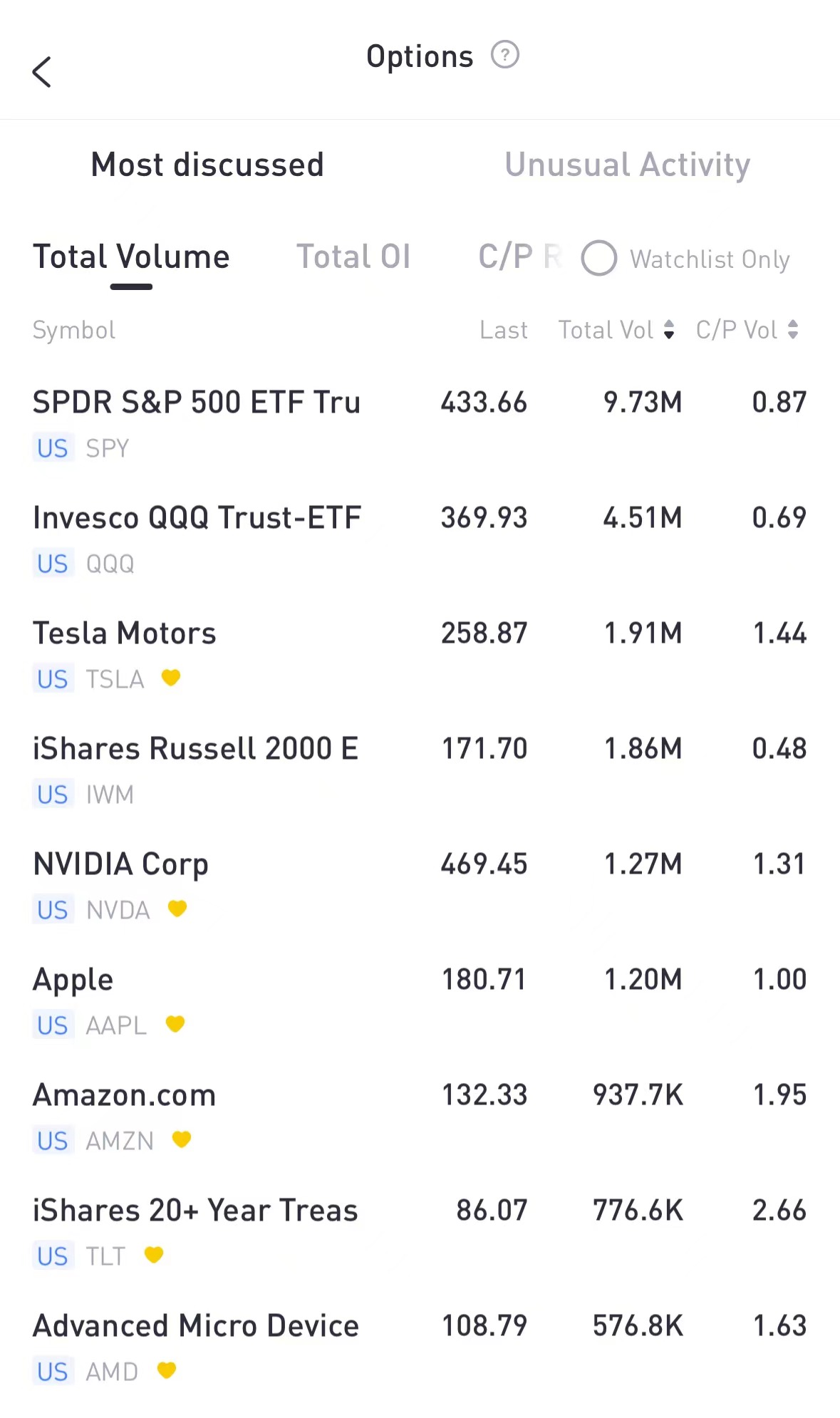

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, IWM, NVDA, AAPL, AMZN, iShares 20+ Year Treasury Bond ETF, Advanced Micro Devices

U.S. benchmark 10-year yields rose after the inflation data and climbed further to hit a session high after the auction. The benchmark yield rose as high as 4.728%, its highest-level since Friday after falling for the last two days.

There are 776.6K TLT option contracts traded on Thursday, up 76.5% from the previous trading day. Call options account for 72% of overall option trades. Particularly high volume was seen for the $87 strike call option expiring Oct 13, with 52,355 contracts trading.$TLT 20231013 87.0 CALL$

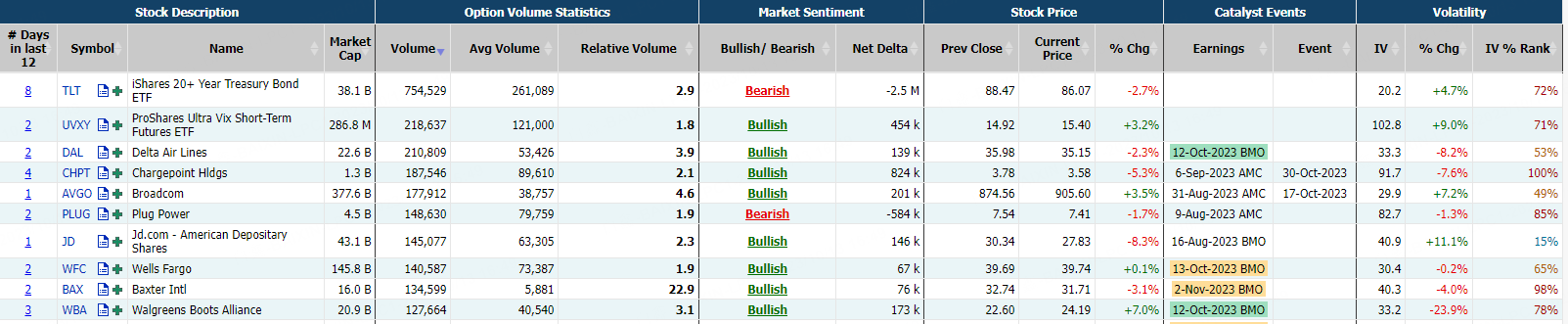

Unusual Options Activity

JD.com Inc. slumped to a record low in Hong Kong as Wall Street brokerages turned bearish on the stock and rumors swirled that a businessman with the same surname as the company’s chairman had been arrested.

There are 145,077 JD.com option contracts traded on Thursday, up 270% from the previous trading day. Call options account for 68% of overall option trades. Particularly high volume was seen for the $27 strike put option expiring Oct 13, with 6,919 contracts trading.$JD 20231013 27.0 PUT$

Most Active Equity Options

Special %Calls >70%: Plug Power, Delta Air Lines, AMC Entertainment, ChargePoint Holdings Inc.

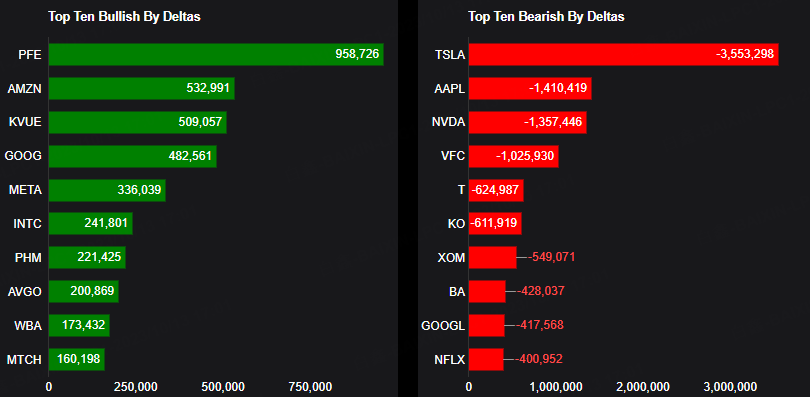

TOP 10 Bullish & Bearish S&P 500

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: PFE, AMZN, KVUE, GOOG, META, INTC, PHM, AVGO, WBA, MTCH

Top 10 bearish stocks: TSLA, AAPL, NVDA, VFC, T, KO, XOM, BA, GOOGL, NFLX

Based on option delta volume, traders sold a net equivalent of -3,553,298 shares of Tesla stock. The largest bearish delta came from selling calls. The largest delta volume came from the 13-Oct-23 265 Call, with traders getting short 3,650,983 deltas on the single option contract.$TSLA 20231013 265.0 CALL$

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments