U.S. stock index futures were mixed on Tuesday as investors refrained from making aggressive bets ahead of inflation data that could determine the Federal Reserve's next policy moves, while caution also prevailed ahead of the earnings season.

Market Snapshot

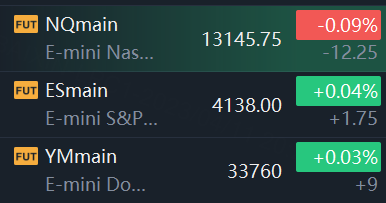

At 8:22 a.m. ET, Dow e-minis were up 9 points, or 0.03%, S&P 500 e-minis were up 1.75 points, or 0.04%, and Nasdaq 100 e-minis were down 12.25 points, or 0.09%.

Pre-Market Movers

CarMax — Shares of the vehicle retailer soared 7% on the back of better-than-expected quarterly earnings. CarMax earned 44 cents per share, beating a Refinitiv forecast of 24 cents per share.

Newmont — The stock lost 2.9% in early morning trading on news that Newmont raised its price proposal in its offer to acquire Australia’s Newcrest Mining for $19.5 billion, which is 16% higher than Newmont’s initial bid. If the deal goes through, it would further secure Newmont’s position as the world’s biggest gold producer.

Upstart — Upstart fell about 2% after JPMorgan initiated coverage of the lending stock with an underweight rating, citing a worsening environment for loans.

Whirlpool — Shares gained more than 2% after Goldman Sachs upgraded Whirlpool to buy from neutral. The bank said the appliance stock is cheap and can rally more than 20%.

Moderna — The biotech giant slid 4.9% after the company said it’s delaying its flu vaccine due to a lack of enrolled cases in a late-stage trial. The news comes after a company spokesperson told CNBC on Monday that Moderna hopes to release a slew of new vaccines that target cancer, heart disease as well as other yet-to-be confirmed conditions by 2030.

LendingClub — The lending platform gained 4.8% after JPMorgan initiated coverage of the stock as overweight. The bank said the LendingClub’s recent selloff was likely too harsh as investors grew nervous about financial institutions and the potential for a recession.

Bumble — Shares of the matchmaking company gained 1% after Baird initiated coverage of Bumble and gave it an outperform rating, noting the stock has lagged the S&P 500 this year and is now trading at a “relatively inexpensive” valuation. The firm assigned a $23 price target on Bumble, suggesting the stock stands to gain more than 23%.

Array Technologies — Shares of the solar technology company gained 2% after Wolfe Research initiated coverage of Array with an outperform rating. Wolfe said in a note to clients that Array should benefit from the expansion of utility-scale solar energy production.

WW International — Shares popped more than 28% after Goldman Sachs said the weight loss company could triple in value. “WW’s subscriber base and earnings power has been shrinking, but we believe a catalyst for a turnaround has emerged with its new obesity drug on-ramp solution,” Goldman said.

Market News

CarMax Posts Lower 4Q Sales as Inflation Weighs on Demand

CarMax Inc.'s sales fell by almost 26% in the fiscal fourth quarter as inflation, rising interest rates and tightening lending standards continued to hamper demand for used cars.

The Richmond, Va., used-car retailer said profit for the three months ended Feb. 28 was $69.0 million, down from $159.8 million a year earlier.

Moderna to Keep Testing Flu Shot as It Fails to Meet "Early Success" Criteria

Moderna Inc said on Tuesday it had not enrolled enough cases in a late-stage trial of its experimental flu vaccine to determine if the shot was successful or not, sending the company's shares down 7% in premarket trading.

The company said, ahead of its annual vaccines conference, that it will continue testing the flu shot for efficacy.

Data from the second trial comes two months after its flu vaccine generated a strong immune response against influenza A strains, but was inferior to an approved vaccine when compared to the less-prevalent influenza B strain in the first late-stage study.

Newmont Plumps Offer for Australia's Newcrest to $19.5 Bln

Newmont Corporation raised its offer for Australia's Newcrest Mining Ltd on Tuesday to A$29.4 billion ($19.5 billion) to close a deal that would extend Newmont's lead as the world's biggest gold producer.

If successful, the deal would lift Newmont's gold output to nearly double its nearest rival Barrick Gold Corp. The merger is set to be the third-largest deal ever involving an Australian company and the third-largest globally in 2023, according to data from Refinitiv and Reuters calculations.

Alibaba to Roll out Generative Ai across Apps, Beijing Flags New Rules

Alibaba Group Holding Ltd on Tuesday showed off its generative AI model - its version of the tech that powers chatbot sensation ChatGPT - and said it would be integrated into all of the company's apps in the near future.

The unveiling, which came on the heels of the launch of a slew of new AI products by SenseTime this week, was swiftly followed by the government's publication of draft rules outlining how generative AI services should be managed.

Comments