- New Oriental Education & Technology press release (NYSE:EDU): Q2 Non-GAAP EPADS of $0.10 beats by $0.01.

- Revenue of $638.2M (-3.1% Y/Y) beats by $24.04M.

- The total number of schools and learning centers was 708 as of November 30, 2022, an increase of2 compared to 706 as of August 31, 2022 and a decrease of 585 compared to 1,293 as of November 30, 2021, respectively. The total number of schools was 95 as of November 30, 2022.

- New Oriental expects total net revenues in the third quarter of the fiscal year 2023 (December 1, 2022 to February 28, 2023) to be in the range of US$702.8 million to US$719.8 million vs. consensus of $672.36M, representing year-over-year increase in the range of 14% to 17%.

The projected increase of revenue in our functional currency Renminbi is expected to be in the range of 24% to 27% for the third quarter of the fiscal year 2023.

New Oriental Education &Technology Group Inc. (NYSE: EDU/ 9901.SEHK), a provider of private educational services inChina, today announced its unaudited financial results for the second fiscal quarter endedNovember 30, 2022, which is the second quarter of New Oriental's fiscal year 2023.

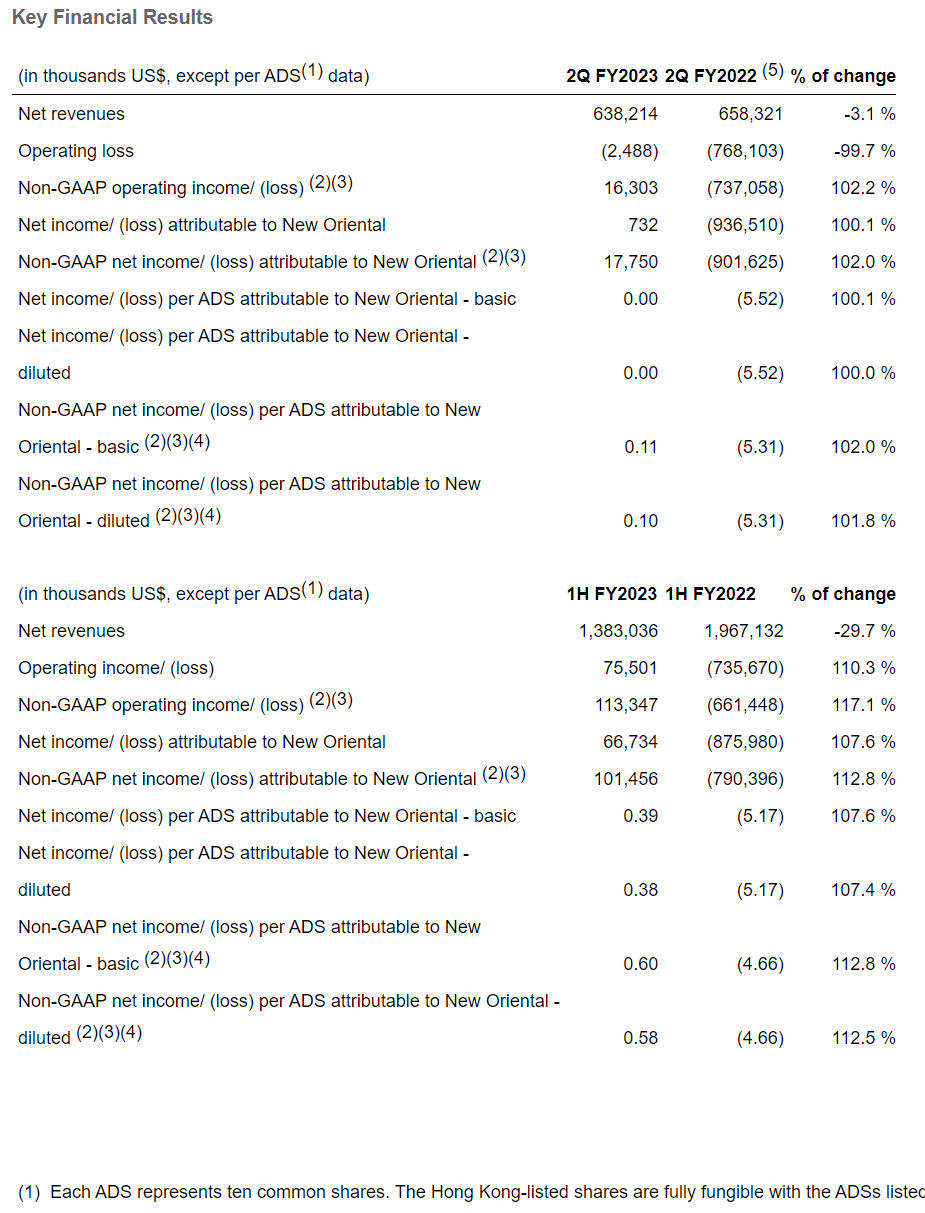

Financial Highlights for the Second Fiscal Quarter Ended November 30, 2022

- Total net revenues decreased by 3.1% year-over-year to US$638.2 million for the second fiscal quarter of 2023.

- Operating loss wasUS$2.5 million, compared to the loss of US$768.1 million in the same period of the prior fiscal year.

- Net income attributable to New Oriental was US$0.7 million, compared to the loss of US$936.5 million in the same period of the prior fiscal year.

Operating Highlights for the Second Fiscal Quarter Ended November 30, 2022

- The total number of schools and learning centers was 708 as ofNovember 30, 2022, an increase of 2 compared to 706 as ofAugust 31, 2022and a decrease of 585 compared to 1,293 as ofNovember 30, 2021, respectively. The total number of schools was 95 as ofNovember 30, 2022.

Michael Yu, New Oriental's Executive Chairman, commented, "It is encouraging to see a continuously strong momentum of our overall business in the second fiscal quarter of this year, which marks a fresh start after downsizing throughout the last fiscal year. Our remaining key businesses started to show a steady trend of recovery after several years of pandemic disruption. In this fiscal quarter, our overseas test preparation and overseas study consulting businesses increased by approximately 17% and 14% year over year, respectively. Simultaneously, our educational new business initiatives sustained a strong growth and generated meaningful profit in this fiscal quarter. The non-academic tutoring business was rolled out in over 60 cities, with 477,000 enrollments in this fiscal quarter, while the intelligent learning system and devices were adopted in around 60 cities, with 108,000 active paid users in this fiscal quarter. With these solid financial results and positive customer feedback, we are increasingly confident in the promising prospects of our new businesses, as well as our ability to capture emerging opportunities in these rapidly-growing markets."

Chenggang Zhou, New Oriental's Chief Executive Officer, added, "By the end of this fiscal quarter, the total number of schools and learning centers remained at 708. We focus more strategically on business opportunities in the major markets of higher-tier cities, and proactively leverage our existing infrastructure and education resources for both the remaining key businesses and new educational initiatives across cities. The continued investment in maintaining our online-merge-offline teaching system provides flexibility and high teaching quality to our customers amid the pandemic.Koolearn.comhas made significant progress in its private label products and livestreaming e-commerce business, and have achieved breakthroughs in our business operations and financial performance. WhileDONG FANG ZHEN XUAN(东方甄选) has become a well-known platform for promoting healthy, top-quality and cost-effective products to the public, it continues to expand its product selection and SKUs through proactive cooperation with third parties, coupled with increase in ourDONG FANG ZHEN XUANprivate label products. By focusing on improving product capabilities and developing diverse cultural content,DONG FANG ZHEN XUANhas yielded millions of revenues and a loyal customer base in the first half of this fiscal year."

Stephen Zhihui Yang, New Oriental's Executive President and Chief Financial Officer, commented, "Despite the fact that the second quarter is traditionally the slowest quarter of the year, we still managed to generate non-GAAP operating profit ofUS$16.3 millionfor the quarter. We recorded a positive operating cash flow ofUS$173.7 millionand by the end of this fiscal quarter, our cash and cash equivalents, term deposits and short-term investments totaled approximatelyUS$4.2 billion. We will continue to ramp up our effort in all aspects to accelerate our recovery and pursue profitable growth. We are confident in delivering more value to our customers, society and shareholders in the long term."

Share Repurchase

OnJuly 26, 2022, the Company's board of directors authorized a share repurchase program, under which the Company may repurchase up toUS$400 millionof the Company's ADSs or common shares during the period fromJuly 28, 2022throughMay 31, 2023. As ofJanuary 16, 2023, the Company repurchased an aggregate of approximately 3.1 million ADSs for approximatelyUS$79.0 millionfrom the open market under the share repurchase program.

Financial Results for the Second Fiscal Quarter EndedNovember 30, 2022

Net Revenues

For the second fiscal quarter of 2023, New Oriental reported net revenues ofUS$638.2 million, representing a 3.1% decrease year over year. The decline was mainly due to the cessation of K-9 academic after-school tutoring services in complying with the government policies inChina.

Operating Costs and Expenses

Operating costs and expenses for the quarter wereUS$640.7 million, representing a 55.1% decrease year-over-year. Non-GAAP operating costs and expenses for the quarter, which exclude share-based compensation expenses, wereUS$621.9 million, representing a 55.4% decrease year-over-year. The decrease was primarily due to the reduction of facilities and number of staff as a result of the downsizing in fiscal year 2022.

- Cost of revenuesdecreased by 31.6% year-over-year toUS$336.2 million.

- Selling and marketing expensesdecreased by 15.0% year-over-year toUS$95.5 million.

- General and administrative expensesfor the quarter decreased by 74.6% year-over-year toUS$209.0 million. Non-GAAP general and administrative expenses, which exclude share-based compensation expenses, wereUS$190.9 million, representing a 75.7% decrease year-over-year.

Total share-based compensation expenses, which were allocated to related operating costs and expenses, decreased by 39.5% toUS$18.8 millionin the second fiscal quarter of 2023.

Operating Income / Loss and Operating Margin

Operating loss wasUS$2.5 million, compared to the loss ofUS$768.1 millionin the same period of the prior fiscal year. Non-GAAP income from operations for the quarter wasUS$16.3 million, compared to the loss ofUS$737.1 millionin the same period of the prior fiscal year.

Operating margin for the quarter was negative 0.4%, compared to negative 116.7% in the same period of the prior fiscal year. Non-GAAP operating margin, which excludes share-based compensation expenses, for the quarter was 2.6%, compared to negative 112.0% in the same period of the prior fiscal year.

Net Income and Net Income per ADS

Net income attributable to New Oriental for the quarter wasUS$0.7 million, compared to the loss ofUS$936.5 millionin the same period of the prior fiscal year. Basic and diluted net income per ADS attributable to New Oriental wereUS$0.00andUS$0.00, respectively.

Non-GAAP Net Income and Non-GAAP Net Income per ADS

Non-GAAP net income attributable to New Oriental for the quarter wasUS$17.8 million, compared to the loss ofUS$901.6 millionin the same period of the prior fiscal year. Non-GAAP basic and diluted net income per ADS attributable to New Oriental wereUS$0.11andUS$0.10, respectively.

Cash Flow

Net cash flow generated from operation for the second fiscal quarter of 2023 was approximatelyUS$173.7 millionand capital expenditures for the quarter wereUS$11.4 million.

Balance Sheet

As ofNovember 30, 2022, New Oriental had cash and cash equivalents ofUS$1,029.9 million. In addition, the Company hadUS$1,033.2 millionin term deposits andUS$2,145.7 millionin short-term investments.

New Oriental's deferred revenue balance, which is cash collected from registered students for courses and recognized proportionally as revenue as the instructions are delivered, at the end of the second quarter of fiscal year 2023 wasUS$1,139.1 million, an increase of 6.9% as compared toUS$1,065.8 millionat the end of the second quarter of fiscal year 2022.

Financial Results for the Six Months EndedNovember 30, 2022

For the first six months of fiscal year 2023, New Oriental reported net revenues ofUS$1,383.0 million, representing a 29.7% decrease year-over-year.

Operating income wasUS$75.5 million, compared to a loss ofUS$735.7 millionin the same period of the prior fiscal year. Non-GAAP operating income for the first six months of fiscal year 2023 wasUS$113.3 million, compared to a loss ofUS$661.4 millionin the same period of the prior fiscal year.

Operating margin for the first six months of fiscal year 2023 was 5.5%, compared to negative 37.4% for the same period of the prior fiscal year. Non-GAAP operating margin, which excludes share-based compensation expenses for the first six months of fiscal year 2023, was 8.2%, compared to negative 33.6% for the same period of the prior fiscal year.

Net income attributable to New Oriental for the first six months of fiscal year 2023 wasUS$66.7 million, compared to a loss ofUS$876.0 millionin the same period of the prior fiscal year. Basic and diluted net income per ADS attributable to New Oriental for the first six months of fiscal year 2023 amounted toUS$0.39andUS$0.38, respectively.

Non-GAAP net income attributable to New Oriental for the first six months of fiscal year 2023 wasUS$101.5 million, compared to a loss ofUS$790.4 millionin the same period of the prior fiscal year. Non-GAAP basic and diluted net income per ADS attributable to New Oriental for the first six months of fiscal year 2023 amounted toUS$0.60andUS$0.58, respectively.

Koolearn's Financial Highlights for the Six Months EndedNovember 30, 2022

New Oriental's subsidiary,Koolearn Technology Holdings Limited("Koolearn"), a leading online extracurricular education service provider and a well known private label products and livestreaming e-commerce platform inChinalisted on theHong Kong Stock Exchange, announced its financial results under International Financial Reporting Standards ("IFRS") for the first six months of fiscal year 2023. Koolearn's financial information in this section is presented in accordance with IFRS.

For the first six months endedNovember 30, 2022, Koolearn recorded revenues ofRMB 2,080.1 million(US$293.5 million), a 590.2% increase from revenues from continuing operations ofRMB301.4 millionin the same period of the prior fiscal year, and recorded a net profit ofRMB585.3 million(US$82.6 million), a 638.5% increase from net loss from continuing operations ofRMB108.7 millionin the same period of the prior fiscal year. Koolearn's gross profit wasRMB982.5 million(US$138.6 million) and gross profit margin was 47.2% for the six months endedNovember 30, 2022.

The translations of RMB amounts intoU.S.dollars in this section are presented solely for the convenience of the readers. The conversion of RMB intoU.S.dollars is based on the exchange rate set forth in the H.10 statistical release of theBoard of Governorsof theFederal Reserve Systemas ofNovember 30, 2022, which wasRMB7.0879toUS$1.00. The percentages stated in this section are calculated based on the RMB amounts.

Koolearn's Proposed Change of Company Name

OnJanuary 5, 2023, Koolearn proposed a change of company name from "Koolearn Technology Holding Limited" ("新東方在綫科技控股有限公司") to "East Buy Holding Limited" (東方甄選控股有限公司") as part of reassessment by Koolearn's board of directors to fully encompass the direction of Koolearn's current business and future outlook.

Outlook for the Third Quarter of the Fiscal Year 2023

New Oriental expects total net revenues in the third quarter of the fiscal year 2023 (December 1, 2022toFebruary 28, 2023) to be in the range ofUS$702.8 milliontoUS$719.8 million, representing year-over-year increase in the range of 14% to 17%.

The projected increase of revenue in our functional currency Renminbi is expected to be in the range of 24% to 27% for the third quarter of the fiscal year 2023.

This forecast reflects New Oriental's current and preliminary view, which is subject to change.

Comments