The year 2023 proved to be nothing short of extraordinary for Singapore's stock market. As the closing bell echoes the end of a tumultuous period, the Straits Times Index (STI) stands testament to the challenges faced, with a slight dip of 0.34%. However, amid the sea of uncertainties, there were shining stars in the form of individual stocks that defied the odds and delivered impressive returns.

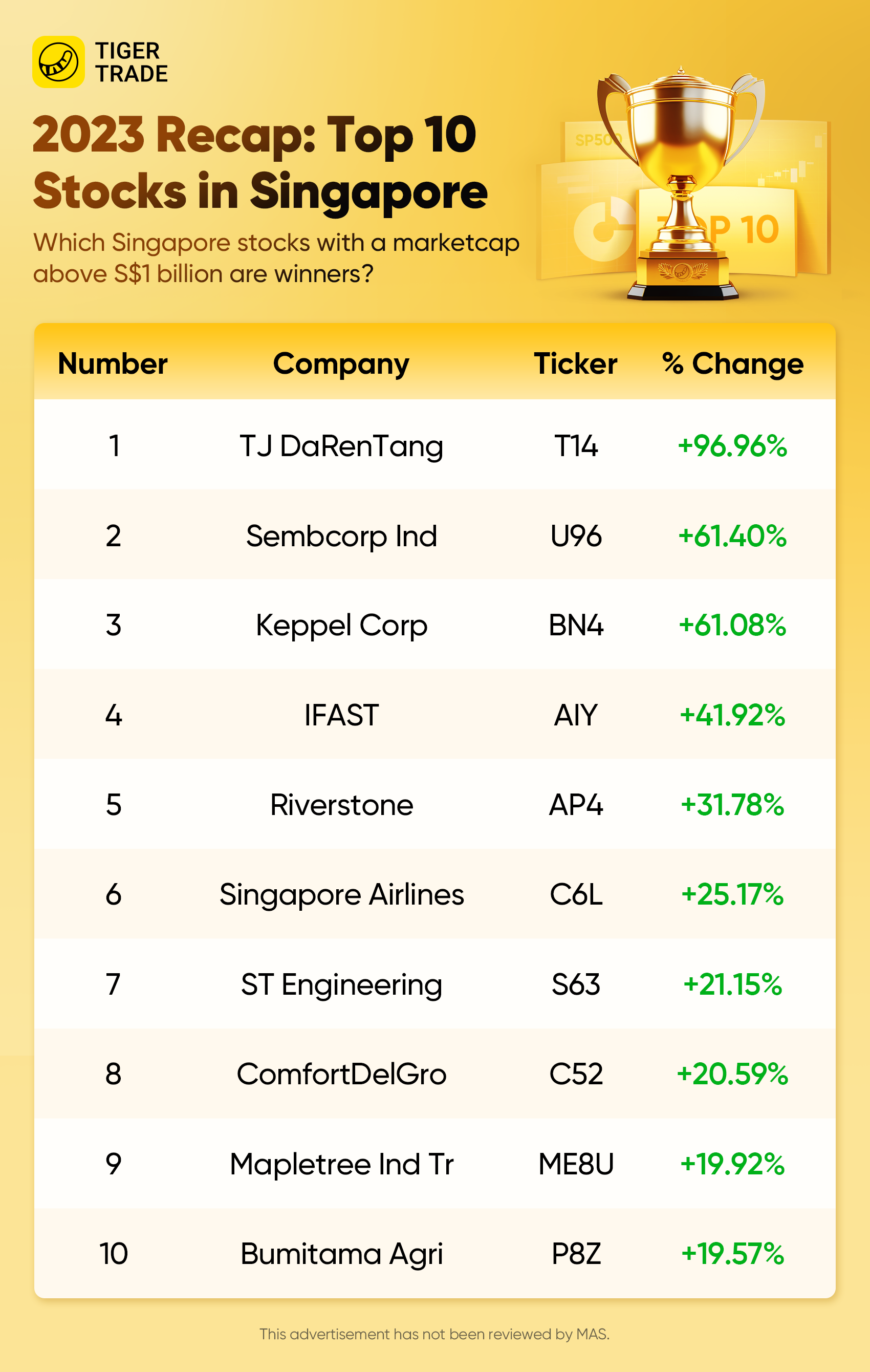

Let's take a look at the winners of the stock market in 2023.

1. TJ DaRenTang (T14)

TJ DaRenTang USD jumped 96.96% in 2023, making it one of the most impressive companies.

In the 1950s, with the China government's policy of merging state-owned pharmaceutical enterprises with the private sector, Tianjin Municipal Chinese Medicinal Materials Corpn (TMCM) merged and reorganised the various factories and stores in Tianjin. In December 1992, TMCM was converted from a state-owned enterprise to a company limited by shares whereby shares were issued to legal persons and its employees. In connection therewith, it was renamed Tianjin Traditional Chinese Medicine Group Co Ltd (TTCM). Following the corporatisation of the Company, the shares issued to the employees were traded at the Tianjin Securities Trading Centre. In conjunction with the proposed public offering, TTCM adopted its present name. Pursuant to the restructuring, it became the holding company for the Group. The Group's businesses cover a wide range of products including Chinese patent medicine, Chinese medicinal drinks, Chinese medicinal raw materials, biotechnology medicine, chemical raw material medicine and preparations, and nutritional and health products. It has over 800 medicinal products in over 20 types of formulations. The main products are Suxiao Jiuxin pill (used for treatment of heart disease), Huoxiang Zhengqi Soft capsule (used for treatment of intestines and stomach disease), Gengnian An (used for treatment of menopause symptoms), Zi Long Jin tablet (used for treatment of cancer), Xuefu Zhuyu capsule (used for treatment of diseases relating to heart and head blood vessel), Biqi capsule (used for treatment of rheumatism), Anfulong a-2b Interferon (used for increasing immunity ), Ge Lie Qi Te (used for treatment of diabetes), and Te Zi She Fu (used for diminishing inflammation). The holding company and ultimate holding company is Tianjin Pharmaceutical Hldgs, a company incorporated in Tianjin, China.

2. Sembcorp Ind (U96)

Sembcorp Industries jumped 61.4% in 2023.

Sembcorp Industries has been included in the MSCI Singapore Index with effect from Sept 1, 2023. Sembcorp H1 profit rose 56% to S$608 million on the disposal of coal business.

Sembcorp Industries (Sembcorp) is a leading energy and urban solutions provider, driven by its purpose to do good and play its part in building a sustainable future. Headquartered in Singapore, Sembcorp leverages its sector expertise and global track record to deliver innovative solutions that support the energy transition and sustainable development. By focusing on growing its Renewables and Integrated Urban Solutions businesses, it aims to transform its portfolio towards a greener future and be a leading provider of sustainable solutions. Sembcorp has an energy portfolio which includes renewables comprising solar, wind and energy storage globally. The company also has a proven track record of transforming raw land into sustainable urban development across Asia.

3. Keppel Corp (BN4)

As a well-known star enterprise in Singapore, Keppel Corp also performed well in 2023, rising 61.08%.

Keppel Corporation said in a voluntary business update that the net profit for its fiscal third quarter ended September was “stronger” on a year-on-year basis, with all three segments – infrastructure, real estate and connectivity – booking improvements. Keppel said its total distribution payout for the current year is set to come in at around S$2.70 per share, including a dividend-in-specie of Keppel Reit units worth S$0.18 per share.

Keppel Corporation is a global asset manager and operator with strong expertise in sustainability-related solutions spanning the areas of infrastructure, real estate and connectivity. Headquartered in Singapore, Keppel operates in more than 20 countries worldwide, providing critical infrastructure and services for renewables, clean energy, decarbonisation, sustainable urban renewal and digital connectivity. Through its quality investment platforms and asset portfolios, Keppel contributes to advancing sustainable development, the energy transition and the digital economy, while creating enduring value for stakeholders.

4. IFAST (AIY)

iFAST shares jumped 41.92% in 2023.

Fintech platform iFast Corporation reported a 308.4 per cent rise in net profit to S$8.5 million for the three months ended Sep 30, 2023, from S$2.1 million a year ago. The CEO said higher dividends are likely next year.

iFAST is an Internet-based investment products distribution platform, with assets under administration of S$5.13 billion as at end-September 2014. Incorporated in year 2000 in Singapore, iFAST provides a comprehensive range of services, including investment administration and transactions services, research and trainings, IT services and backroom functions to banks, financial advisory firms, financial institutions, multinational companies, as well as investors in Asia. The Group is also present in Hong Kong, Malaysia and China. iFAST has two main business divisions, namely its Business-to-Consumer (B2C) website, Fundsupermart.com, targeted at DIY investors; and its Business-to-Business (B2B) platform that caters to the specialised needs of financial advisory (FA) companies, financial institutions and banks. As at end September 2014 and across the jurisdictions the Group operates, iFAST has over 115 distribution agreements with global fund houses offering over 1,800 investment products (including over 1,600 funds) on the platform across the different regions it operates in. Over 5,000 FA representatives and over 150 FA companies and financial institutions use the iFAST B2B platform.

5. Riverstone (AP4)

Riverstone shares jumped 31.78% in 2023.

Malaysian glovemaker Riverstone posted a 55% H1 net profit decline on weakening demand for consumer electronics; Q3 profit slides 6.6% to RM 59.3 million, declares 5 sen interim dividend. CGS-CIMB recently upgraded Riverstone Holdings to ‘buy’ on nimble execution, raised TP to S$0.75.

Riverstone was established in 1991 and listed on the Mainboard of the Singapore Stock Exchange in 2006. The Group specialises in the production of Cleanroom and Healthcare Gloves, finger cots, cleanroom packaging bags and face masks. Over the years, with the full support of the valued customers and commitment of the staff, the Group has grown to become the leading global supplier for Cleanroom and Healthcare Gloves. The Group's products are qualified and widely used by major global players in the electronic and healthcare industries. It exports more than 80% of the products to key customers in Asia, the Americas and Europe. As a global supplier of Cleanroom Consumables and Healthcare Gloves, currently the Group has five manufacturing facilities, located in Malaysia, Thailand, China and established network of sales offices and strategic partners in Asia, the Americas and Europe.

6. Singapore Airlines (C6L)

As one of the most beloved stocks of Singaporeans, Singapore Airlines jumped 25.17% in 2023, giving a good report.

Singapore Airlines (SIA) posted record H1 earnings of S$1.4 billion; to redeem an additional 25% of June 2021 MCBs. SIA posted a 17.6 per cent year-on-year increase in passenger traffic in November, amid strong passenger demand heading into the year-end peak travel season.

Singapore Airlines Limited (“Singapore Airlines”) was incorporated as a public company with limited liability and a wholly-owned subsidiary of Temasek Holdings (Private) Limited on 28 January 1972. Its history began in 1947 when a twin-engined Airspeed Consul under the Malayan Airways Ltd’s insignia started scheduled services between Singapore, Kuala Lumpur, Ipoh and Penang. Malayan Airways Ltd grew steadily and by 1955, international services were added to its operations. With the formation of the Federation of Malaysia in 1963, the airline was renamed Malaysian Airways Ltd. In 1966 the governments of Malaysia and Singapore acquired joint control of the airline, which was then renamed Malaysia-Singapore Airlines Ltd (“MSA”). In 1971, MSA was restructured into 2 entities: Singapore Airlines and Malaysia Airline System. Singapore Airlines, a full member of the global Star Alliance, is one of the world's premium airlines, with the distinction of operating a young and modern fleet. The Singapore Airlines route network extends across 105 destinations in 37 countries, including those served by its subsidiaries, Singapore Airlines Cargo and SilkAir. The Singapore Airlines Group has over 20 subsidiaries, covering a range of airline-related services, from cargo to engine overhaul. Its subsidiaries also include SIA Engineering Company, Scoot, Tiger Airways, Singapore Flying College and Tradewinds Tours and Travel. Principal activities of the Group consist of air transportation, engineering services and other airline related activities.

7. ST Engineering (S63)

ST Engineering jumped 21.15% in 2023.

Technology and engineering group ST Engineering reported a 9 per cent increase in revenue to S$2.4 billion for the third quarter ended September, from S$2.2 billion a year prior; interim dividend at S$0.04 per share. ST Engineering unit recently won the contract to upgrade Singapore navy frigates.

ST Engineering is a global technology, defence and engineering group with offices across Asia, Europe, the Middle East and the U.S., serving customers in more than 100 countries. The Group uses technology and innovation to solve real-world problems and improve lives through its diverse portfolio of businesses across the aerospace, smart city, defence and public security segments. Headquartered in Singapore, ST Engineering reported revenue of $7.2b in FY2020 and ranks among the largest companies listed on the Singapore Exchange. It is a component stock of the FTSE Straits Times Index, MSCI Singapore, iEdge SG ESG Transparency Index and iEdge SG ESG Leaders Index.

8. ComfortDelGro (C52)

ComfortDelGro jumped 20.59% in 2023.

Land transport giant ComfortDelGro posted a 54.5 per cent rise in net profit to S$49.9 million for the third quarter ended Sep 30, 2023, from S$32.3 million a year earlier. The company has agreed to fully acquire taxi network operator A2B Australia for A$165.1 million.

The transport operator will increase its commissions from cabbies to 7 per cent from 5 per cent from Jan 1, 2024. This will be applicable to app and phone-booked rides.

ComfortDelGro is a public listed passenger land transport company, with a fleet of more than 38,700 vehicles world-wide. The Group has a global workforce, a global shareholder base and a global outlook. With their beginnings in the early 70s, Comfort Group and DelGro Corporation were both listed land transport companies. On 29 March 2003, ComfortDelGro Corporation was formed through the merger of the two. ComfortDelGro is listed on the Singapore Exchange. ComfortDelGro's businesses include taxi, bus, rail, car rental and leasing, automotive engineering and maintenance services, inspection, test and assessment services, learner drivers’ instruction services, insurance brokerage services and outdoor advertising. SBS Transit Ltd and VICOM Ltd are subsidiaries listed on the Singapore Exchange. SBS Transit is Singapore’s largest public bus transport operator with a fleet of more than 2,400 buses, as well as urban rail operation, serving more than 2 million passengers daily. VICOM provides inspection, test and assessment services. The Group is also Singapore’s largest taxi operator with more than 17,000 taxis. The Group’s overseas operations currently extend from the United Kingdom and Ireland to Vietnam and Malaysia, as well as across 12 cities in China, including Beijing, Shanghai, Guangzhou, Shenyang and Chengdu.

9. Mapletree Ind Tr (ME8U)

Mapletree Industrial Trust jumped 19.92% in 2023.

Mapletree Industrial Trust, or MIT, is an industrial REIT with a portfolio of 142 properties across six different sub-types. These properties are in Singapore (85), the US (56) and Japan (1) and the portfolio has assets of management (AUM) of S$9.2 billion as of 30 September 2023.

For the first half of fiscal 2024 (1H 2024) ending 30 September 2023, the industrial REIT posted a mixed set of earnings. Gross revenue inched up 0.4% year on year to S$344.7 million but net property income (NPI) dipped by 0.3% year on year to S$259.4 million. Distribution per unit (DPU) slid 2% year on year to S$0.0671.

Mapletree Industrial Trust ("MIT") was constituted as a private trust on 29 January 2008. On 1 July 2008, MIT acquired its portfolio of 64 properties from JTC Corporation, comprising 27 property clusters, being the IPO Portfolio excluding the Mapletree Singapore Industrial Trust ("MSIT") Portfolio. Mapletree Industrial Trust is a Singapore real estate investment trust (âREITâ) established with the principal investment strategy of investing, directly or indirectly, in a diversified portfolio of income-producing real estate used primarily for industrial purposes, whether wholly or partially, in Singapore, as well as real estate-related assets. Mapletree Industrial Trust Management Ltd is the manager of Mapletree Industrial Trust.

10. Bumitama Agri (P8Z)

Bumitama Agri shares jumped 19.57% in 2023.

Bumitama Agri reported a net profit of 874 billion rupiah (S$74.7 million) for the third quarter ended Sep 30, up 33 per cent from 655 billion rupiah the year prior. This marked the Indonesian palm oil producer’s first period of year-on-year improvement on a rising trend in its quarterly performance. RHB Research upgraded its call on the stock to “buy” from “neutral” in November, as it believes the valuations are now “cheap”.

Incorporated in Singapore on 2 December 2005, Bumitama Agri Ltd is an Indonesia-based producer of crude palm oil and palm kernel with oil palm plantations and mills located in three provinces of Indonesia, namely Central Kalimantan, West Kalimantan and Riau. Its primary business activities are cultivating and harvesting oil palm trees, processing fresh palm fruit bunches from its oil palm plantations, plasma plantations and third parties into crude palm oil and palm kernel, and selling crude palm oil and palm kernel.

Comments