A risk-off mood continued to grip global markets on Tuesday as the conflict in Ukraine intensified amid mounting penalties against Russia. U.S. equity futures fell along with stocks in Europe, while bonds surged and oil pushed sharply higher.

Market Snapshot

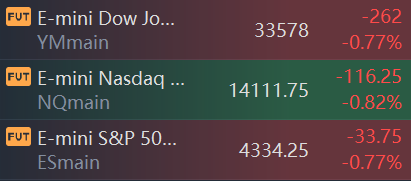

At 8:00 a.m. ET, Dow e-minis were down 262 points, or 0.77%, S&P 500 e-minis were down 33.75 points, or 0.77%, and Nasdaq 100 e-minis were down 116.25 points, or 0.82%.

Oil prices surged Tuesday, with U.S. crude hitting its highest level since July 2014.West Texas Intermediate crude futures, the U.S. oil benchmark, jumped 5.7% to trade at $101.17 per barrel.International benchmark Brent crude advanced 6.3% to trade at $104.16 per barrel. The contract rose to $105.79 last week, the highest since 2014.

Pre-Market Movers

Lucid Group (LCID) — Shares of Lucid Group tanked more than 12% premarket after a disappointing quarterly report. The electric vehicle maker reported a wider-than-expected loss of 64 cents per share compared with the Refinitiv consensus estimate loss of 25 cents per share. Revenue also missed expectations.

Zoom Video (ZM) — Zoom shares lost 2.5% in premarket trading after the video conferencing platform issued full-year guidance below what analysts had predicted. The company beat earnings and revenue expectations.

Novavax (NVAX) — Shares of Novavax fell 6.6% premarket after the company missed on the top and bottom line of its quarterly report. Novavax posted a loss of $11.18 per share on revenue of $222.2 million.

Sea(SE) — Sea shares fell more than 7% after reporting quarterly results.The stock had once previously risen more than 10%.Sea reported quarterly losses of $(0.88) per share which missed the analyst consensus estimate of $(0.59) by 49.15 percent. This is a 1.15 percent decrease over losses of $(0.87) per share from the same period last year. The company reported quarterly sales of $3.22 billion which beat the analyst consensus estimate of $2.91 billion by 10.72 percent. This is a 105.62 percent increase over sales of $1.57 billion the same period last year.

Target(TGT) — Shares of the big-box retailer rallied 11% in premarket trading after Target said it expects growth to continue even after its pandemic-era gains. Target posted adjusted fourth-quarter earnings of $3.19 per share on revenue of $31 billion. Analysts surveyed by Refinitiv expected a profit of $2.86 per share on revenue of $31.39 billion.

Kohl’s(KSS) — Shares of Kohl’s rose more than 5% in the premarket after the company gave upbeat guidance for fiscal year 2022. The retailer beat earnings expectations in the fourth quarter but missed the Refinitv consensus sales estimate.

AutoZone(AZO) — AutoZone shares added 3.6% in early morning trading after a better-than-expected earnings report. The company reported second-quarter earnings of $22.30 per share on revenue of $3.37 billion. Analysts surveyed by Refinitiv had expected a profit of $17.79 per share on revenue of $3.17 billion.

Kroger(KR) — Shares of Kroger rose more than 2% in the premarket after Telsey upgraded the grocery store chain ahead of its earnings report. “We believe we have higher visibility and confidence into Kroger’s multi-year omni-channel growth runway,” Telsey’s Joseph Feldman said.

Foot Locker(FL) — Foot Locker shares retreated 3% in premarket trading after Goldman Sachs became the latest Wall Street firm to downgrade the athletic retailer after a disappointing update Friday.Barclays and B. Riley on Tuesday both also downgraded Foot Locker.

Workday(WDAY) — Shares of Workday rose more than 7% in premarket trading after the software company beat expectations for its quarterly results. The company reported a profit of 78 cents per share, topping the Refinitiv estimate of 71 cents per share. Revenue also surpassed projections.

HP Inc.(HPQ) — Shares of HP dipped 2% in premarket trading even after an earnings beat. The company posted adjusted earnings of $1.10 per share versus the Refinitiv estimate of $1.02 per share. Sales also topped expectations.

Market News

Sea reported quarterly losses of $(0.88) per share which missed the analyst consensus estimate of $(0.59) by 49.15 percent. This is a 1.15 percent decrease over losses of $(0.87) per share from the same period last year. The company reported quarterly sales of $3.22 billion which beat the analyst consensus estimate of $2.91 billion by 10.72 percent. This is a 105.62 percent increase over sales of $1.57 billion the same period last year.

NIO delivered 6,131 vehicles in February 2022, increasing by 9.9% year-over-year;NIO delivered 15,783 vehicles in 2022 in total, increasing by 23.3% year-over-year;Cumulative deliveries of the ES8, ES6 and EC6 as of February 28, 2022 reached 182,853.

XPeng delivered 6,225 Smart EVs in February 2022, representing a 180% increase year-over-year. The February deliveries consisted of 3,537 P7 smart sports sedans, representing a 151% year-over-year increase. 2,059 P5 smart family sedans were delivered in February, bringing cumulative deliveries of the P5 to 13,953 since its launch in September 2021. Also 629 G3 & G3i smart compact SUVs were delivered in February.

Li Auto Inc. today announced that the Company delivered 8,414 Li ONEs in February 2022, up 265.8% year over year. The cumulative deliveries of Li ONE reached 144,770 since the vehicle’s market debut.

SWIFT said on Tuesday it was waiting to see which banks authorities want disconnected from its global financial messaging system as sanctions in response to Russia are rolled out.

Payment and credit card giants Visa and Mastercard have blocked financial institutions from their networks in response to sanctions targeting Russia.

Comments