U.S. stocks closed lower on Monday, adding to last week's sharp losses on nagging concerns about the Federal Reserve's determination to aggressively hike interest rates to fight inflation even as the economy slows.

The Dow Jones Industrial Average fell 184.41 points, or 0.57%, to 32,098.99, the S&P 500 lost 27.05 points, or 0.67%, to 4,030.61 and the Nasdaq Composite dropped 124.04 points, or 1.02%, to 12,017.67.

The CBOE's volatility index (VIX), Wall Street's fear gauge, hit a seven-week high of 27.67 points.

Options Broad View

A total volume of 32,959,441 contracts are traded on Monday, down 24% from the previous day. Call options account for 52% of total options trades.

There are 7.69 million SPDR S&P500 ETF Trust options traded on Monday. Put options account for 62% in overall option trades. Particularly high volume was seen for the $400 strike put option expiring August 29, with 335,318 contracts trading on Monday.

Top 10 Option Volumes

Top 10:SPY, QQQ, TSLA, AAPL, BBBY, AMZN, IWM, NVDA, VIX, HYG

Options related to equity index ETFs are still top choices for investors, with 2.78 million Invest QQQ Trust ETF options contracts trading on Monday. Total trading volume for SPY and QQQ decrease 23% and 19%, respectively, from the previous day.

Tesla options trading continued to be active after the stock was split into 3-for-1.

There are 1.27 million Tesla option contracts traded on Monday, down from the previous trading day. Call options account for 52% of overall option trades. Particularly high volume was seen for the $290 strike call option expiring September 2, with 59,414 contracts trading on Monday.

Regarding Apple, a total volume of 1.22 million option contracts is traded on Monday, which was also down from the previous trading day. Call options account for 50% of overall option trades. Particularly high volume was seen for the $160 strike put option expiring September 2, with 104,489 contracts trading on Monday.

The VIX added 0.65 to 26.21 on Monday, hit a seven-week high of 27.67 points in the session. Options trading tied to VIX also saw an increase on Monday.

There are 492.7K VIX option contracts traded on Monday. Call options account for 52% of overall option trades.

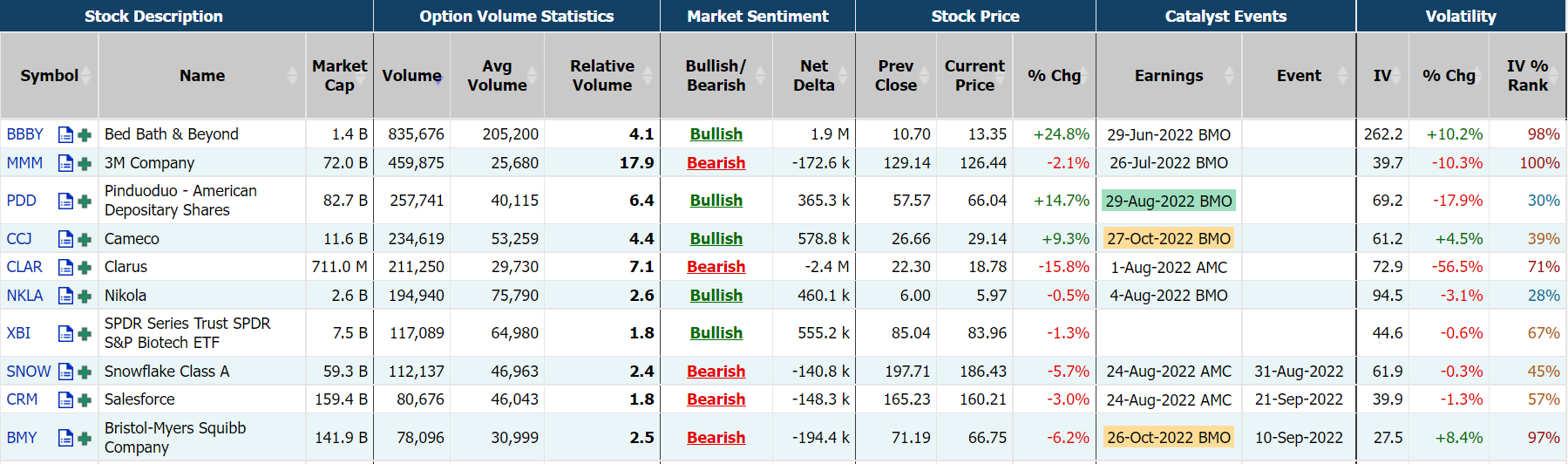

Unusual Options Activity

Shares of Bed Bath & Beyond Inc. soared 24.77% on Monday, as meme-stock investors expressed optimism a day ahead of the home goods retailer's strategic update. The recent gains also followed a report in The Wall Street Journal that said the retailer, which has struggled with liquidity issues and slumping sales and margins, was nearing final terms for a loan of close to $400 million.

There are 839.1K Bed Bath & Beyond option contracts traded on Monday, an increase of 31% over the previous trading day. Call options account for 69% of overall option trades. Particularly high volume was seen for the $45 strike call option expiring September 2, with 49,766 contracts trading on Monday.

3M hit a 2-1/2-year low on Monday even as it appealed a recent bankruptcy court ruling. The price slipped as much as 3% to $125.27 a share before partly rebounding during Monday’s session. In addition, 3M on Monday issued an exchange ratio for its split-off exchange offer to shareholders to exchange their shares of 3M for shares of Garden SpinCo Corp.

3M's options trading was extremely active on Monday. There are 458.5K 3M option contracts traded on Monday. Call options account for 49% of overall option trades. Particularly high volume was seen for the $200 strike call option expiring September 16, with 104,632 contracts trading on Monday.

Pinduoduo Inc reported quarterly revenue above Street's estimates on Monday, as a strict lockdown in several COVID-hit Chinese cities kept up demand for online shopping. U.S.-listed shares of the Shanghai-based company jumped 14.7% on Monday.

Pinduoduo's options trading was also active on Monday. There are 251.7K Pinduoduo option contracts traded on Monday. Call options account for 61% of overall option trades. Particularly high volume was seen for the $70 strike call option expiring September 2, with 14,780 contracts trading on Monday.

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive there is more bullish pressure. If the net is negative there is more bearish pressure.

Top 10 bullish stocks: QQQ, BBBY, CCL, F, TAL, IWM, AVCT, WEAT, ARKK, SOXL

Invesco QQQ Trust had the highest bullish wagers, with traders getting long 2M deltas on balance. Bed Bath & Beyond Inc. and Carnival Corp. also saw bullish option activities.

Total options volume related to Ford also saw an increase on Monday. There are 229.5K Ford option contracts traded on Monday. Call options account for 68% of overall option trades.

Ford Motor Company is developing a new electric truck that is expected to go on sale in 2025, per a report from Automotive News. The details on the new EV truck fromthe Detroit automaker are thin, but Automotive News noted that it could be a new-style full-size pickup under the F-Series umbrella aimed more at retail buyers than the electric Lightning F-150.

Top 10 bearish stocks: CLAR, SQQQ, UVXY, EWZ, TSLA, PBR, GOOG, NTNX, AMAZ, MNMD

Clarus Corp. saw options trading volume of 215.5K contracts on Monday, call options account for 60%. Particularly high volume was seen for the $20 strike call option expiring September 16, with 42,444 contracts trading on Monday.

Clarus stock plummet 15.8% on Monday. The sporting apparel and equipment manufacturer and distributor may have been feeling the aftereffects of last Friday's sell-off that stemmed from Federal Reserve Board Chair Jerome Powell's hawkish speechat Jackson Hole. But there was also news in its industry related to one of its primary competitors, Ammo. Reuters reported Monday that the largest investor, Steve Urvan, is seeking to take control of the Ammo board and pivot more toward e-commerce and new other new distribution and manufacturing categories that he believes could push the company past $1 billion in annual sales.

ProShares UltraPro Short QQQ's options trading was also active on Monday. There are 173.6K SQQQ option contracts traded on Monday. Call options account for 78% of overall option trades.

Comments