Recently, two new Chinese ETFs, KPRO and KBUF, were launched on the New York Stock Exchange (NYSE) by the American fund KraneShares. Following the introduction of an actively managed Chinese ETF by overseas China investment expert Matthews Asia in January 2024, global asset management institutions are once again promoting tools to expand their presence in the Chinese market.

It is worth mentioning that these two ETFs provide downside protection while focusing on the Chinese internet industry. KPRO and KBUF allocate most of their assets to the China Internet ETF—KWEB, which is a mature ETF with a deep options market. The end date is from February 8, 2024, to January 16, 2026.

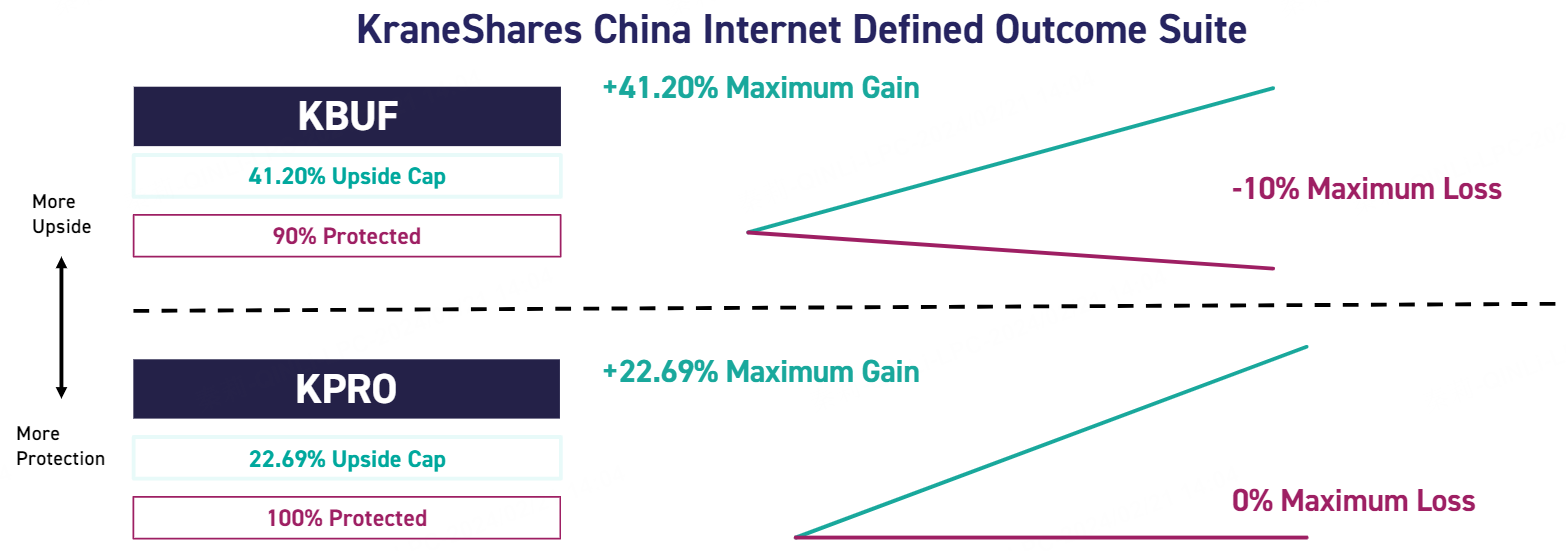

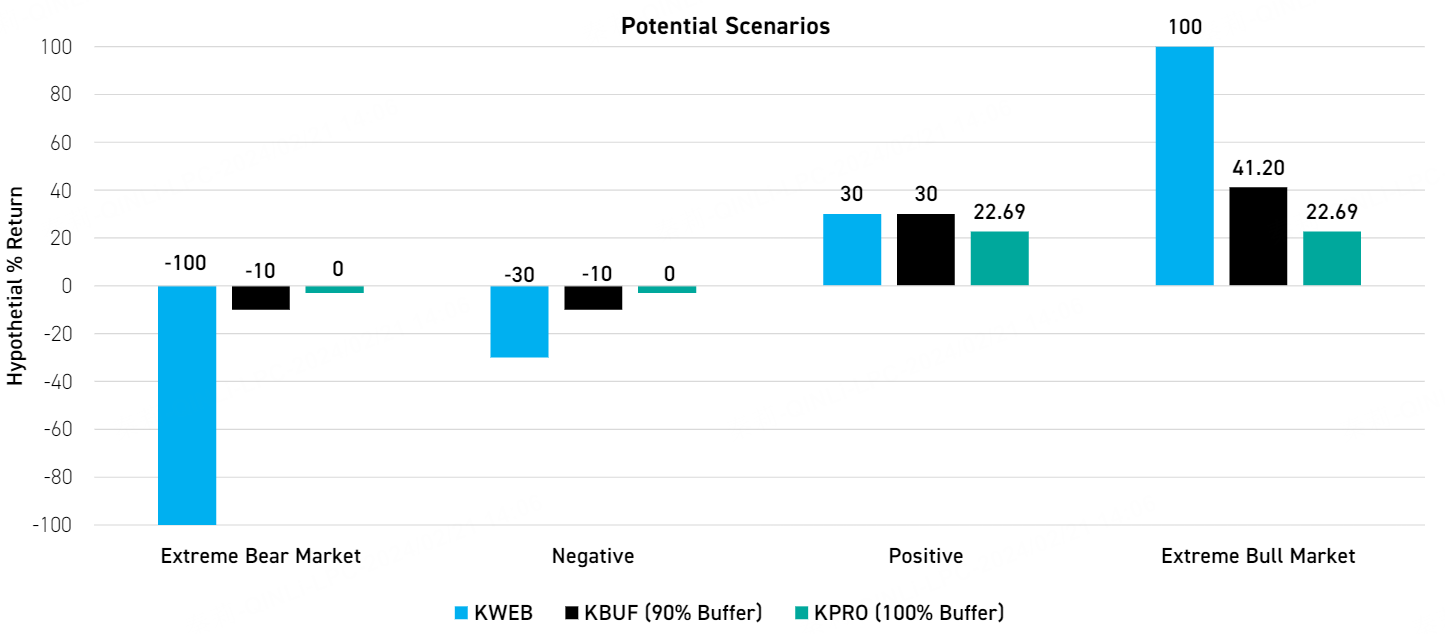

KPRO has an estimated upper limit of 22.69% for its net asset value (NAV) on the upside. This ETF provides 100% downside protection to investors.

KBUF has an estimated upper limit of 41.20% for its net asset value (NAV) on the upside. This ETF provides 90% downside protection to investors. In other words, when the underlying ETF KWEB experiences a loss of more than 10% within the specified period, KBUF's loss is limited to 10%.

Scenario analysis: Extreme bear market, negative, positive, and extreme bull market

According to its official website, KraneShares is an asset management company headquartered in New York, focusing on providing innovative investment solutions in three key areas for global investors: China, climate change, and low correlation assets.

Jonathan Shelon, Chief Operating Officer of KraneShares, said, "We see the valuation gap between the United States and China reaching historic highs and believe now is the time to invest. However, volatility still exists as we progress through 2024. These ETFs are an excellent choice for investors seeking Chinese investment with downside protection."

James Maund, Capital Markets Director at KraneShares, explained that these defined outcome strategies are possible because of the good liquidity and market depth of options linked to KWEB.

As of now, KWEB under KraneShares is the largest Chinese ETF listed in the United States, with the latest scale estimated at $5.26 billion. Among the top four Chinese ETFs listed in the United States, KWEB, MCHI, FXI, and ASHR, KWEB tracks the China Internet Index, MCHI tracks the MSCI China Index, FXI tracks the FTSE China 50 Index, and ASHR tracks the CSI 300 Index. Since 2024, KWEB has attracted a net inflow of $262 million.

(Recently, there have been continuous favorable domestic policies in China. We have mentioned some large-scale Chinese concept ETFs listed in the United States in our previous article "What signal does China's announcement of reserve requirement ratio cut release?")

A professional options investor in China introduced that relevant ETFs (KBUF, KBRO) may use collar options strategies. It is understood that collar options lock in most of the profit and loss space on the upside and downside by combining protective put options and selling call options.

It is understood that in January 2024, overseas China expert Matthews Asia launched the actively managed Chinese ETF MCHS. It aims to dig alpha from relatively unknown small and entrepreneurial companies, invest in continuously growing innovative and vibrant economic sectors driven by domestic consumption, and tilt towards high value-added growth industries, which benefit from innovation and superior capital efficiency. David Dali, Head of Matthews Asia's portfolio strategy, told ETF.com in an interview that China is expected to be the best-performing major market globally in 2024. He candidly said that the current sentiment of global investors is still relatively low, partly due to concerns about the real estate industry. Looking ahead, he believes that a series of "catalysts" are expected to reverse the situation, including stable stock market policies, stimulating economic policies, and more real estate-related stimulus policies.

JPMorgan: PBoC's unexpected interest rate cut helps boost confidence

On February 20, Zhao Yaoting, Global Market Strategist for JPMorgan in the Asia-Pacific region (excluding Japan), commented on the People's Bank of China's unexpected interest rate cut, saying that the People's Bank of China announced a 25 basis point cut in the 5-year loan market quoted rate (LPR) to 3.95%, while the 1-year LPR remained unchanged. This is the first time since last summer that the central bank has cut the LPR, and the cut exceeded expectations by 10-15 basis points. Although the 1-year LPR remained unchanged, the 5-year LPR cut was at a historic high. This indicates that the central bank is selectively using monetary tools and has not fully turned to a "broad-based loose policy" to stimulate the economy.

He believes that the interest rate cut exceeding expectations has sent a signal to the market, indicating that policy makers are seriously considering providing more support for the real estate industry. After a round of cuts last year, the current 5-year LPR is at a historical low. Coupled with recent measures, including providing more financing for developers and providing state-owned bank loans for unfinished projects, it is expected to lay a more solid foundation for the real estate market.

Overall, this interest rate cut, combined with the overall measures taken by policymakers to boost investor confidence and market sentiment, can complement each other, he said, adding that continuous stimulus measures are expected to continue the recent market rally. Looking ahead, he expects the relaxation of monetary policy to continue to support the real estate market, but he expects the central bank may not implement a broad-based loose policy.

Comments