(Reuters) - The U.S. securities regulator on Wednesday approved the first U.S.-listed exchange traded funds (ETFs) to track bitcoin, its Chair Gary Gensler said, in a watershed for the world's largest cryptocurrency and the broader crypto industry.

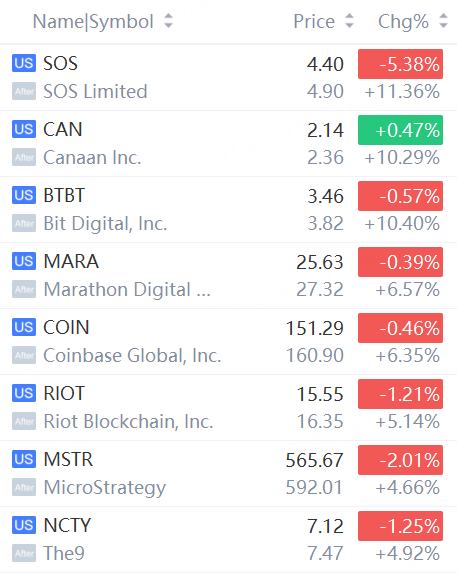

Crypto shares rallied in extended trading. SOS Limited rose 11%; Canaan, Bit Digital rose more than 10%.

The U.S. Securities and Exchange Commission approved 11 applications, including from BlackRock, Ark Investments, 21Shares, Fidelity, Invesco and VanEck, among others, according to a notice on its website. Some products are expected to begin trading as early as Thursday.

The products - a decade in the making - are a game-changer for bitcoin, offering institutional and retail investors exposure to the world's largest cryptocurrency without directly holding it, and a major boost for a crypto industry beset by a string of scandals.

Standard Chartered analysts this week said the ETFs could draw $50 billion to $100 billion this year alone, potentially driving the price of bitcoin as high as $100,000. Other analysts have said inflows will be closer to $55 billion over five years.

"It's a huge positive for the institutionalization of bitcoin as an asset class," said Andrew Bond, managing director and senior fintech analyst at Rosenblatt Securities. "The ETF approval will further legitimize bitcoin."

Bitcoin was last up 2.13% at $46,924. Some analysts had noted that the market may have already priced in the news of approval - bitcoin had soared more than 70% in recent months on growing anticipation of an ETF, and hit its highest level since March 2022 earlier in the week.

A green light marks a U-turn for the SEC, which for a decade rejected bitcoin ETFs due to worries they could be easily manipulated. SEC chair Gensler is also a fierce crypto skeptic.

Hopes the SEC would finally approve bitcoin ETFs surged last year after a federal appeals court ruled that the agency was wrong to reject an application from Grayscale Investments to convert its existing Grayscale Bitcoin Trust (GBTC) into an ETF. That ruling forced the agency to re-examine its position.

In a statement, Gensler said that in light of the court ruling, approving the products was "the most sustainable path forward," but added the agency did not endorse bitcoin, which is risky and volatile.

The crypto industry celebrated the news.

"Like many of Grayscale’s future-forward investors, we believed that bitcoin could change the world, and we were and remain excited at the prospect of democratizing access to this asset through a U.S. regulated investment vehicle,” said Grayscale CEO Michael Sonnenshein.

Douglas Yones, head of exchange traded products at the New York Stock Exchange, where some products will be listed, said the approval was also an important "milestone" for the ETF industry.

The approvals come a day after an unauthorized person published a fake post on the SEC’s account on social media platform X, saying the agency had approved the new products for trading. The agency quickly disavowed and deleted the post.

On Wednesday it said it is coordinating with law enforcement including the Federal Bureau of Investigation and the SEC's own internal watchdog to investigate the incident.

Further confusion ensued on Wednesday afternoon when the SEC posted a notice on its website appearing to show that the ETFs had been approved but then removed it, only to repost it again.

Comments