Market Overview

Wall Street's three main stock indexes rallied nearly 2% on Thursday on hopes that the U.S. Federal Reserve has reached the end of its interest rate hiking campaign.

The Dow Jones Industrial Average rose 1.7%, the S&P 500 gained 1.89%, and the Nasdaq Composite added 1.78%.

Regarding the options market, a total volume of 44,562,488 contracts was traded, up 13.6% from the previous trading day.

Top 10 Option Volumes

Top 10: SPDR S&P 500 ETF Trust, Invesco QQQ Trust-ETF, Tesla Motors, iShares Russell 2000 ETF, Apple, NVIDIA Corp, iShares 20+ Year Treasury Bond ETF, Palantir Technologies Inc., Cboe Volatility Index, $iShares iBoxx High Yield Corporate Bond ETF

Tesla Motors rose 6.25% on Thursday, Musk commented on the idea that Tesla could become a $4 trillion company – agreeing but adding that it would need to “knock the ball out of the park several times”.

There were 2.48 million Tesla Motors option contracts traded on Thursday. Call options account for 52.29% of overall option trades. Particularly high volume was seen for the $220 strike call option expiring November 3 $TSLA 20231103 220.0 CALL$, with 206,533 contracts trading. Meanwhile, the option mentioned above surged 794.74% on Thursday.

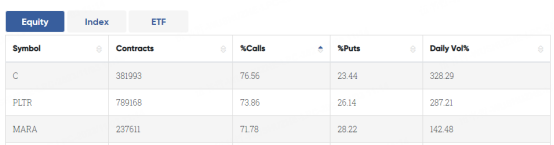

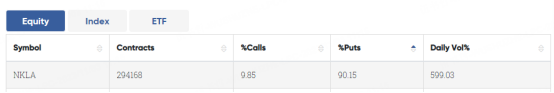

Most Active Trading Equities Options

Special %Calls >70%: Citigroup, Palantir Technologies Inc., Marathon Digital Holdings Inc

Special %Puts >70%: Nikola Corporation;

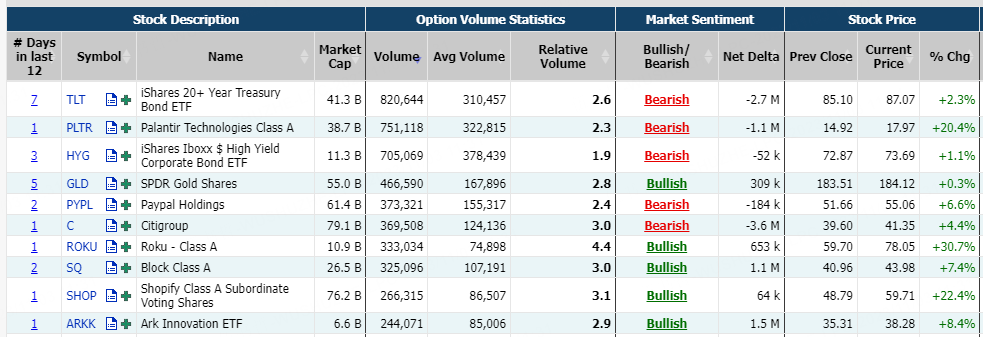

Unusual Options Activity

Palantir Technologies Inc. surged over 20% on Thursday after it reported the fourth consecutive quarter of profitability and highest earnings since its founding 20 years ago, citing strong demand for new AI offerings.

There were 788.2K Palantir Technologies Inc. option contracts traded on Thursday, jumping over 140% from the previous day. Call options account for 73.86% of overall option trades. Particularly high volume was seen for the $18.5 strike call option expiring November 3 $PLTR 20231103 18.5 CALL$, with 61,453 contracts trading. Meanwhile, the $17 strike call option expiring November 3 $PLTR 20231103 17.0 CALL$ surged 395.24% on Thursday.

Shopify jumped 22.36% on Thursday after returning to a profit in Q3, helped by strict cost controls and the use of AI across its products to attract more merchants.

There were 280.5K Shopify option contracts traded on Thursday, more than doubling from the previous day. Call options account for 67% of overall option trades. Particularly high volume was seen for the $60 strike call option expiring November 3 $SHOP 20231103 60.0 CALL$, with 27,714 contracts trading. Meanwhile, the $57 strike call option expiring November 3 $SHOP 20231103 57.0 CALL$ surged 1091.67% on Thursday.

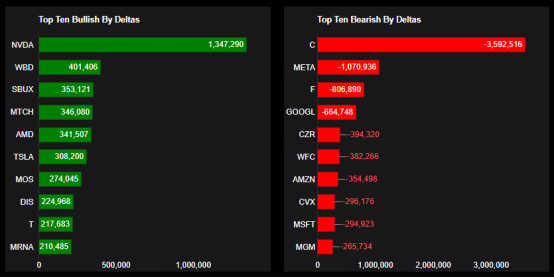

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: NVIDIA Corp, Warner Bros. Discovery, Starbucks, Match, Advanced Micro Devices, Tesla Motors, Mosaic, Walt Disney, AT&T Inc, Moderna, Inc.

Top 10 bearish stocks: Citigroup, Meta Platforms, Inc., Ford, Alphabet, Caesars Entertainment, Wells Fargo, Amazon.com, Chevron, Microsoft, MGM Resorts International

Based on option delta volume, traders bought a net equivalent of 1,347,290 shares of NVIDIA Corp stock. The largest bearish delta came from selling calls. The largest delta volume came from the 19-Jan-24 380 Call, with traders getting long 2,702,827 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments