Market Overview

U.S. stocks rose on Thursday (Mar. 30) as technology-related shares extended their recent strong run, while regional U.S. bank shares fell as the Biden administration proposed stronger measures to help reduce risk.

Regarding the options market, a total volume of 36,120,280 contracts was traded on Thursday, up 3% from the previous trading day. Alibaba and JD.com attracted traders' attention amid spinoff potential. Intel continues to see unusual activity.

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, IWM, AAPL, AMZN, BABA, NVDA, VIX, INTC

Options related to equity index ETFs are popular with investors, with 8.35 million SPDR S&P500 ETF Trust (SPY) and 3.37 million Invest QQQ Trust ETF (QQQ) options contracts trading on Thursday.

Total trading volume for SPY increased by 6%, from the previous day. 57% of SPY trades bet on bearish options.

U.S.-listed shares of Alibaba Group Holding climbed 3.5% on a report that its logistics arm had started preparations with banks for its Hong Kong initial public offering.

There are 667.7K Alibaba option contracts traded on Thursday. Call options account for 75% of overall option trades. Particularly high volume was seen for the $105 strike call option expiring March 31, with 41,107 contracts trading.

Most Active Options

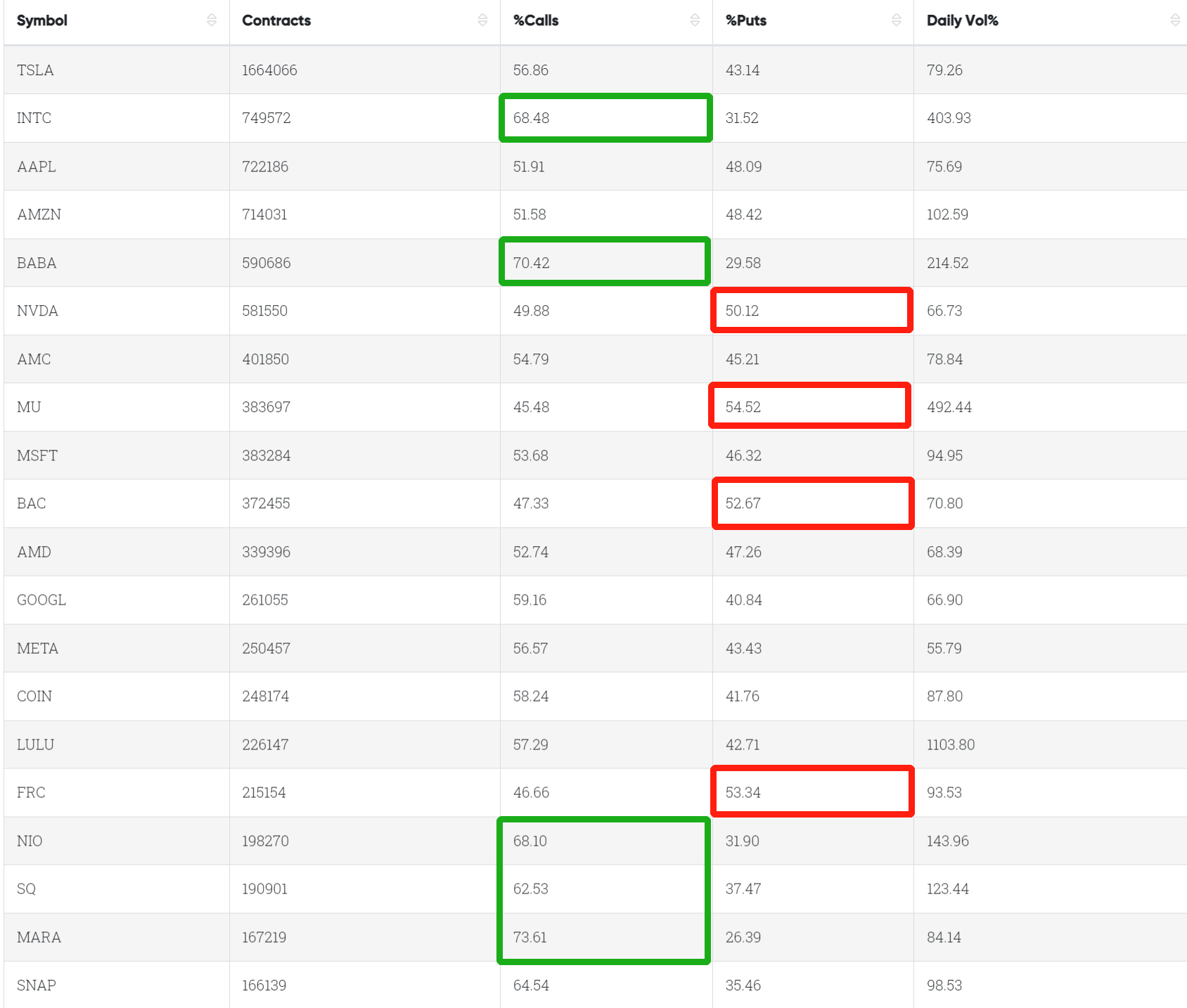

1. Most Active Trading Equities Options:

Special %Calls >60%: Intel, Alibaba, NIO Inc., Block, Marathon Digital Holdings Inc

Special %Puts >50%: NVIDIA Corp, Micron Technology, Bank of America, First Republic Bank

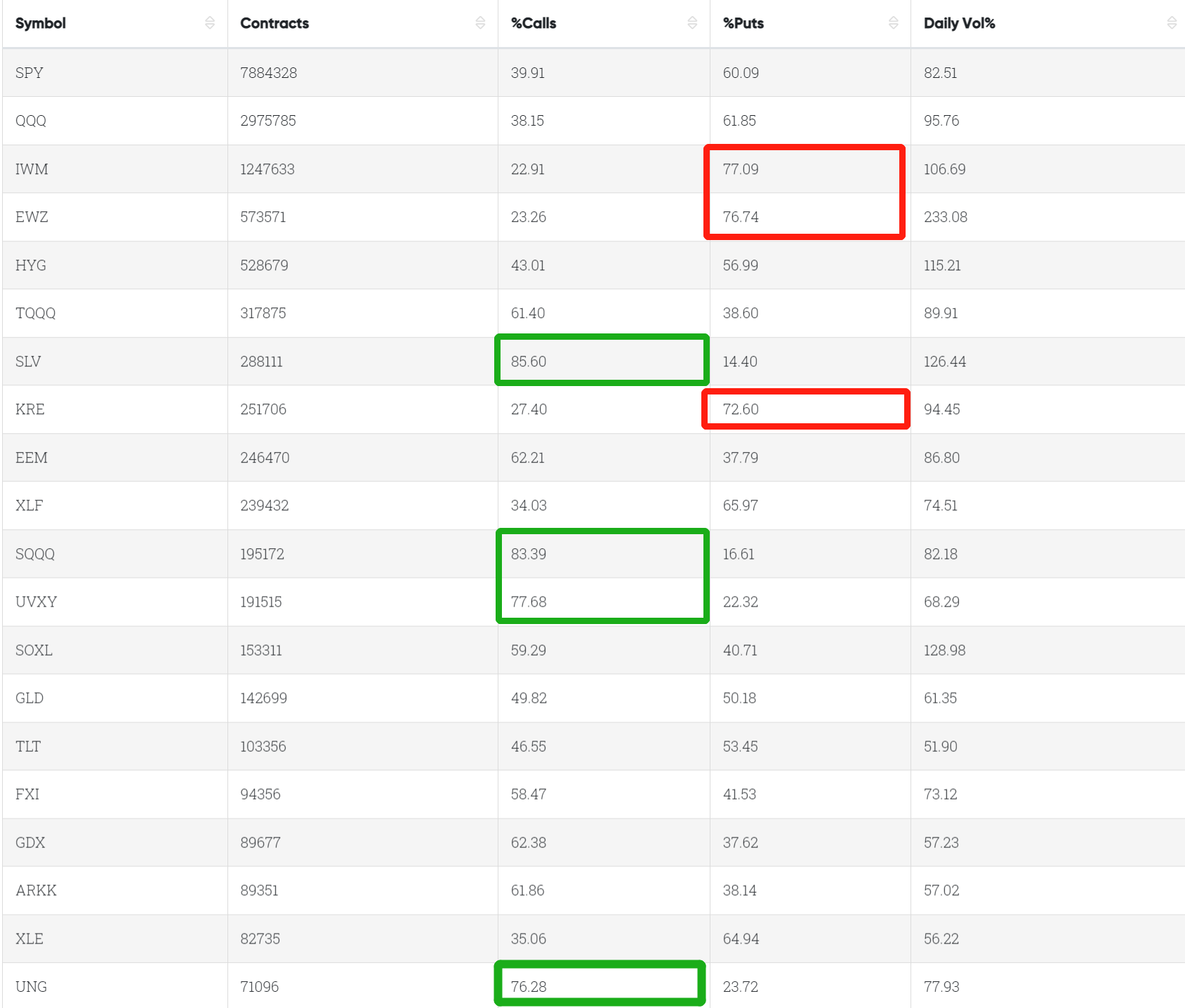

2. Most Active Trading ETFs Options

Special %Calls >70%: iShares Silver Trust, Nasdaq100 Bear 3X ETF, VIX Short-Term Futures 1.5X ETF, United States Natural Gas Fund LP

Special %Puts >70%: iShares Russell 2000 ETF, iShares MSCI Brazil ETF, SPDR S&P Regional Banking ETF

3. Top 10 Most Active Trading Indexes options

Special %Calls >50%: Cboe Volatility Index, NASDAQ 100, DJIA 1/100th, XND

Special %Puts >50%: S&P 500, RUT, XSP, Nanos Standard & Poor's 500, MXEF, NQX

Unusual Options Activity

The Philadelphia semiconductor index hit its highest level in nearly a year on Thursday, as optimism grows that a sales downturn in the industry has reached its nadir, in part due to a surge in artificial intelligence (AI) technology. Chip giant Intel gained 1.8%. The stock closed Wednesday with a gain of 7.6% after Intel announced new data-center products and a timeline for their release. Intel has risen more than 20% this year.

There are 490.4K Intel option contracts traded on Thursday. Call options account for 62% of overall option trades. Particularly high volume was seen for the $50 strike call option expiring January 19, 2024, with 27,852 contracts trading. The next is the $32 strike call option expiring March 31, with 24,283 contracts trading.

JD.com shares jumped 7.8% on Thursday as the Chinese e-commerce giant said that it intends to spin off its JD Property and JD Industrials businesses through separate listings on the Hong Kong Stock Exchange.

There are 178.5K JD.com option contracts traded on Thursday. Call options account for 79% of overall option trades. Particularly high volume was seen for the $45 strike call option expiring March 31, with 15,886 contracts trading. The next is the $50 strike call option expiring April 6, with 12,476 contracts trading

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: SPY, EEM, SQQQ, AAPL, NVDA, PBR, MULN, AI, VHC, XPEV

Top 10 bearish stocks: QQQ, TSLA, EWZ, ATVI, MSFT, BAC, AMC, SCHW, BBBY, OSH

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments