Taiwanese chipmaker TSMCposted an 80% surge in third-quarter net profit on Thursday, Reuters calculations showed, buoyed by strong sales of its advanced chips despite a slowdown in the global chip industry because of economic headwinds.

Taiwan Semiconductor Manufacturing Co Ltd (TSMC), the world's largest contract chipmaker and a major Apple Incsupplier, saw net profit for the July-September period rise to T$280.9 billion ($8.81 billion) from T$156.3 billion a year earlier.

That compared with the T$265.64 billion average of 21 analyst estimates compiled by Refinitiv.

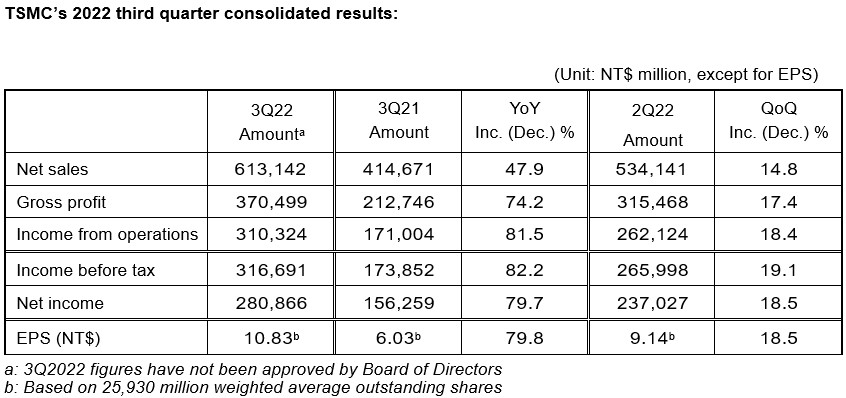

TSMC today announced consolidated revenue of NT$613.14 billion, net income of NT$280.87 billion, and diluted earnings per share of NT$10.83 (US$1.79 per ADR unit) for the third quarter ended September 30, 2022.

Year-over-year, third quarter revenue increased 47.9% while net income increased 79.7% and diluted EPS increased 79.8%. Compared to second quarter 2022, third quarter results represented a 14.8% increase in revenue and a 18.5% increase in net income. All figures were prepared in accordance with TIFRS on a consolidated basis.

In US dollars, third quarter revenue was $20.23 billion, which increased 35.9% year-over-year and increased 11.4% from the previous quarter.

Gross margin for the quarter was 60.4%, operating margin was 50.6%, and net profit margin was 45.8%.

In the third quarter, shipments of 5-nanometer accounted for 28% of total wafer revenue; 7-nanometer accounted for 26%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 54% of total wafer revenue.

Comments