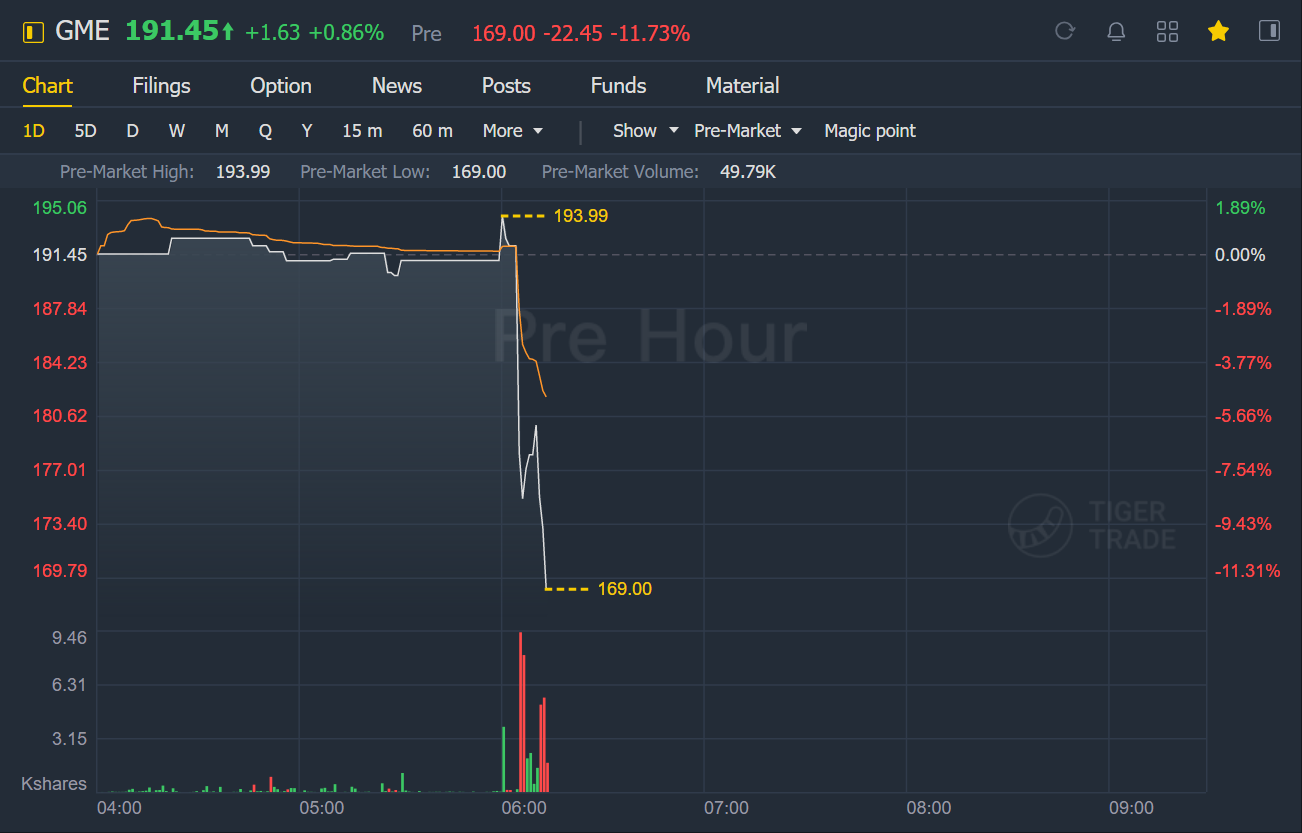

GameStop plunged 11% in premarket trading.Company Can Sell Up to 3.5 Million Shares and Intends to Use Any Proceeds to Further Accelerate Transformation and Strengthen Balance Sheet。

GameStop Corp. (NYSE: GME) (“GameStop” or the “Company”) today announced that it has filed a prospectus supplement withthe U.S. Securities and Exchange Commission (“SEC”), under which it may offer and sell up to a maximum of 3,500,000 shares of its common stock (the “Common Stock”) from time to time through an “at-the-market” equity offering program (the “ATM Offering”). The Company intends to use the net proceeds from any sales of its Common Stock under the ATM Offering to further accelerate its transformation as well as for general corporate purposes and further strengthening its balance sheet. The timing and amount of any sales will be determined by a variety of factors considered by the Company.

Common Stock will be offered through Jefferies LLC (“Jefferies”), which is serving as the sales agent. Jefferies may sell Common Stock by any lawful method deemed to be an “at-the-market offering” defined by Rule 415(a)(4) of the Securities Act of 1933, as amended, including without limitation, sales on any existing trading market. Sales may be made at market prices prevailing at the time of a sale or at prices related to prevailing market prices. As a result, sales prices may vary.

Comments