Mastercard, Visa, and PayPal are about to report earnings, so let's take a look at what investors need to know.

Mastercard

Mastercard is set to release its earnings data before the market opens on Thursday, January 27th.

Analysts expect the company to announce earnings of $2.19 per share for the quarter.

Analysts think disruption in the payments space could continue to weigh on Mastercard.

There's a lot of disruption in the fintech space right now, and there are fears that hefty margins enjoyed by credit card companies for many years may be in jeopardy.

Undoubtedly, Buy Now Pay Later (BNPL) is a hot trend in the fintech space, promising no interest on payment plans based on fixed installments. For consumers, it's a great deal versus the incredibly high interest on credit card debt, arguably one of the priciest debts to have aside from pay-day loan debt.

With digital retail kingpin Amazon previously remarking on high fees on Visa (V) cards, retailers could side with consumers as up-and-comers duke it out in the payments space in what could become a race to the bottom in terms of rates charged on consumer debts.

Analysts view the rise of BNPL firms and ongoing disruption in the payments space as a potentially long-lasting headwind that could continue to weigh on many incumbents.

While credit card issuers have created their own BNPL offerings, such moves are unlikely to stop the erosion of margins in credit cards that have helped firms like Mastercard and Visa grow earnings at an enviable pace over the years.

Visa

Visa is scheduled to be announcing its earnings results after the market closes on Thursday, January 27th.

This global payments processor is expected to post quarterly earnings of $1.69 per share in its upcoming report, which represents a year-over-year change of 19%.

Revenues are expected to be $6.76 billion, up 18.9% from the year-ago quarter.

Visa has launched multiple cryptocurrency initiatives in recent years as the company seeks to remain relevant in the changing payment industry. The company viewed cryptocurrency as a massive expansion from the fiat currency as more consumers recognized the value of the decentralized system. In addition, Visa also seeks to enhance its cross-border payment solutions as more fintech delivers more transparency and value to consumers.

The cryptocurrency market experienced extreme growth by the end of 2021, surpassing $3T of value in November, representing an increase of 375% since the start of the year. In addition, Bitcoin hit its all-time high of $68.7K on 10 November 2021, while Ether hit $4.4K on 11 November 2021.

Analysts expect the cryptocurrency market to perform well as a long-term digital asset with increased institutional adoption and federal government regulation. As a result, it made sense for Visa to perform a crucial bridging role between "banks, crypto trading, and custody platforms," as more consumers embrace the decentralized currency. Moving forward, Analysts expect to see Visa flourish alongside the cryptocurrency market's macro growth trends.

In December 2021, Visa reported that it had acquired Currencycloud, a B2B cross-border payments solution, in a £700M deal. The company expects to further enhance its existing cross-border payments through the acquisition, on top of its current strategic partnership since 2019. Currencycloud currently supports 500 banking and technology clients in 180 countries, with over $5B in monthly cross-border transactions. Globally, around $1.9T of payment revenues are reported in 2020, with the number expected to rise to $2.5T by 2025, at a CAGR of 5.64%. It shows that global businesses are growing exponentially and that legacy payment platforms like Visa needs to innovate to stay competitive.

As a result, Visa and its consumers stand to gain from the enhanced cross-border payments as global B2B businesses and eCommerce becomes more mainstream.

PayPal

Early next month, PayPal will deliver 4Q21’s financials, and after lowering expectations last quarter, Deutsche Bank’s Bryan Keane expects the digital payments giant to deliver “steady growth.”

Boosted by ~24% year-over-year TPV growth, the analyst anticipates PYPL will generate revenue growth of ~12.9% and EPS of $1.12.

That said, Keane does not foresee any unexpected fireworks. “Given the latest quarterly trends in eComm, continued supply-chain issues, delta/omicron, and eBay headwinds, we see relatively limited upside again this quarter,” said the 5-star analyst.

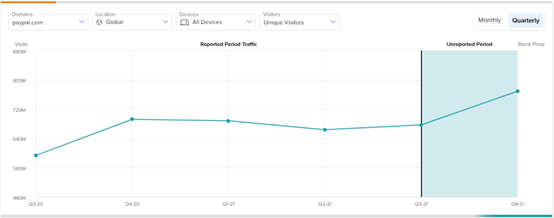

Looking at PayPal’s monthly users trends, Keane’s expected results appear in the same ballpark as the quarter’s action. Unique Visitors (UVs) rose by 14% sequentially from 676.8 million to 769 million and came in 11% above the figure reported during the same period last year.

That, however, “should mark the trough as growth rates steady and start to re-accelerate.” In fact, by 4Q22, Keane anticipates revenue growth will increase to 20% year-over-year with EPS potentially seeing out 2022 up by 25%. This is due to both easier comps and the addition of “modest incremental momentum” from the Super App.

In September, the company launched the first version of the Super App, which mixes services such as BNPL and crypto with “new products” including high-yield savings, in-app shopping tools, deals, rewards and bill pay. Over the coming months, the app’s features will be further enhanced with the introduction of additional investment capabilities, new online and in-store shopping processes, and “better PYPL branded capabilities.” The company also recently announced it is looking at potentially adding its own stablecoin.

Keane reiterated a Buy rating while sticking to a $260 price target.

Comments