(Reuters) - Best Buy Co Inc on Thursday beat quarterly profit estimates, as its promotional programs aided higher sales even as a pull back in discretionary spending hit other retailers.

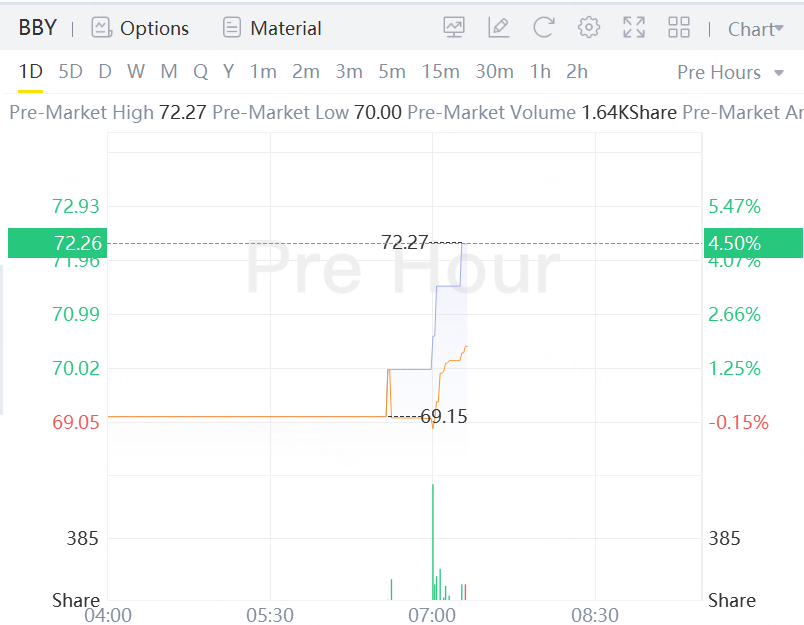

Shares of the top U.S. electronics retailer were up 4.5% in premarket trading as Best Buy also maintained its full-year profit and revenue forecasts.

The company and other discretionary goods retailers have offered steeper discounts in a bid to counter weakness in demand for TVs, laptops and other electronic products as high inflation pressures consumers' wallets.

Best Buy's adjusted net earnings stood at $1.15 per share in the first quarter, higher than the average analyst estimate of $1.11 per share.

Its results buck the trend seen by Home Depot (HD.N) and Target Corp (TGT.N) that have taken a cautious approach to their expectations for 2024, as inflation-hit Americans turn away from spending on nonessential goods.

Best Buy logged a smaller-than-expected decline in comparable sales of 10.1%, compared with analysts' average estimate of a 10.3% fall, according to IBES data from Refinitiv.

The company's revenue came in at $9.47 billion in the first quarter ended April 29, compared with analysts' average estimate of $9.52 billion, according to IBES data from Refinitiv.

Comments