U.S. stocks ended sharply lower on Thursday (August 24th), led by a drop in the Nasdaq after this week's sharp gains and investor nervousness ahead of Federal Reserve Chair Jerome Powell's speech Friday.

Regarding the options market, a total volume of 37,605,169 contracts was traded, up 1.7% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY; QQQ; NVDA; TSLA; AMD; AAPL; IWM; AMZN; PLTR; SQQQ

Wall Street is cheering Nvidia Corp.'s blowout results and outlook, but investors aren't extending that enthusiasm to the company's peers as the chip sector sells off sharply in the wake of the latest report.

Shares of Advanced Micro Devices Inc. fell 6.97% on Thursday and sat among the S&P 500's SPX biggest laggards on a down day for tech stocks.

Additionally, Nvidia's eye-popping revenue forecast and its talk of strong visibility into future demand could be reinforcing a Wall Street fear that spending on AI hardware is eating away at budget share for more traditional chips

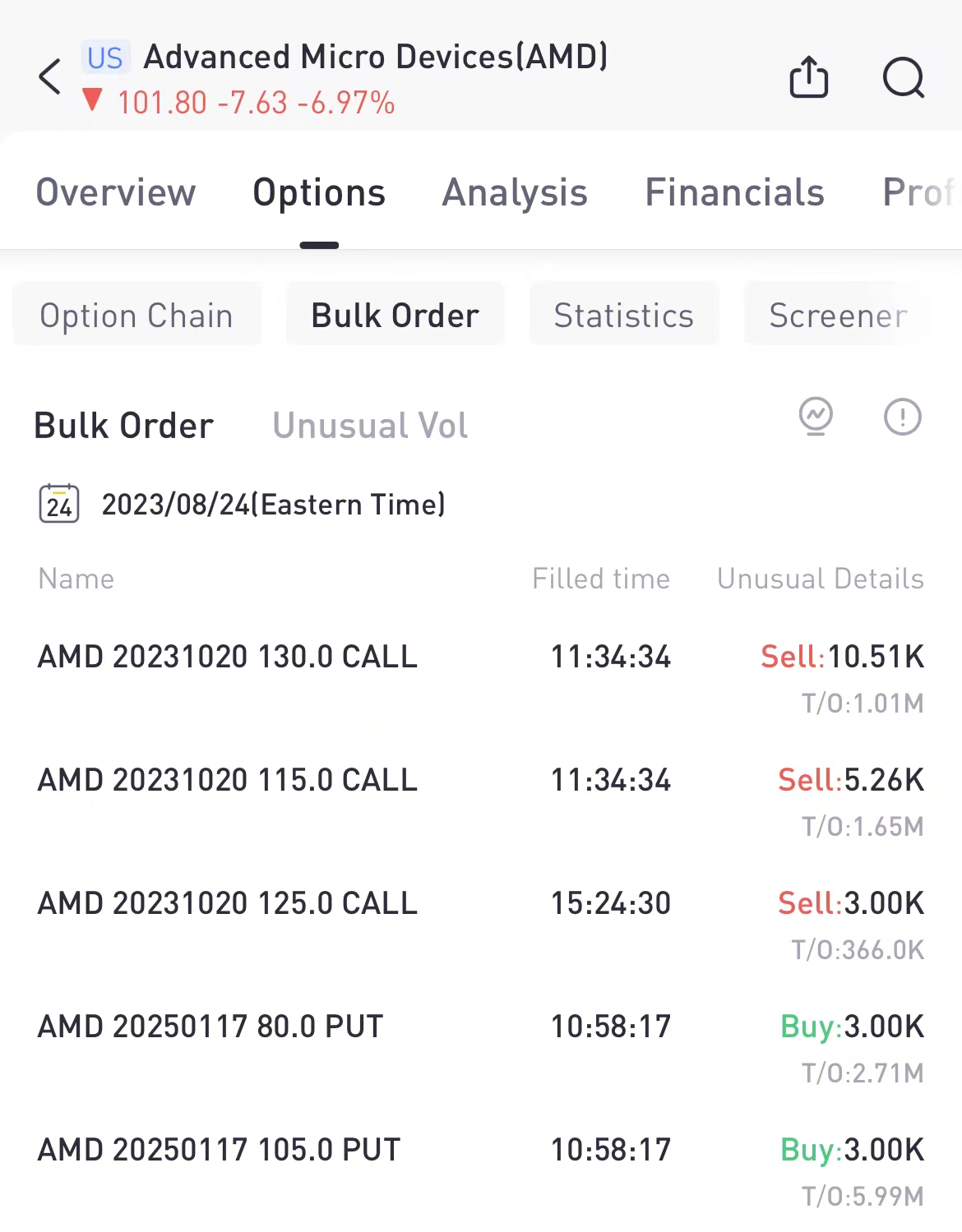

A total number of 1.08 million options contracts related to AMD was traded. A particularly high trading volume was seen for the $130 strike call options expiring October 20, with a total number of 10.51K option contracts trading on Thursday.

Unusual Options Activity

The Nasdaq Composite closed Thursday's trading session down nearly 1.9% as investors digested hawkish commentary from Fed officials that suggesting interest rates will need to remain elevated for a long period of time to bring inflation down.

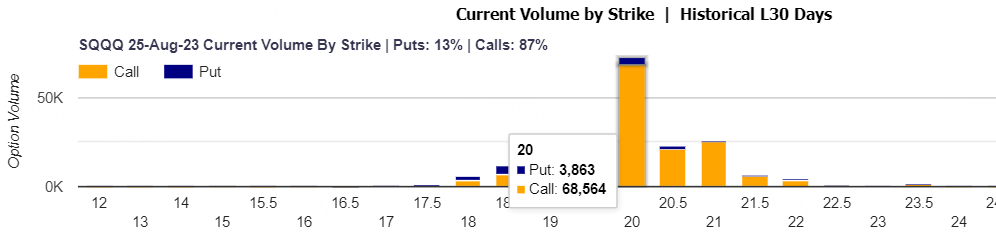

A total number of 391,015 options contracts related to SQQQ was traded. A particularly high trading volume was seen for the $20 strike call options expiring this Friday, with a total number of 68,564 option contracts trading on Thursday.

Central bankers and other economic leaders gathered Thursday for an annual symposium in Jackson Hole, Wyoming. Powell's highly anticipated speech on the economic outlook is due Friday.

"As much as investors want to focus on Nvidia and want to focus on tech - and it's been a good year so far - this is still a market that is Fed obsessed. This is still all about what is Jay Powell going to say tomorrow to mess things up... that may lead investors to be sellers instead of buyers," said Jake Dollarhide, chief executive officer of Longbow Asset Management in Tulsa, Oklahoma.

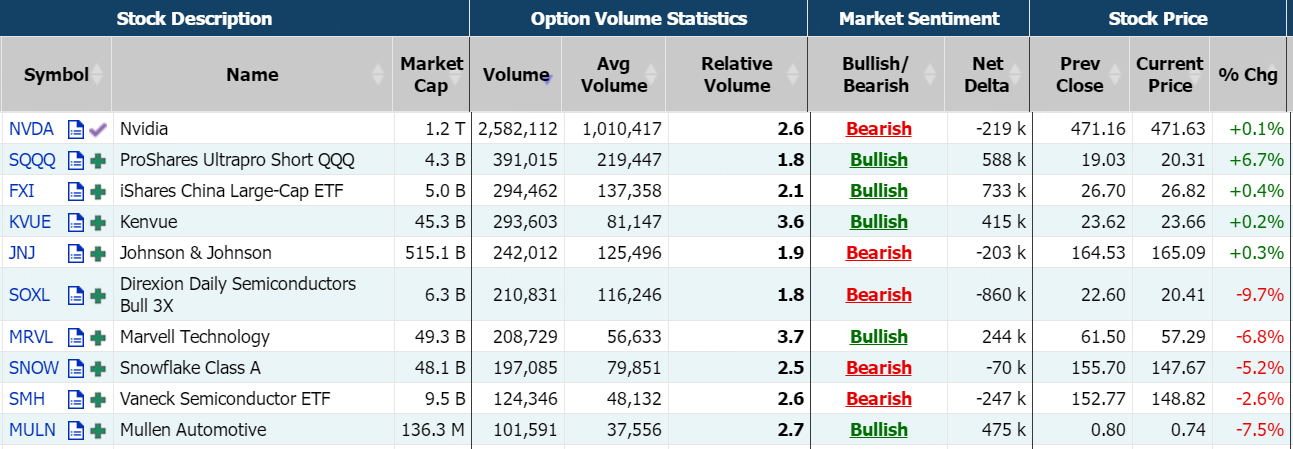

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: NVTA; SPLK; MULN; OPEN; KVUE; INTC; LC; FL; BSX; DKS

Top 10 bearish stocks: TSLA; NKLA; AAPL; DIS; GOOGL; MSFT; PLUG; PLTR; FTCH; CVS

Based on option delta volume, traders sold a net equivalent of -3,140,558 shares of Tesla stock. The largest bearish delta came from selling the 25-Aug-23 235 Call, with traders getting short 3,150,744 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments