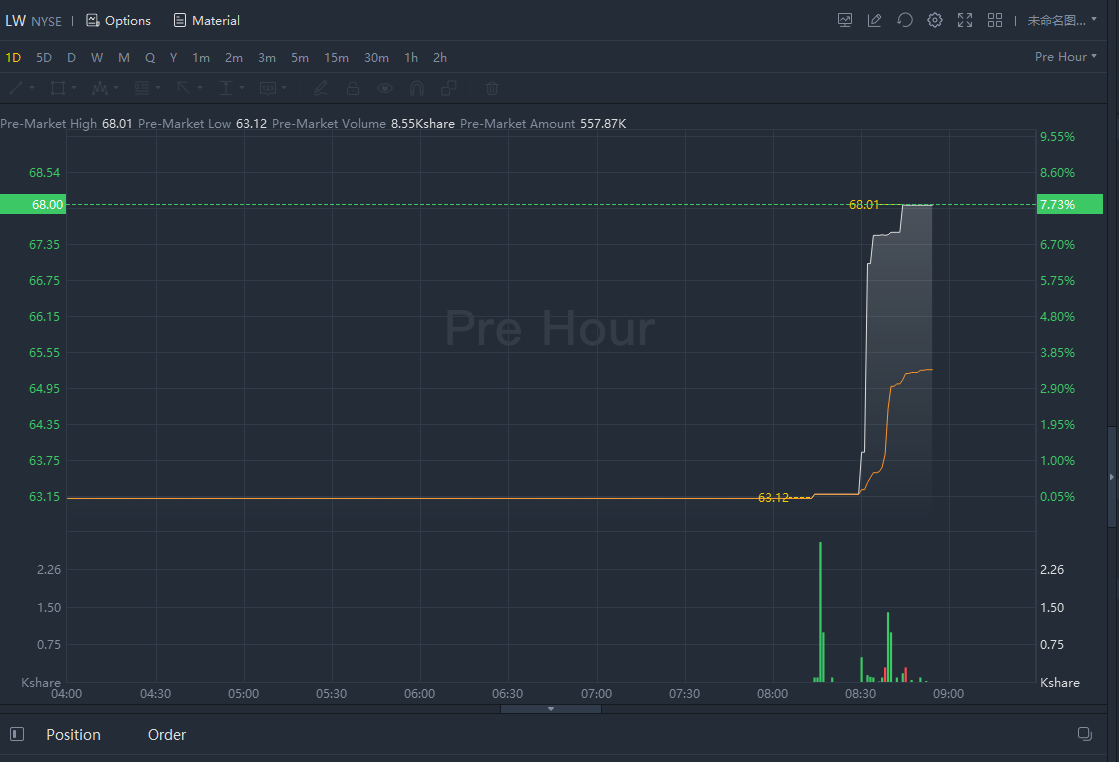

Lamb Weston stock jumped over 7% in premarket trading as it beated on earnings.

"We are pleased with our financial and operating progress in the quarter as we continue to navigate through a difficult and volatile macro environment defined by cost inflation, supply chain disruptions and production challenges due primarily to a tight labor market," said Tom Werner, President and CEO. "We generated strong sales as solid demand across our restaurant and foodservice sales channels in North America drove volume growth, and as we continued to implement pricing actions in each of our business segments. These pricing actions, along with the other strategic actions we’ve taken to offset cost pressures and improve throughput in our factories, led to sequential gross margin gains in the quarter."

"Looking ahead, we are on track to deliver our financial targets for the year. We expect our pricing actions, productivity improvements in our factories, and product optimization efforts to mitigate the effect of the ongoing macro-operational challenges and higher potato costs resulting from an exceptionally poor harvest in the Pacific Northwest. We remain confident in the strong long-term outlook for the global frozen potato category, and believe that executing on our strategies and ongoing investments in our business will keep us on a path to deliver sustainable, profitable growth and create value for our stakeholders."

Q2 2022 Commentary

Net sales increased $110.5 million to $1,006.6 million, up 12 percent versus the prior year quarter, with volume and price/mix each up 6 percent. The ongoing recovery in demand for frozen potato products in the Company’s restaurant and foodservice channels in North America drove the increase in sales volumes, while the initial benefits of product pricing actions, as well as higher prices charged to customers for product delivery, primarily drove the increase in price/mix.

Income from operations declined $25.2 million to $114.4 million, down 18 percent versus the prior year quarter, reflecting lower gross profit and higher selling, general and administrative expenses ("SG&A"). Gross profit declined $18.0 million, as the benefits from increased sales volumes and higher price/mix were more than offset by higher manufacturing and distribution costs on a per-pound basis. The higher costs per pound predominantly reflected double-digit cost inflation from key inputs, particularly edible oils; ingredients, such as grains and starches used in product coatings; transportation; and packaging. The increase in costs per pound also reflected the effect of labor shortages on production run-rates, as well as lower raw potato utilization rates. The increase in per pound costs was partially offset by supply chain productivity savings. The decline in gross profit also included a $6.1 million decrease in unrealized mark-to-market adjustments associated with commodity hedging contracts, which includes a $1.0 million loss in the current quarter, compared with a $5.1 million gain related to these items in the prior year quarter.

SG&A increased $7.2 million compared to the prior year quarter, primarily due to a $2.5 million increase in advertising and promotion expenses ("A&P"), higher sales commissions associated with increased sales volumes, and higher expenses largely related to employee recruiting and retention. The increase in SG&A was partially offset by lower consulting expenses associated with improving the Company’s commercial and supply chain operations, as well as fewer expenses for its new enterprise resource planning system ("ERP"). Approximately $2 million of the ERP-related expenses recognized in the quarter consisted primarily of consulting expenses that will not continue after the Company implements the new ERP system, compared to approximately $5 million in the prior year quarter.

Net income was $32.5 million, down $64.4 million versus the prior year quarter, and Diluted EPS was $0.22, down $0.44 versus the prior year quarter. The declines were driven by a loss of $53.3 million ($40.5 million, or $0.28 per share, after-tax) associated with the extinguishment of debt (see Cash Flow and Liquidity below), as well as lower income from operations and equity method investment earnings.

Excluding a loss of $40.5 million after-tax for the extinguishment of debt, net income was $73.0 million, down $23.9 million versus the prior year quarter, and Adjusted Diluted EPS(1)was $0.50, down $0.16 versus the prior year quarter, reflecting lower income from operations and equity method investment earnings.

Adjusted EBITDA including unconsolidated joint ventures(1)declined $32.3 million to $180.9 million, down 15 percent versus the prior year quarter, driven by lower income from operations and equity method investment earnings.

The Company’s effective tax rate(2)in the second fiscal quarter was 22.8 percent, versus 24.8 percent in the prior year period. The Company’s effective tax rate varies from the U.S. statutory tax rate of 21 percent principally due to the impact of U.S. state taxes, foreign taxes, permanent differences, and discrete items.

Q2 2022 Segment Highlights

Global

Net sales for the Global segment, which is generally comprised of the top 100 North American based quick service ("QSR") and full-service restaurant chain customers as well as all of the Company’s international sales, increased $40.8 million to $516.7 million, up 9 percent versus the prior year quarter, with price/mix up 5 percent and volume up 4 percent. The increase in price/mix largely reflected the benefit of pricing actions, including higher prices charged for freight. Strong growth in shipments to restaurant chain customers in the U.S. drove the increase in sales volumes. While demand in most of the Company’s key international markets was solid, export sales volumes declined as a result of limited shipping container availability and disruptions to ocean freight networks.

Global segment product contribution margin declined $11.8 million to $80.9 million, down 13 percent versus the prior year quarter. Higher manufacturing and distribution costs per pound more than offset the benefit of favorable price/mix and higher sales volumes.

Foodservice

Net sales for the Foodservice segment, which services North American foodservice distributors and restaurant chains generally outside the top 100 North American based restaurant chain customers, increased $72.8 million to $313.9 million, up 30 percent versus the prior year quarter, with volume up 22 percent and price/mix up 8 percent. Strong demand at small and regional chain restaurants, as well as independently-owned restaurants, drove the increase in sales volumes. Shipments to non-commercial customers, such as lodging and hospitality, healthcare, schools and universities, sports and entertainment, and workplace environments, also increased versus the prior year quarter, but remained below pre-pandemic levels. The segment’s overall volume growth was tempered by the inability to serve full customer demand due to widespread industry supply chain constraints, including labor shortages, that resulted in lower production run-rates and throughput in the factories. The increase in price/mix largely reflected the initial benefits of pricing actions taken earlier in the year, higher prices charged for freight, and favorable mix.

Foodservice segment product contribution margin increased $16.7 million to $104.4 million, up 19 percent compared to the prior year quarter. Favorable price/mix and higher sales volumes drove the increase, and were partially offset by higher manufacturing and distribution costs per pound.

Retail

Net sales for the Retail segment, which includes sales of branded and private label products to grocery, mass merchant and club customers in North America, increased $1.9 million to $142.6 million, up 1 percent versus the prior year quarter, with price/mix up 5 percent and volume down 4 percent. The increase in price/mix was largely driven by favorable price in our branded portfolio, including higher prices charged for freight, and improved mix. The sales volume decline largely reflects lower shipments of private label products resulting from incremental losses of certain low-margin business, partially offset by an increase in branded product sales volumes. Product shipments were tempered by the inability to serve full customer demand due to lower production run-rates and throughput in the factories.

Retail segment product contribution margin declined $8.7 million to $21.4 million, down 29 percent versus the prior year quarter. Higher manufacturing and distribution costs per pound, a $1.9 million increase in A&P expenses, and lower sales volumes drove the decline.

Equity Method Investment Earnings

Equity method investment earnings from unconsolidated joint ventures in Europe, the U.S., and South America were $10.1 million and $19.2 million for the second quarter of fiscal 2022 and 2021, respectively. Equity method investment earnings included a $3.6 million unrealized gain related to mark-to-market adjustments associated with currency and commodity hedging contracts in the current quarter, compared to a $0.1 million unrealized loss related to these items in the prior year quarter.

Excluding the mark-to-market adjustments, earnings from equity method investments declined $12.8 million compared to the prior year period. The earnings decline largely reflects input cost inflation and higher manufacturing and distribution costs in Europe and the U.S.

Cash Flow and Liquidity

The Company ended the first half of fiscal 2022, with $621.9 million of cash and cash equivalents and no borrowings outstanding under its $1.0 billion revolving credit facility.

Net cash from operating activities was $207.5 million, down $111.3 million versus the first half of the prior year, primarily due to lower earnings. Capital expenditures, including information technology expenditures, were $148.1 million, up $94.4 million versus the prior year period, reflecting increased investments to support capacity expansion projects.

During the second quarter, the Company lowered the interest rates and extended the maturities on approximately $1.7 billion of its outstanding debt. In connection with doing so, the Company paid an aggregate call premium of $39.6 million in cash related to the loss on extinguishment of debt associated with the redemption of its senior notes due in 2024 and 2026.

Capital Returned to Shareholders

In the second quarter, the Company returned a total of $84.3 million to shareholders, including $34.3 million in cash dividends and $50.0 million through share repurchases. The Company repurchased 868,753 shares at an average price per share of $57.55. In December 2021, the Company announced a 4 percent increase in its quarterly dividend, and increased its existing share repurchase authorization by $250 million. The Company has approximately $344 million remaining under its updated share repurchase authorization.

Fiscal 2022 Outlook

The Company expects fiscal 2022 net sales growth will be above its long-term target of low-to-mid single digits. The Company anticipates net sales growth in the second half of fiscal 2022 will be driven largely by price/mix as the Company’s recent pricing actions are more fully implemented in the market. The Company expects to continue to benefit from solid global demand for frozen potato products, although growth in sales volumes may be tempered by disruptions to the Company’s production and logistics networks, as well as the effect of the COVID-19 variants on restaurant traffic and consumer demand.

The Company expects net income and Adjusted EBITDA including unconsolidated joint ventures(1)will be pressured for the remainder of fiscal 2022, as it manages through significant inflation for key production inputs, transportation and packaging compared to fiscal 2021 levels, as well as industrywide operational challenges, including labor shortages, and upstream and downstream supply chain disruptions, resulting from volatility in the broader supply chain. In addition, the Company’s raw potato costs on a per pound basis will increase as the year progresses due to the impact of extreme summer heat that negatively affected the yield and quality of potato crops in the Pacific Northwest.

Accordingly, the Company expects its full year fiscal 2022 gross margin to be 18 percent to 20 percent, or approximately 600 to 700 basis points below its pre-pandemic gross margin of 25 percent to 26 percent. The Company previously expected its full year fiscal 2022 gross margin to be 17 percent to 21 percent, or approximately 500 to 800 basis points below its pre-pandemic gross margin.

The Company continues to expect that ongoing investments in information technology, including the second phase of its ERP project, will increase operating expenses during the second half of fiscal 2022 as compared to the first half of the year. The Company expects that these investments will improve its ability to support growth and margin improvement over the long-term.

In addition, for fiscal 2022, the Company continues to expect:

Depreciation and amortization of approximately $190 million,

Income tax expense of approximately 22 percent, and

Cash used for capital expenditures, excluding acquisitions, of approximately $450 million.

The Company is increasing its estimate for interest expense, net to approximately $163 million from its previous estimate of approximately $115 million. The current estimate reflects the benefits of recent refinancing initiatives and includes a $53.3 million loss on the extinguishment of debt that the Company recognized during the second quarter of fiscal 2022.

Comments